SMO Exclusive: Strength Report Technology Sector 2024-04-04

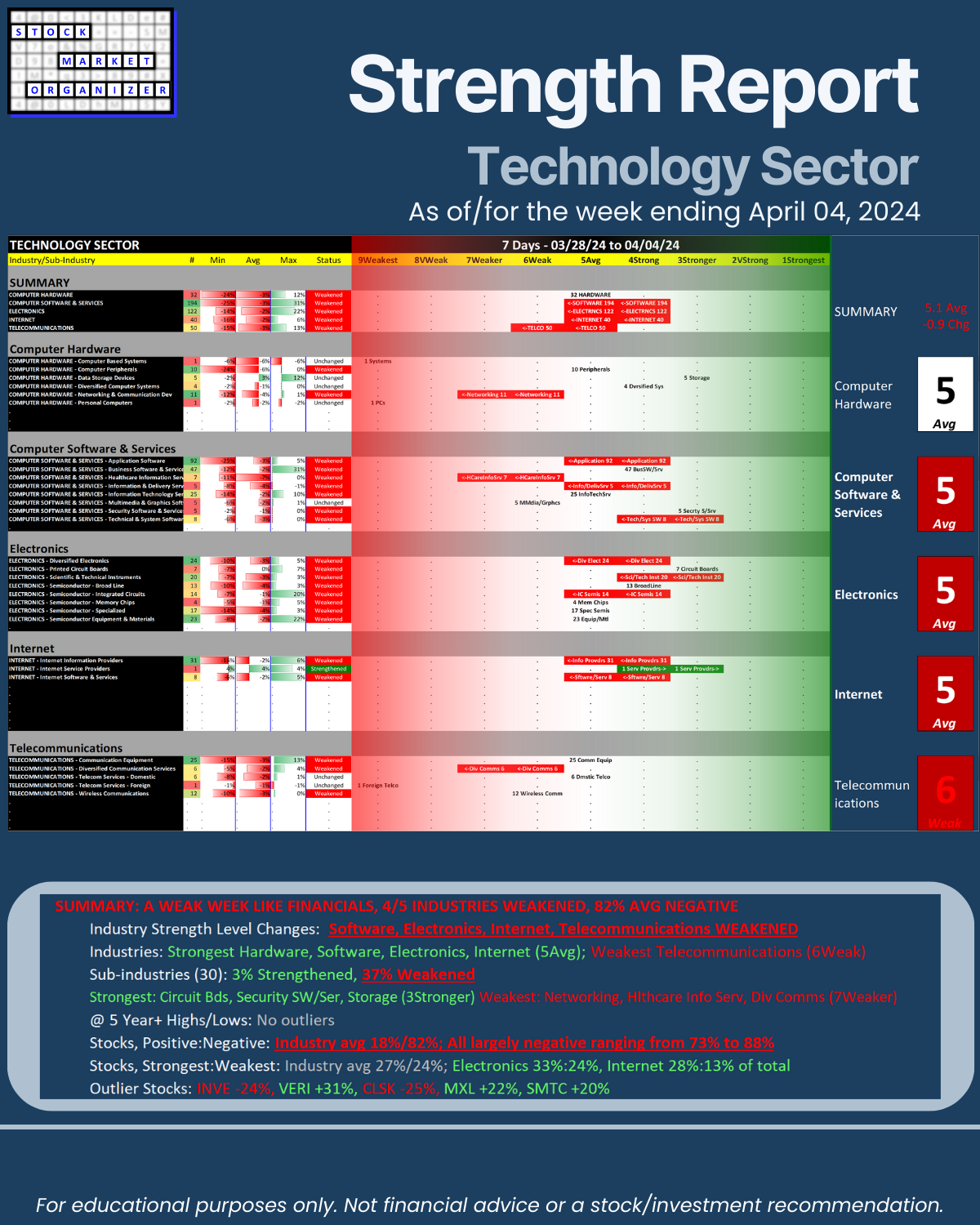

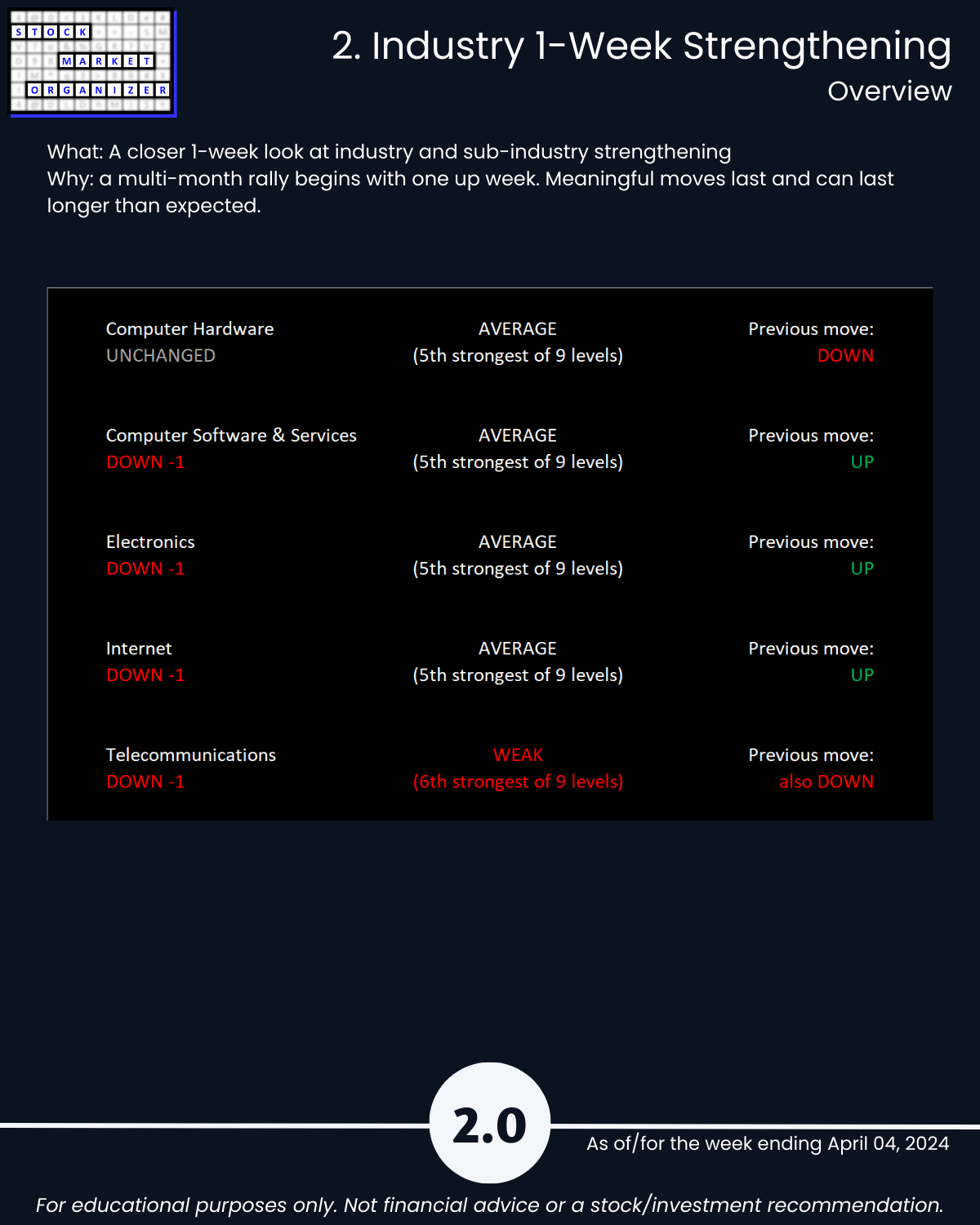

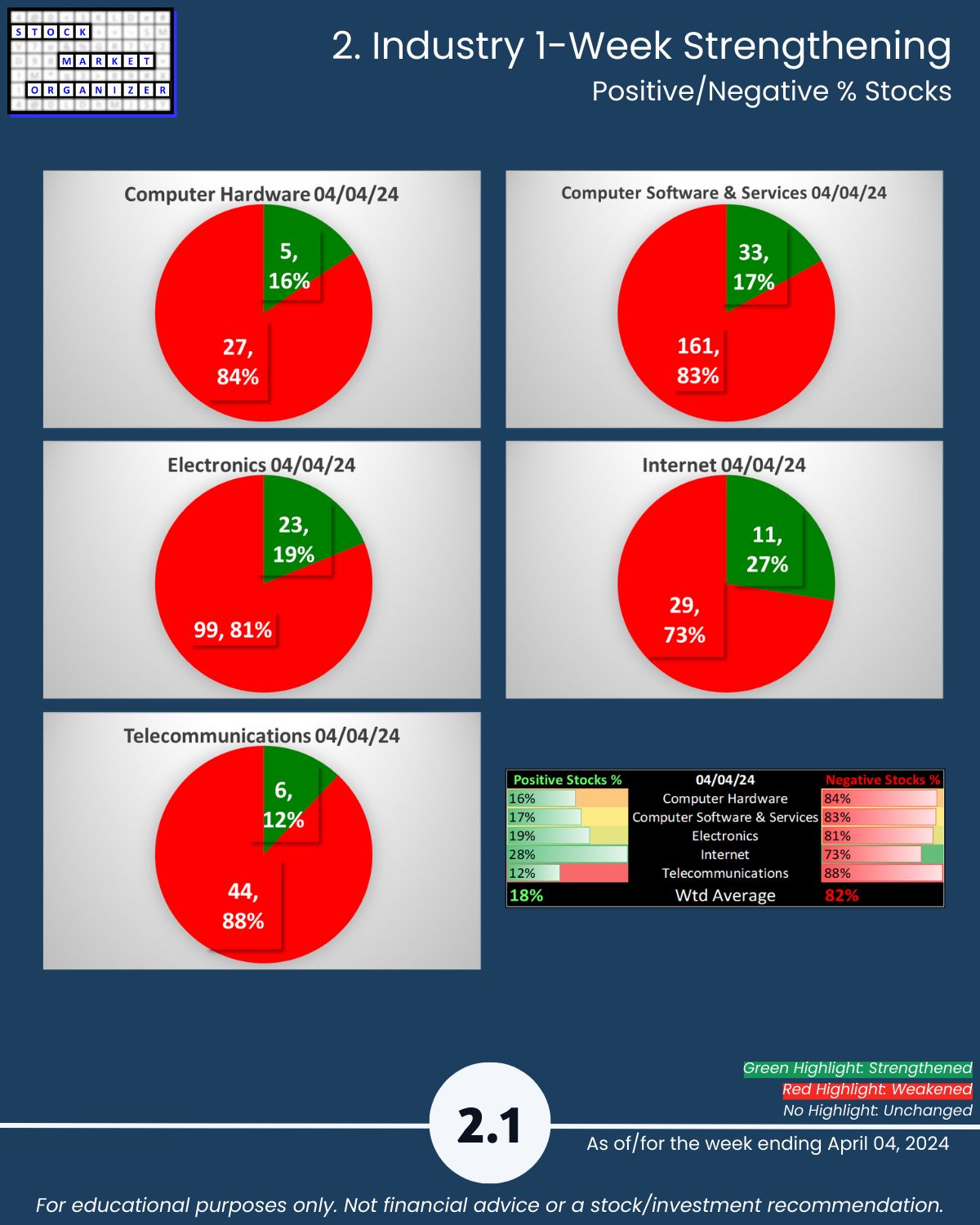

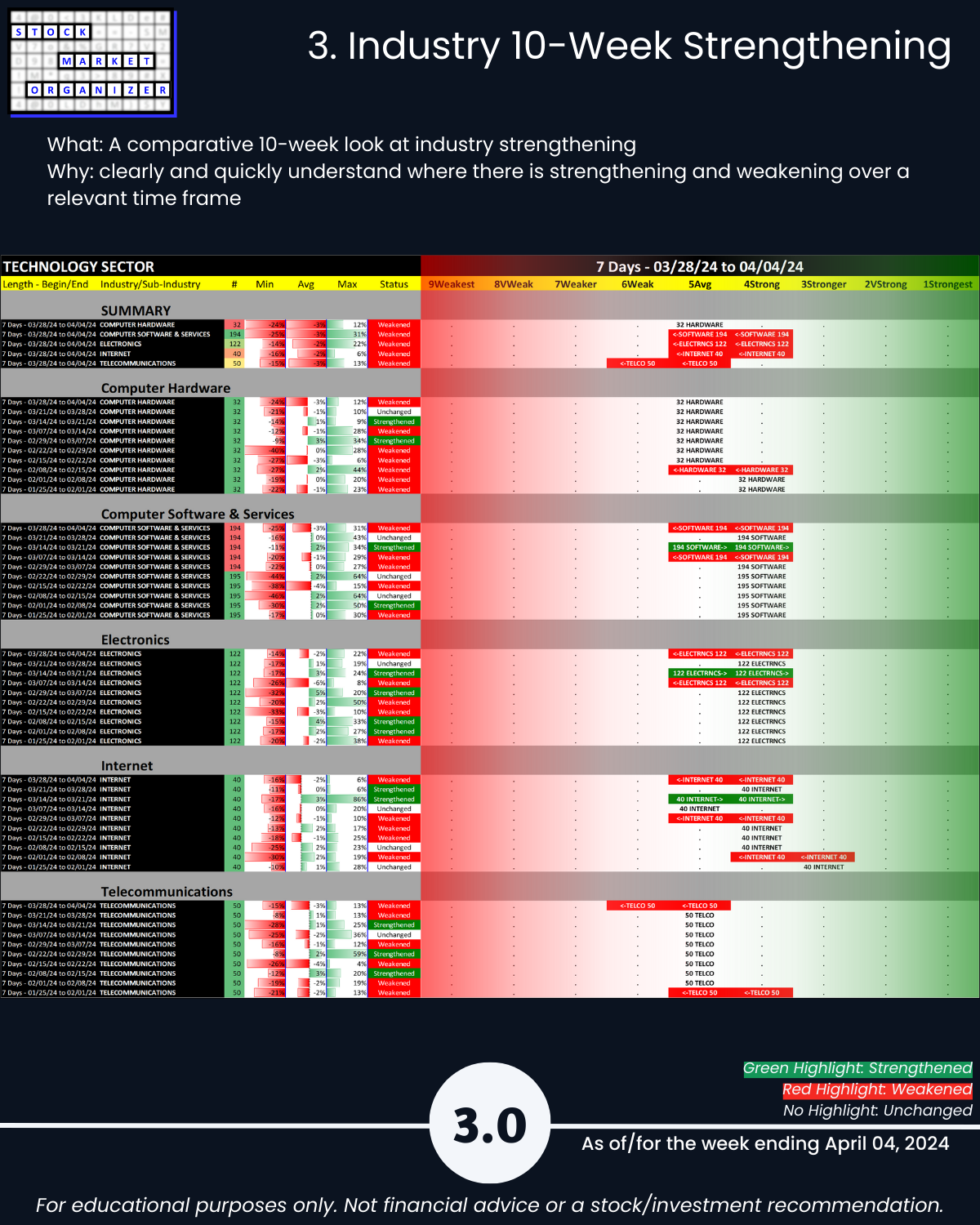

Market turning? 4/4/24 like Financials yesterday, bad week for the Tech Sector - unique U.S. Stock Market strength-based insights: 🔹 4 of 5 industries weakened as the average score falls 0.9 (a large drop) to 5.1 – lower than Average (which is 5.0), 🔹 82% average negative stocks with Telecommunications 88%, Hardware 84%, and Software 83%,🔹 37% of 30 sub-industries weakened (4 of 8 Software sub-industries weakened).

WHAT’S HAPPENING HERE?

I am…

Finding U.S. Stock Market strength from the

top down,

inside out,

and bottom up, because

the stronger your stocks, the greener your P&L.

WHAT CAN I TELL YOU THAT YOU MAY NOT ALREADY KNOW?

SUMMARY: A WEAK WEEK LIKE FINANCIALS, 4/5 INDUSTRIES WEAKENED, 82% AVG NEGATIVE

