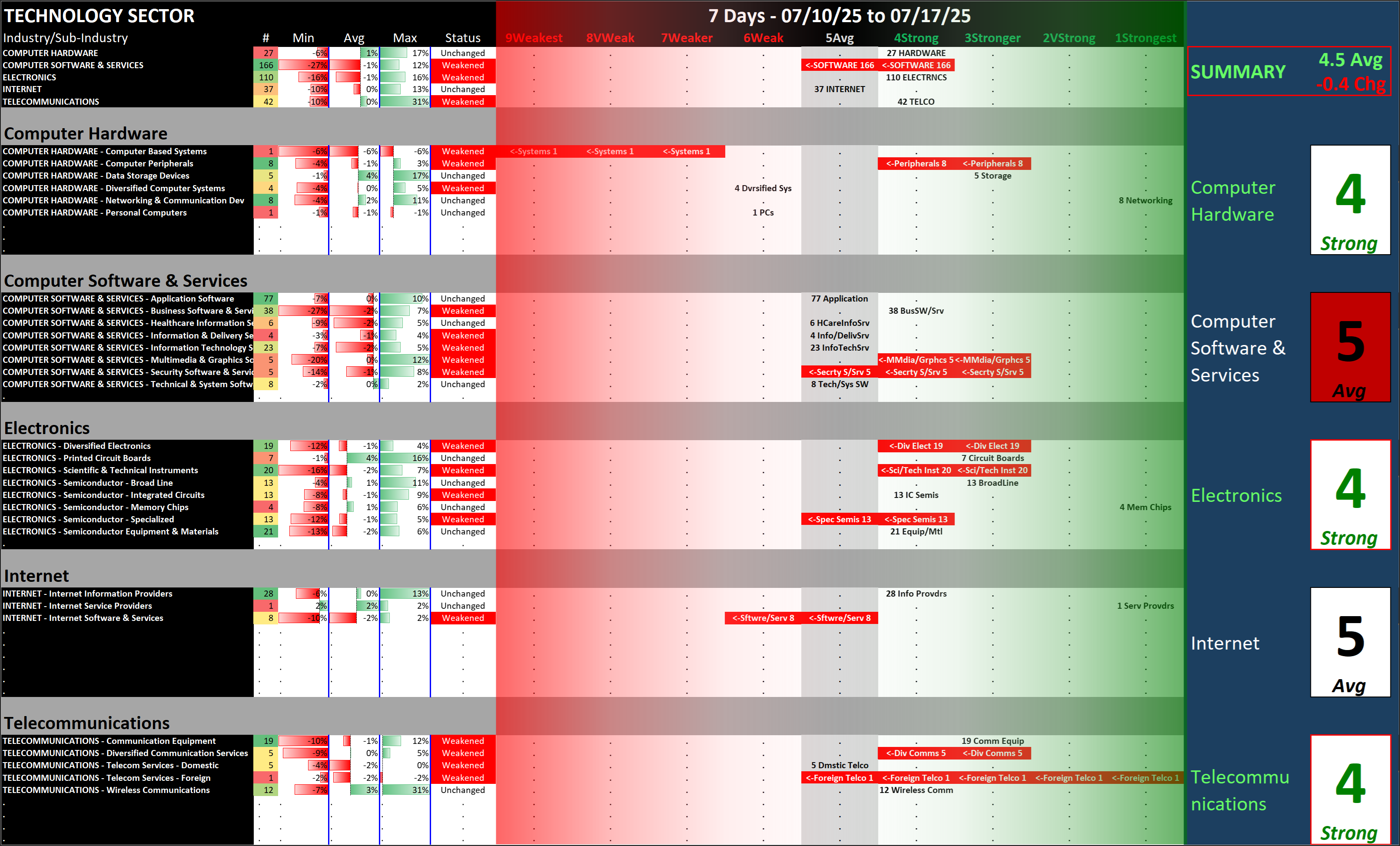

Tech Sector -0.4 week ending Thu 2025-07-17 (4.5 Strength Score)

Below, in order:

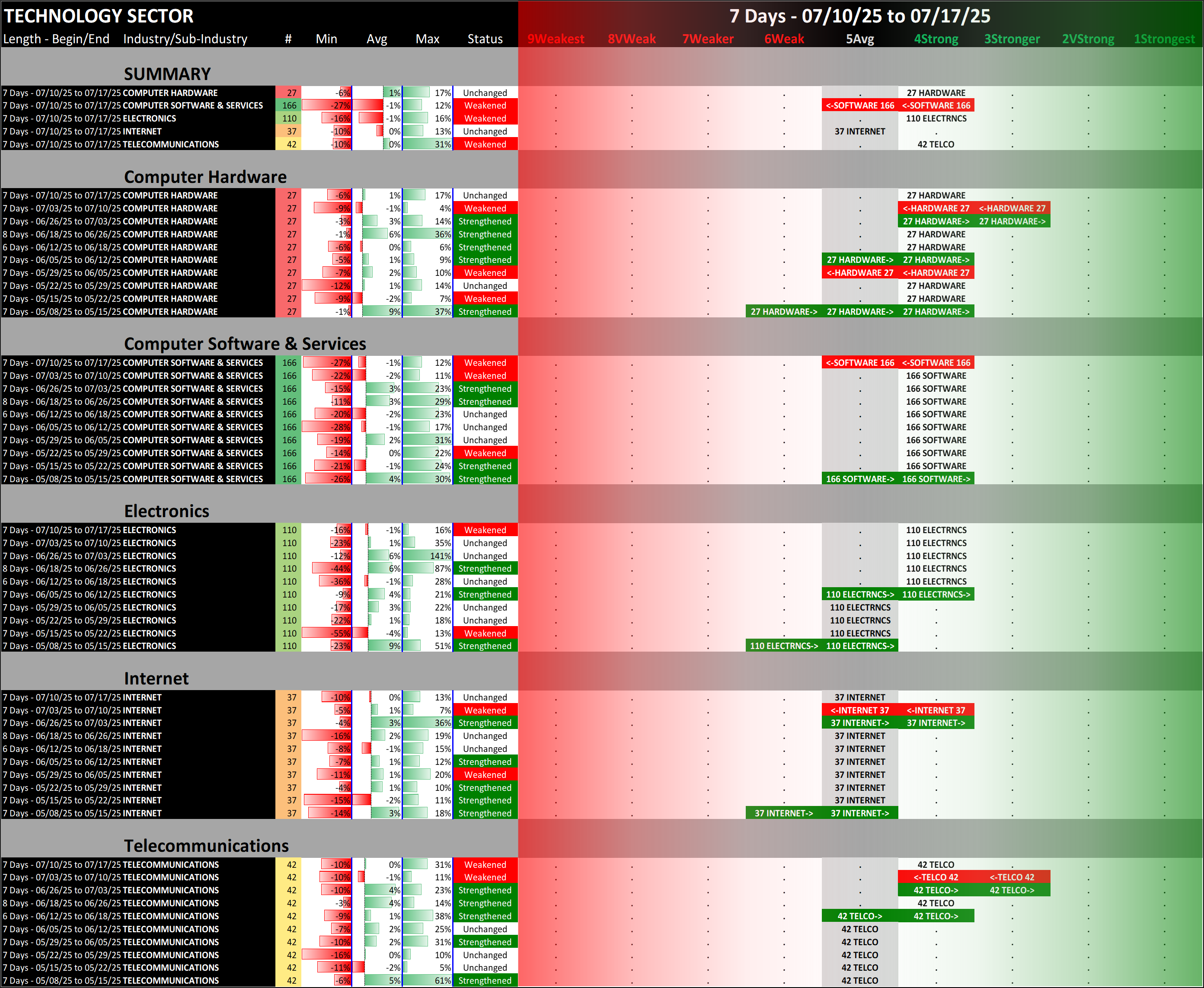

BACKGROUND: 10-Week Bigger Picture Perspectives

- By Industry

- By Sub-industry

CANDIDATES: Outlier Stock Perspectives

- Current 1Strongest and 9Weakest

- 1-Week Large % Changes

- 5-Year Highs/Lows

BACKGROUND: 10-Week Bigger Picture Perspectives

By Industry

How have the sector's industries performed over the past 10 weeks?

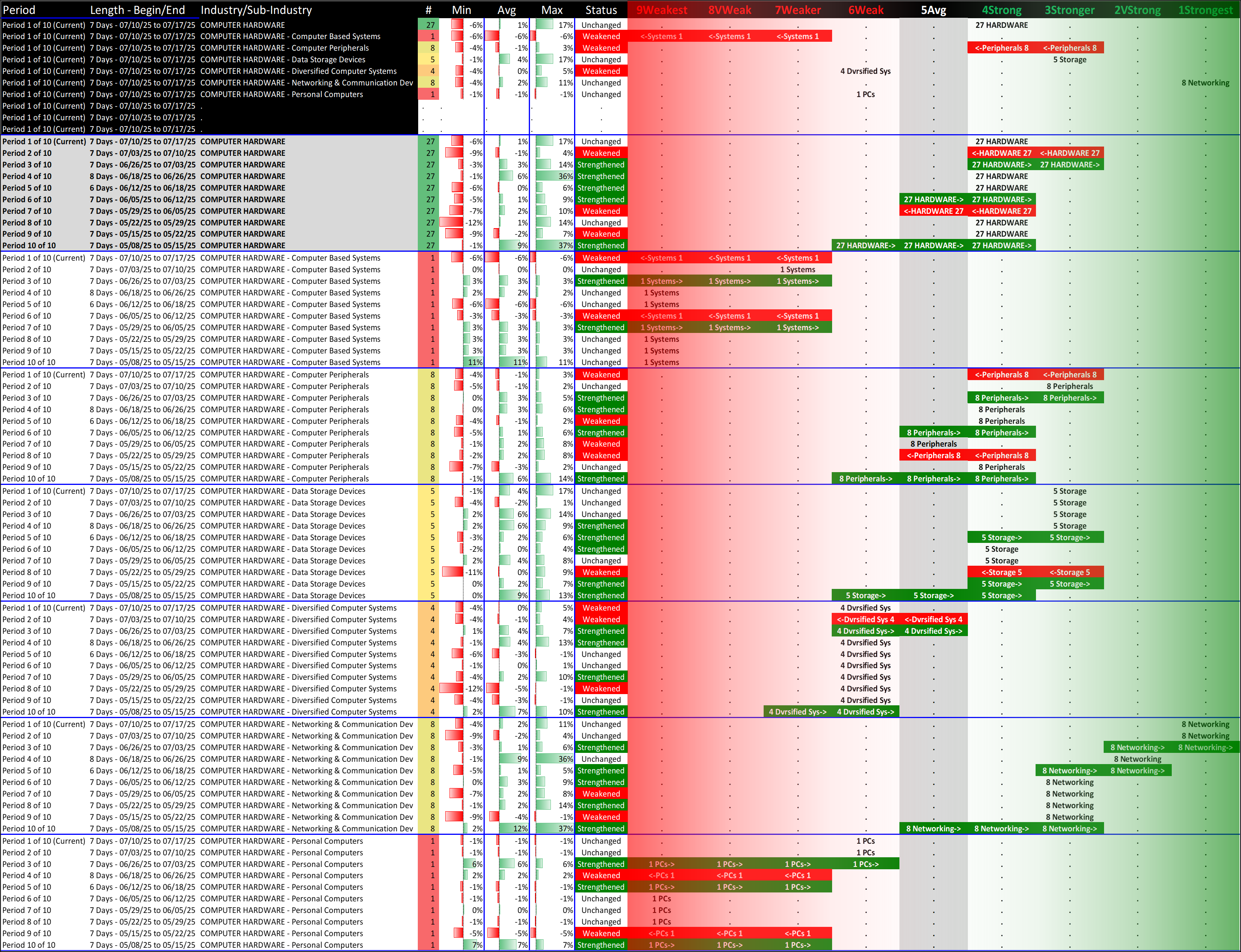

By Sub-Industry

How have each industry's sub-industries performed over the past 10 weeks?

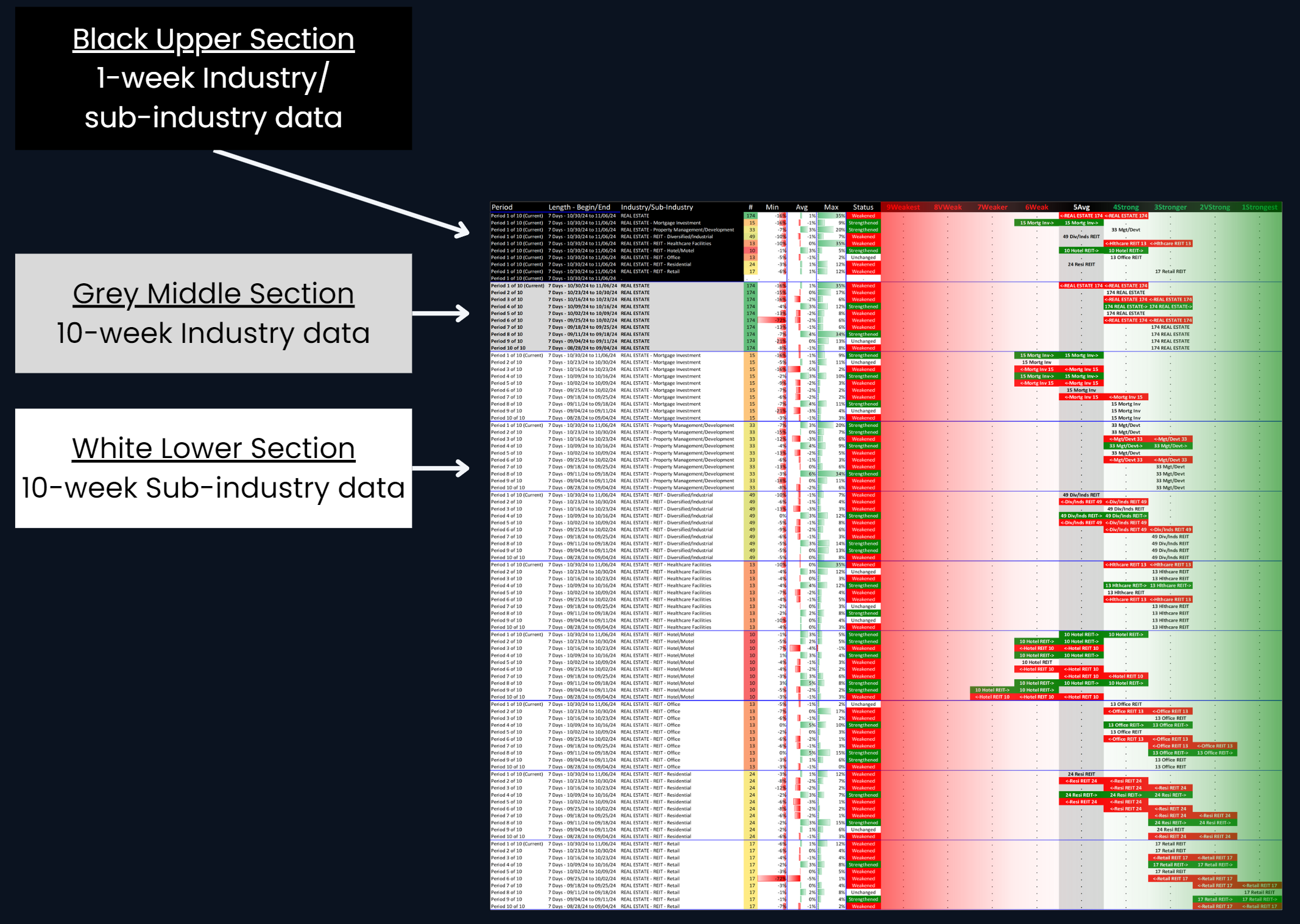

Use this guide to understand the subsequent tables:

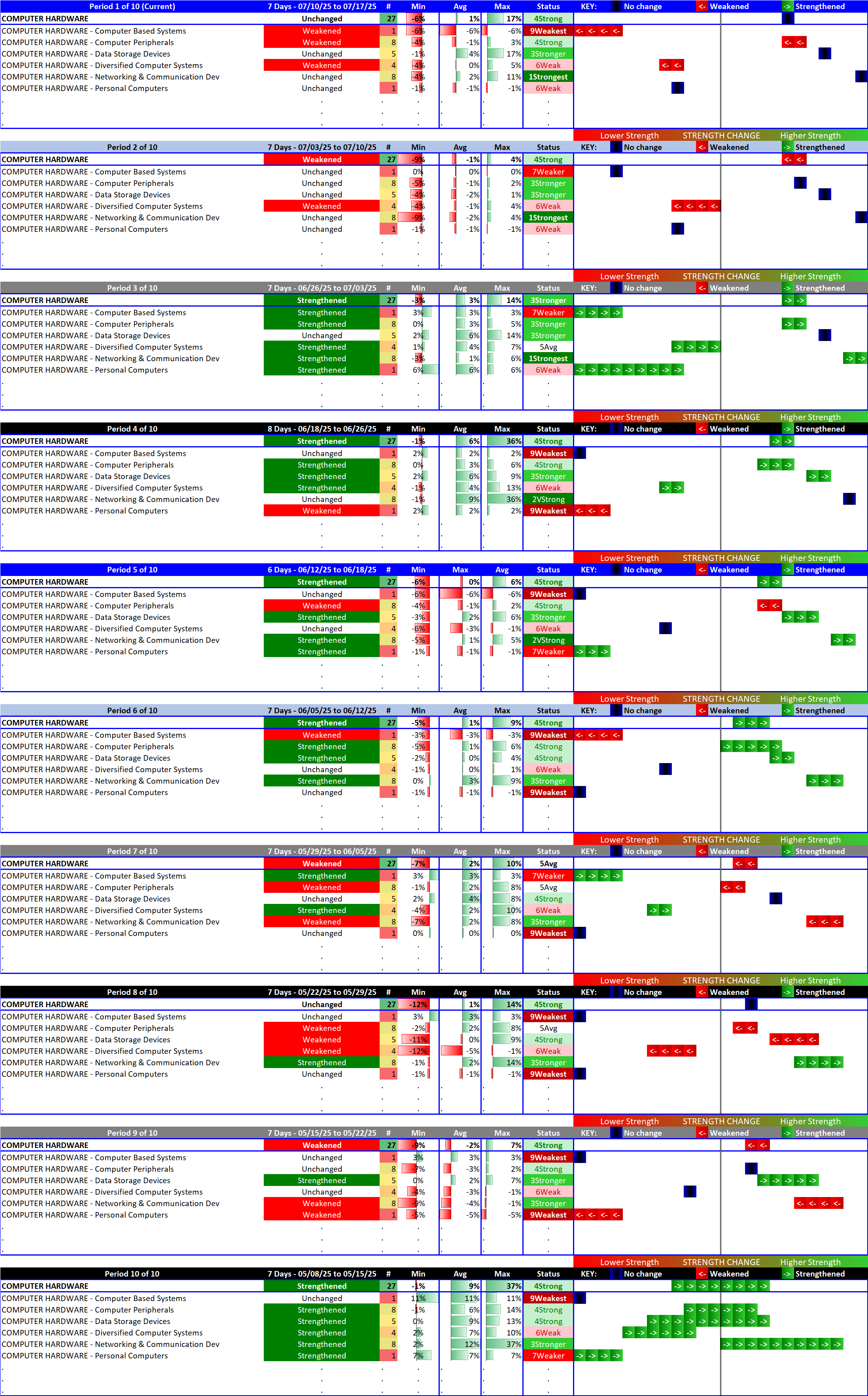

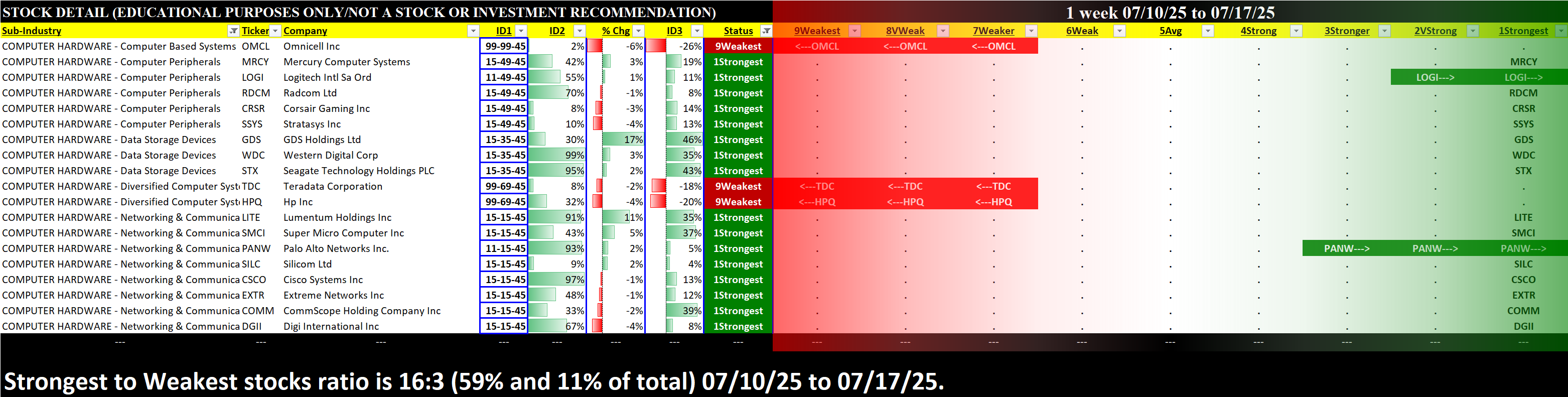

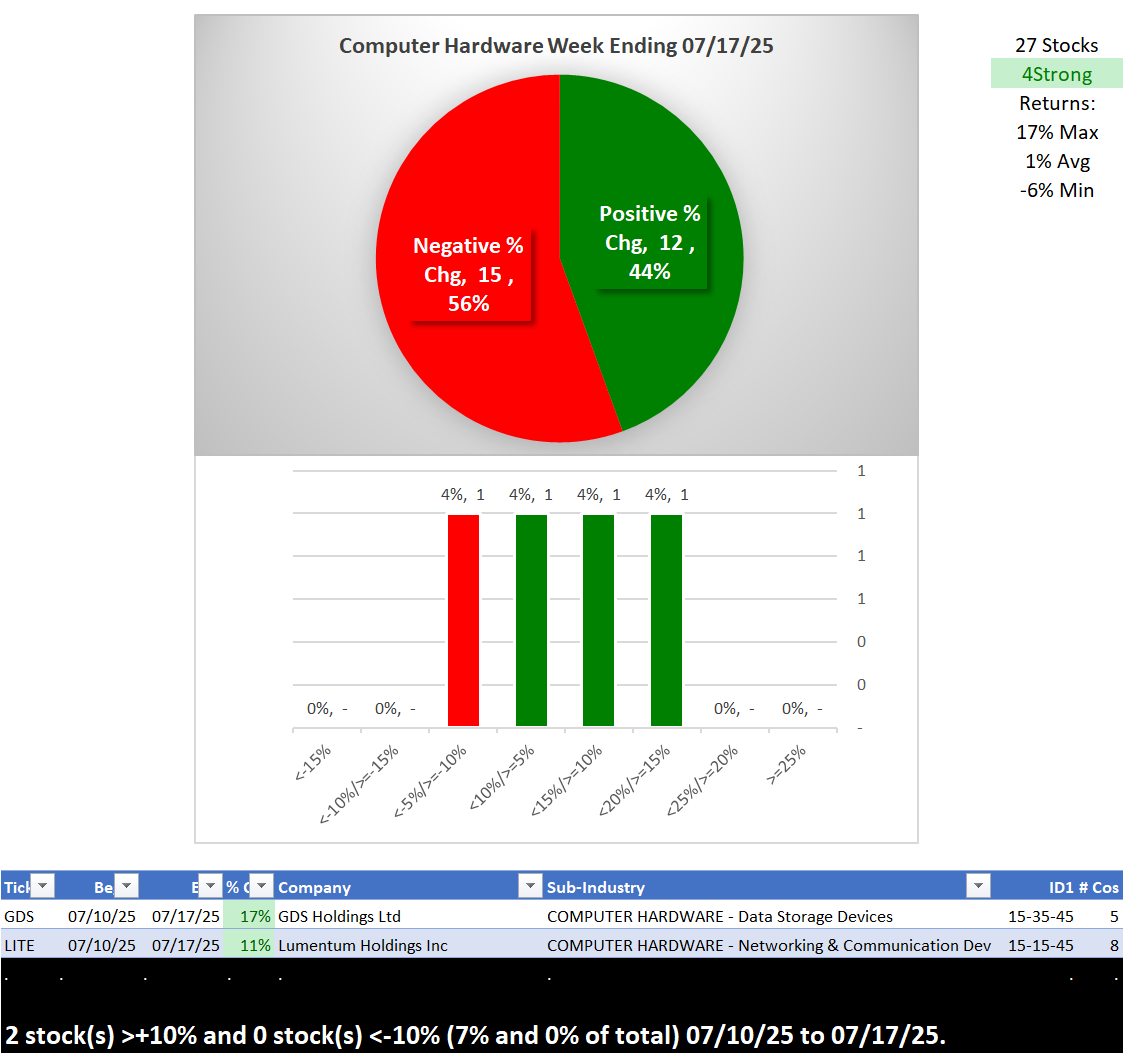

Computer Hardware

Summary

Detail

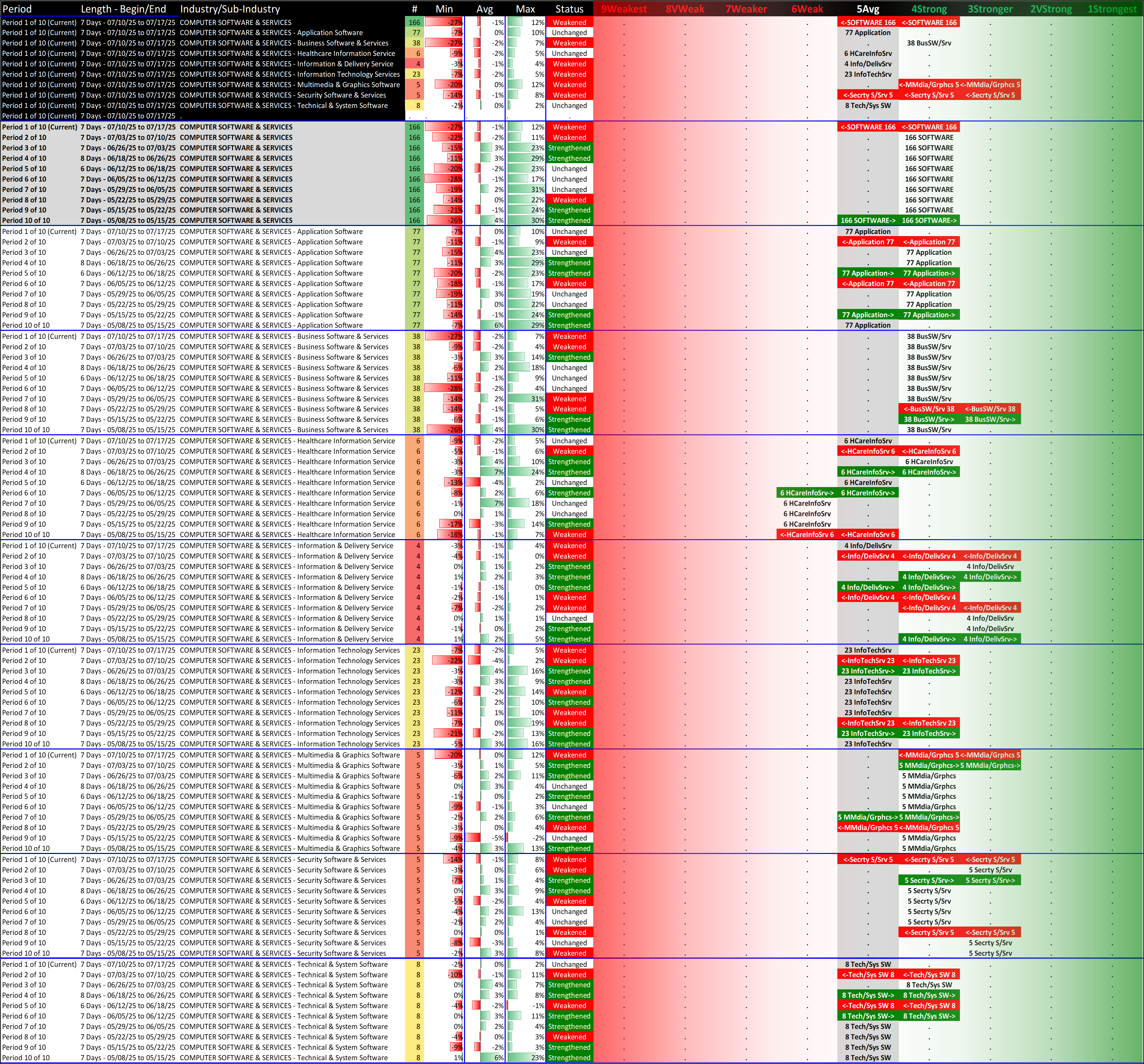

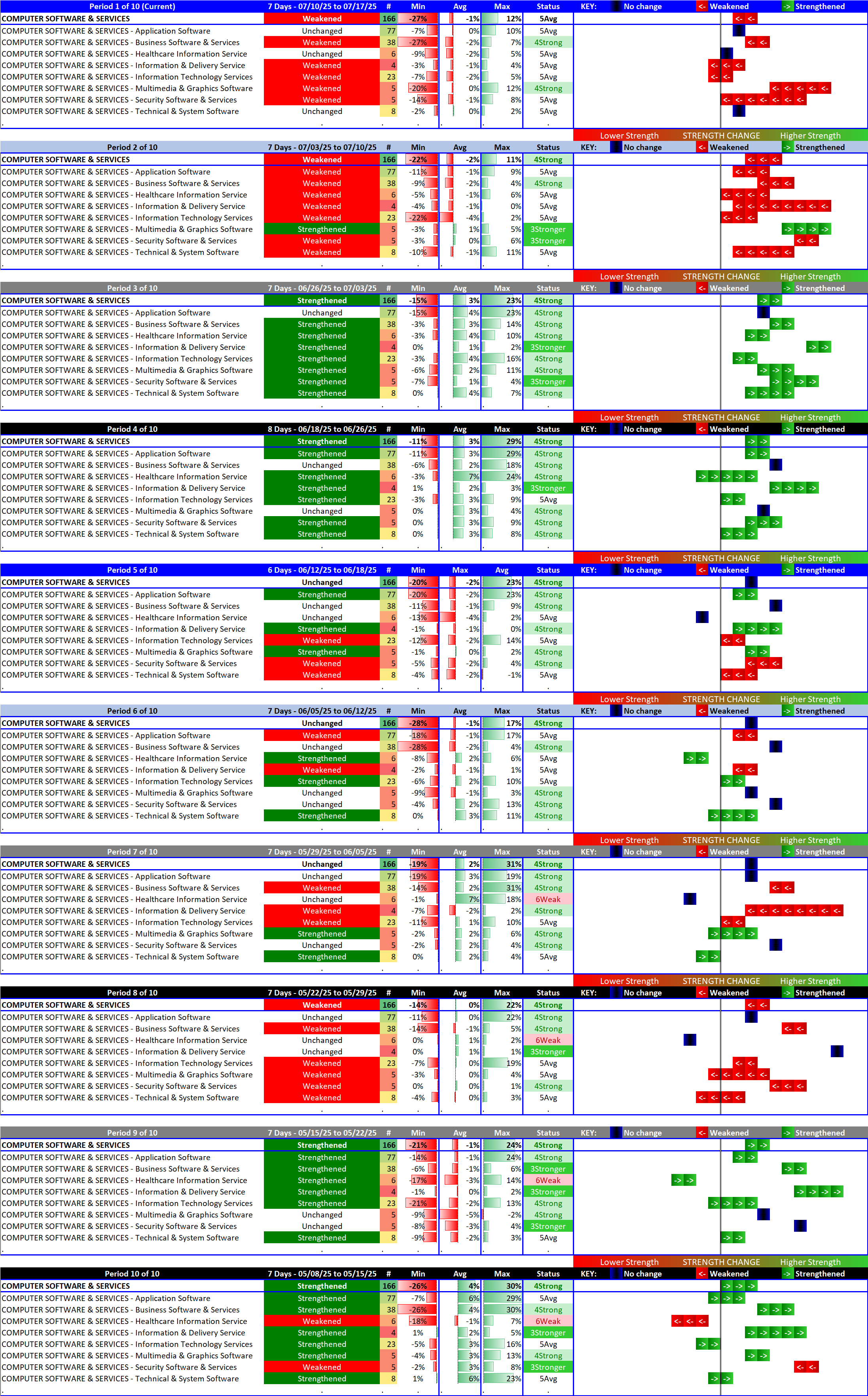

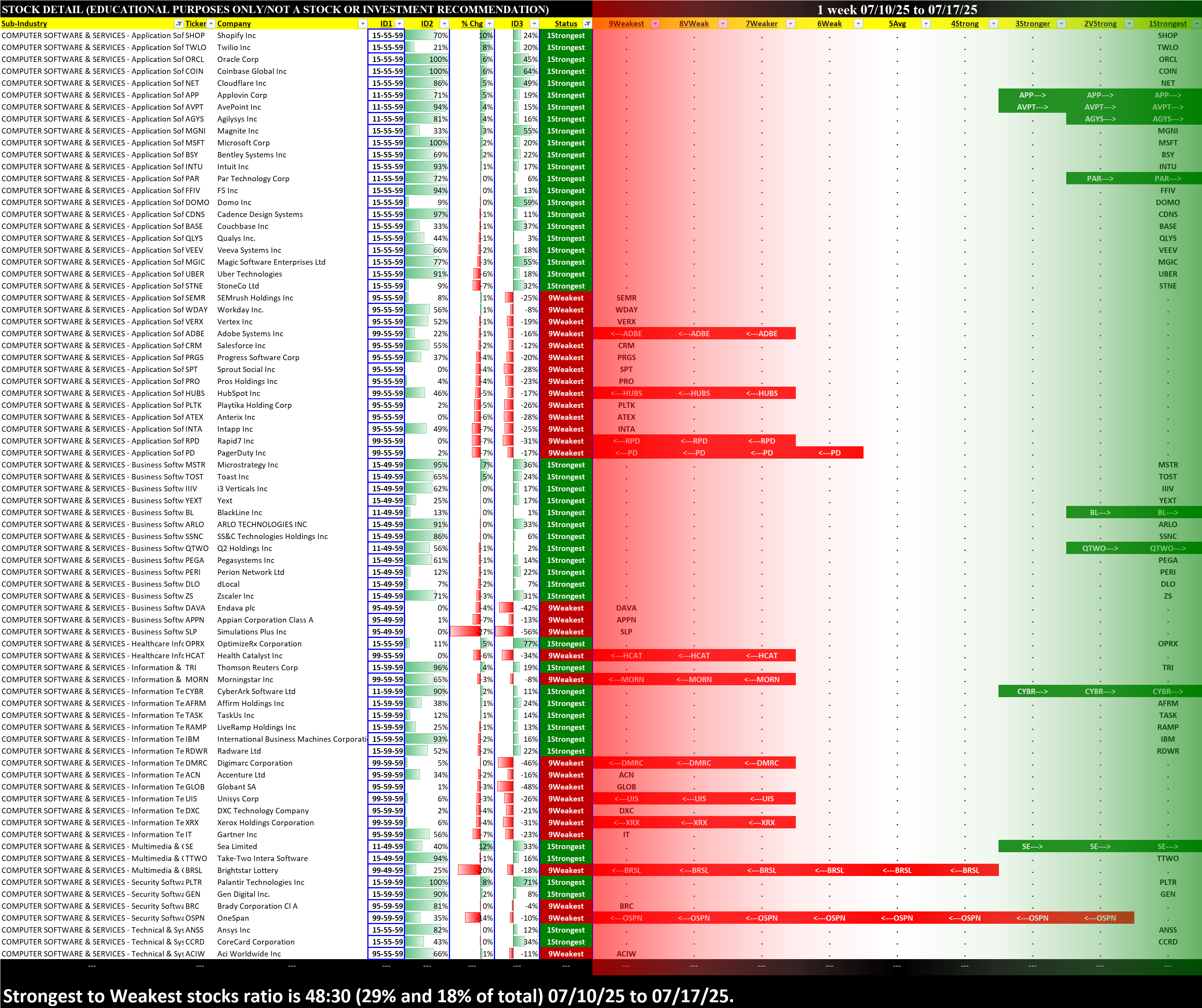

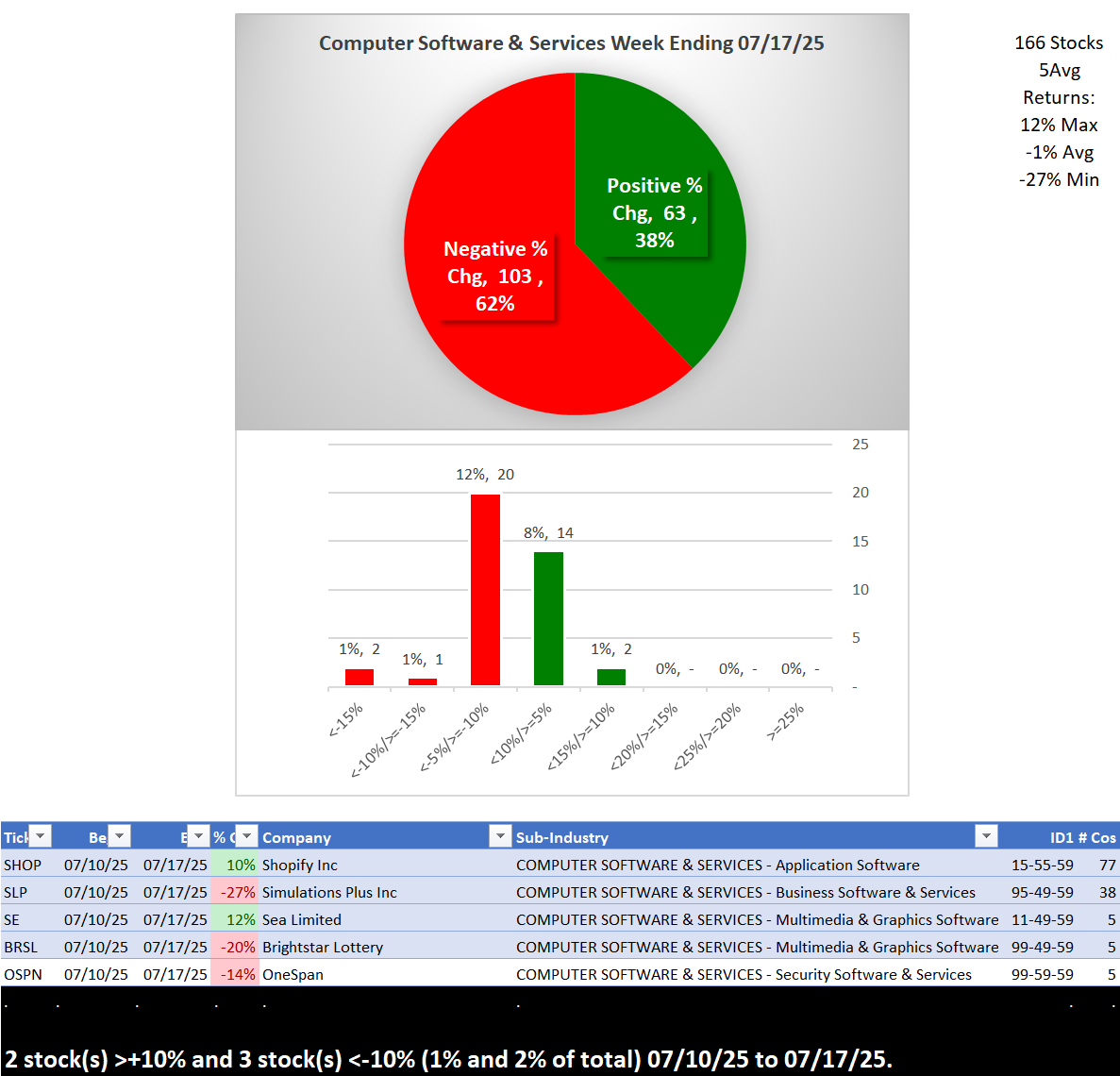

Computer Software & Services

Summary

Detail

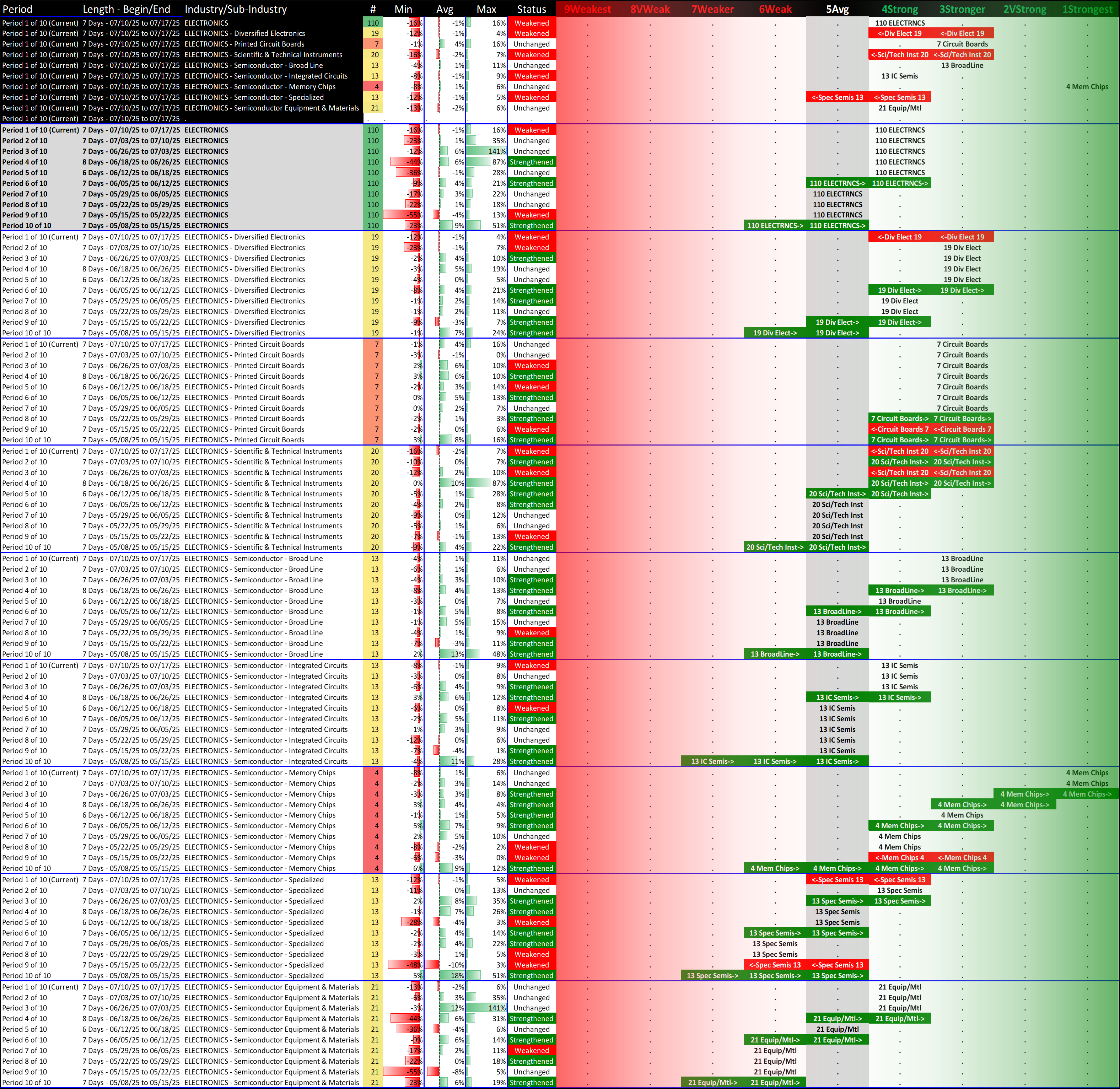

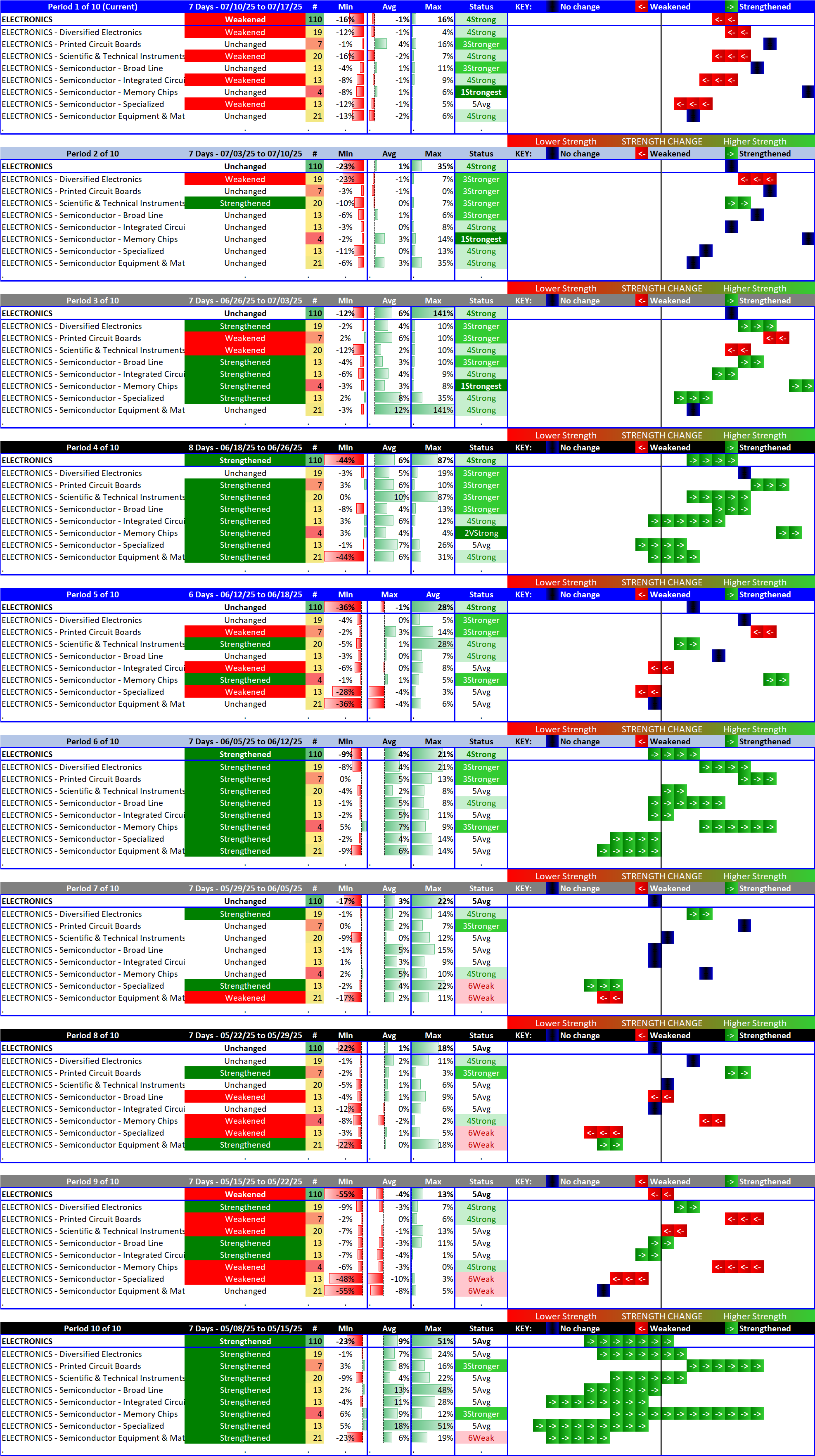

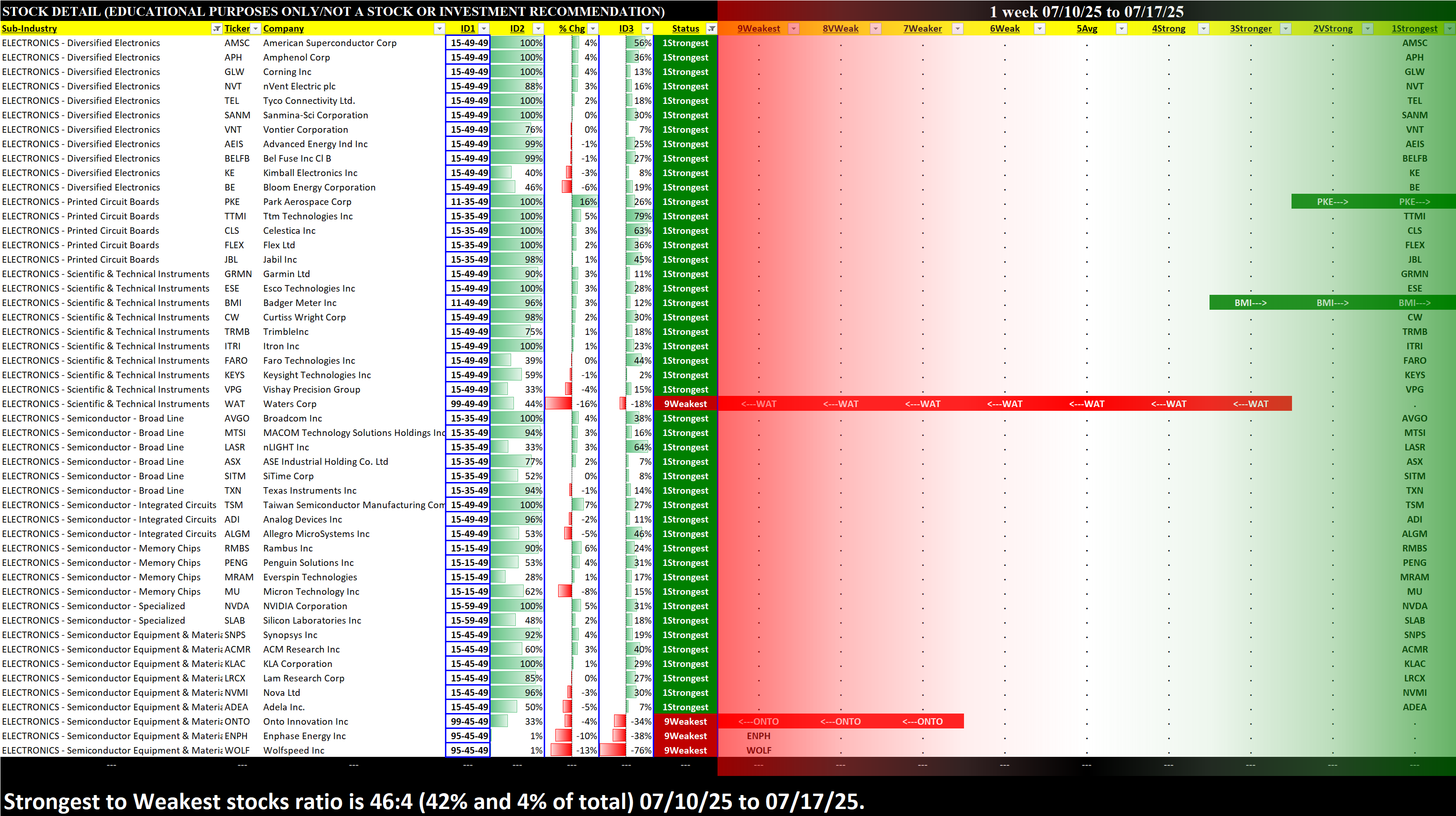

Electronics (Semis, Chips)

Summary

Detail

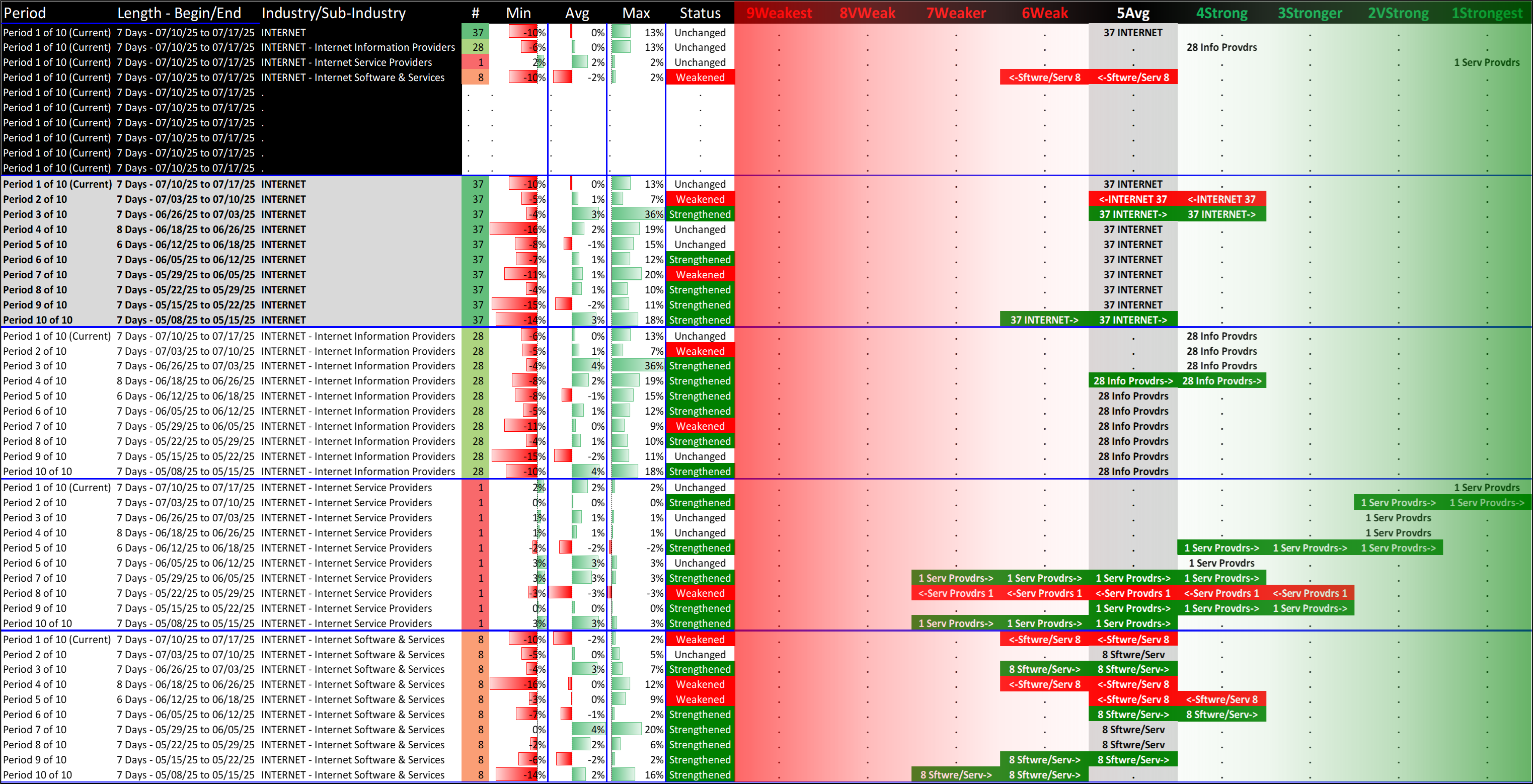

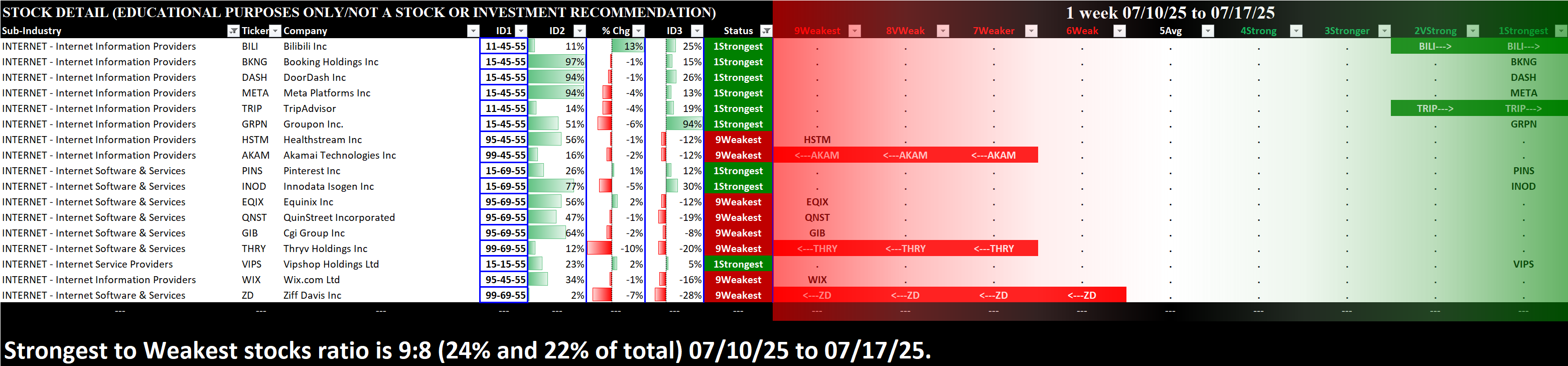

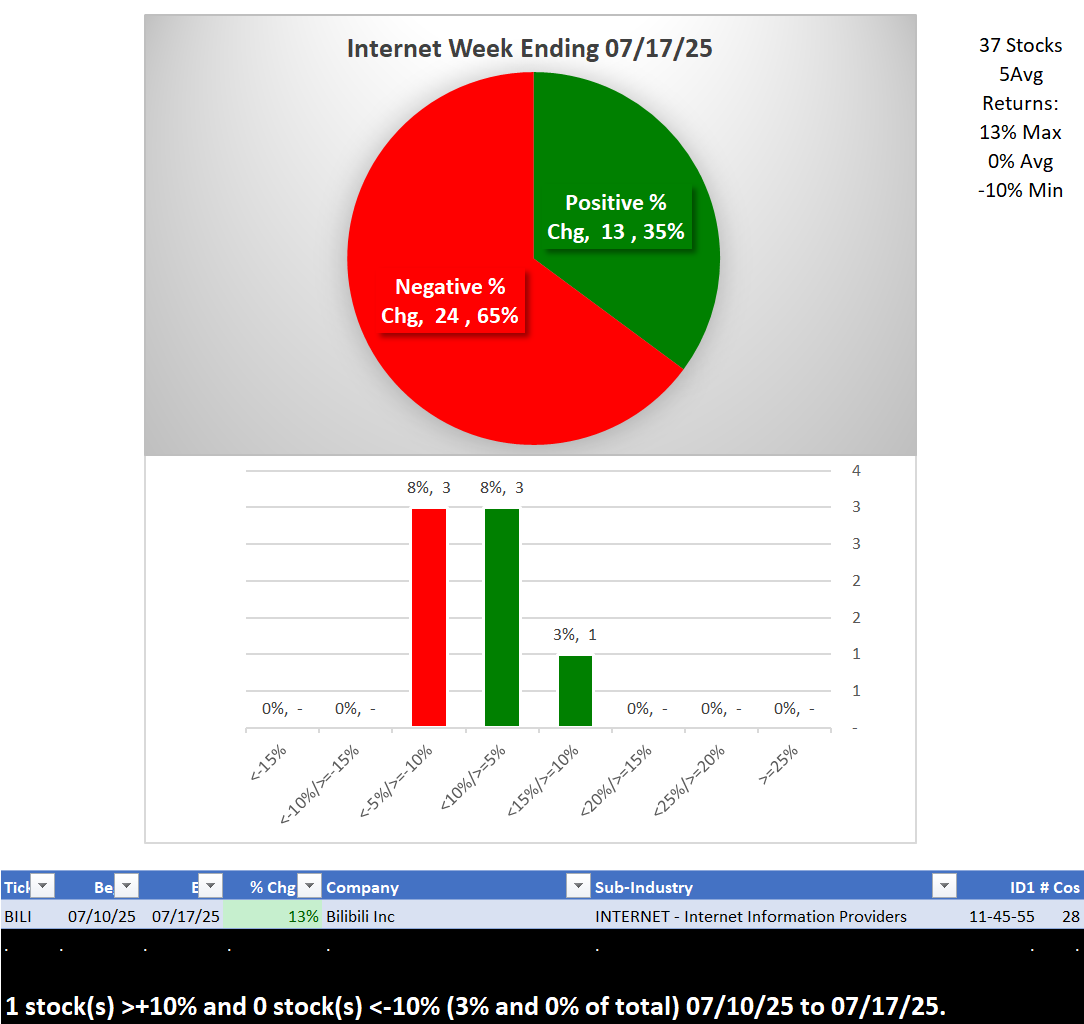

Internet

Summary

Detail

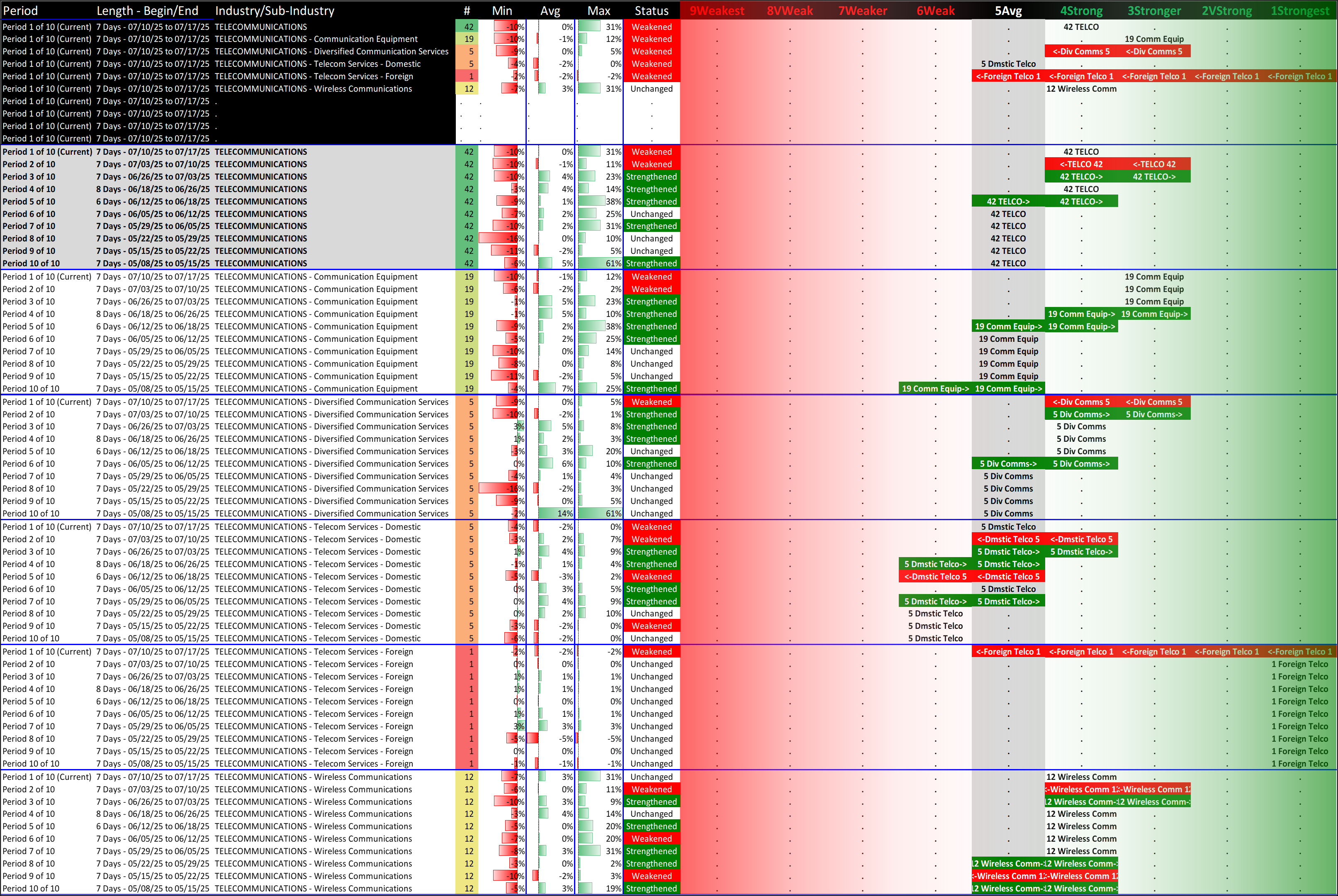

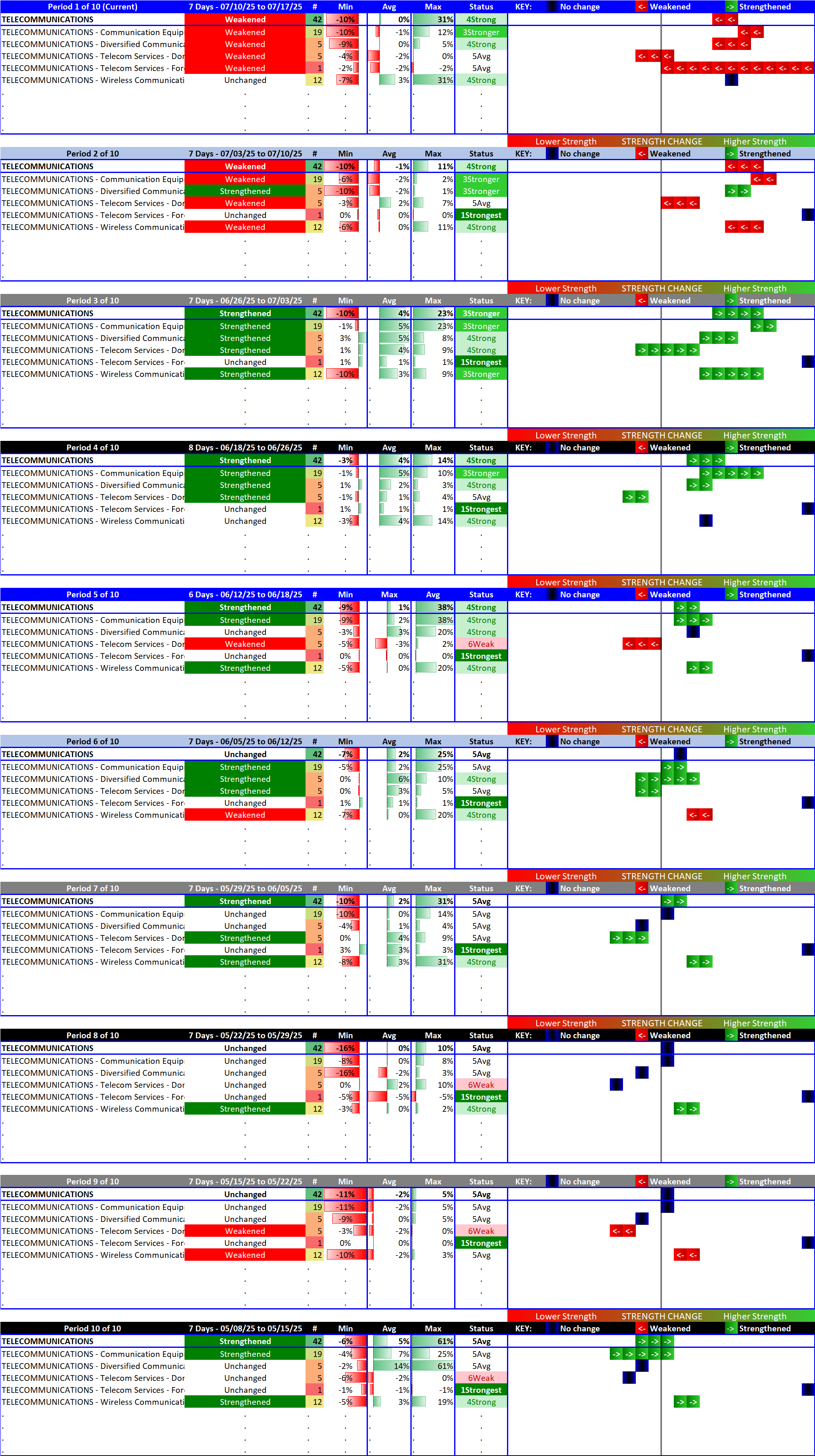

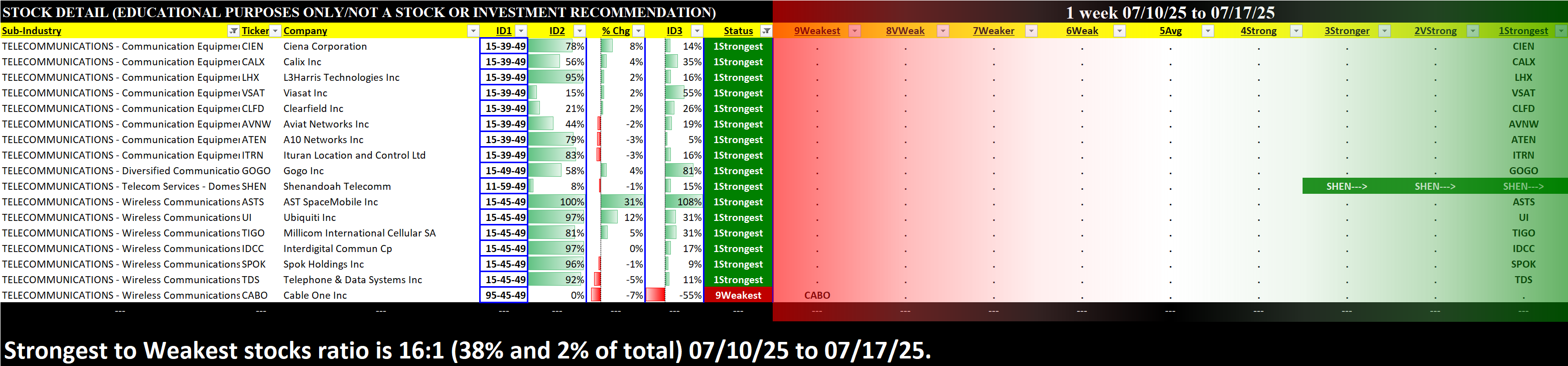

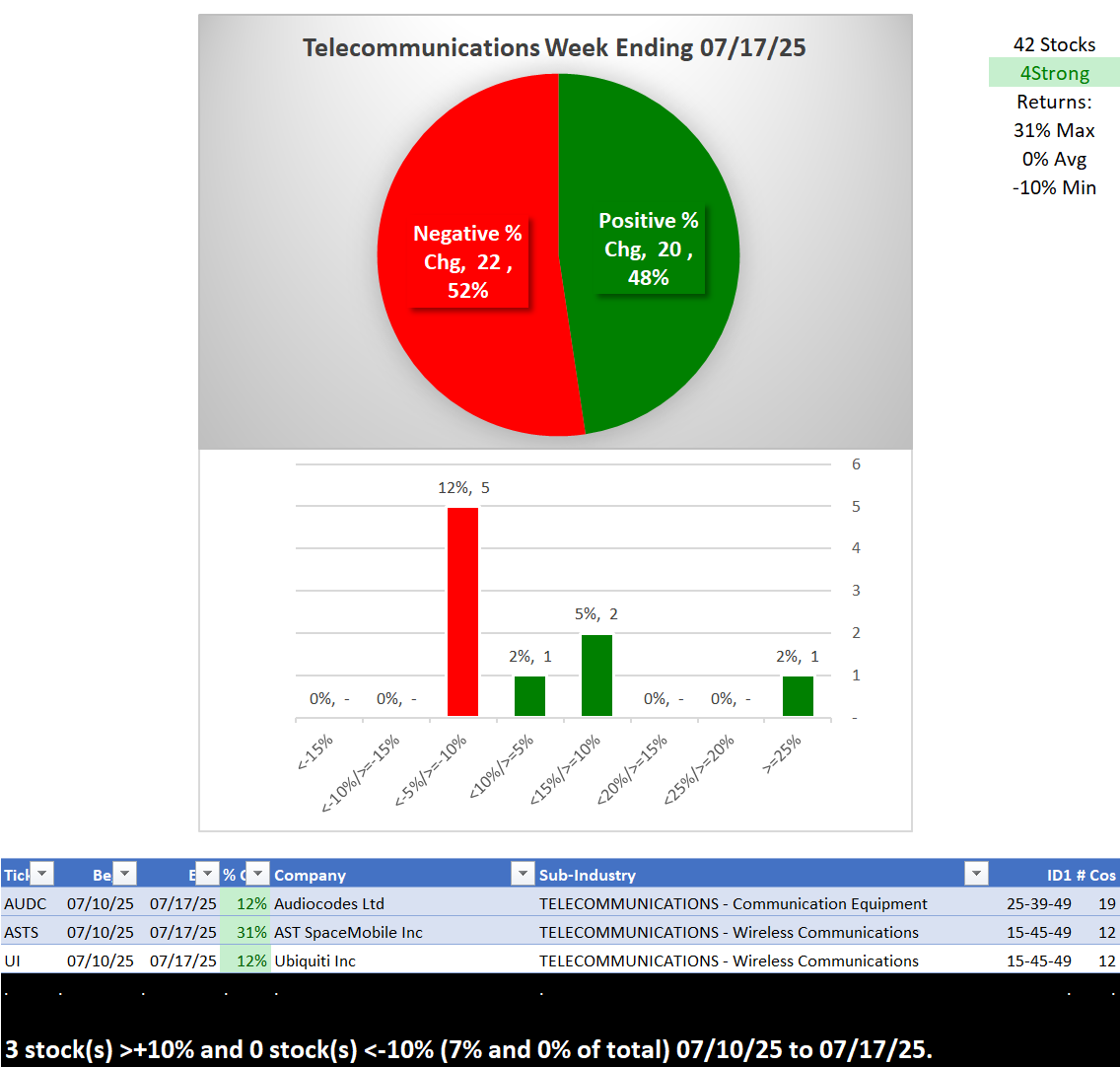

Telecommunications

Summary

Detail

CANDIDATES: Outlier Stock Perspectives

Current 1Strongest and 9Weakest

What: stocks currently rated Strongest/Weakest (highest/lowest of 9 strength ratings)

Why: these are interesting stocks for available capital because

- The Strongest have the least amount of overhead supply to dampen breakouts

- the Weakest may be prone to volatility, subject to big pops from bottom-fishing and short-covering BUT ALSO to bigger and faster falls.

- (Not guaranteed and not a recommendation - weak stocks in weakening sub-industries may be better shorts than high-flyers.)

Computer Hardware

Computer Software & Services

Electronics (Chips, Semis)

Internet

Telecommunications

1-Week Large % Changes

What: stocks with atypically strong or weak performance this week

Why: these are interesting stocks for available capital because

The journey to 100%+ returns begins with 10% returns...

- Strength can beget strength

- So too weakness

- Momentum and trend-following are time-tested.

- A multi-month rally begins with one up week...

- Meaningful moves last

- And can last longer than expected.

Computer Hardware

Computer Software & Services

Electronics (Chips, Semis)

Internet

Telecommunications

5-Year Highs/Lows

What: stocks at 5-year highs and lows

Why: potential large and/or rapid price movement

This section shows the strongest of the strong and the weakest of the weak, hitting 5-year highs and lows, respectively. The strongest are the leaders of the market. Meanwhile, there is no rational reason to hold weak stocks that are at multi-year lows. There are far too many other attractive choices to waste time or capital (long positions) on such candidates.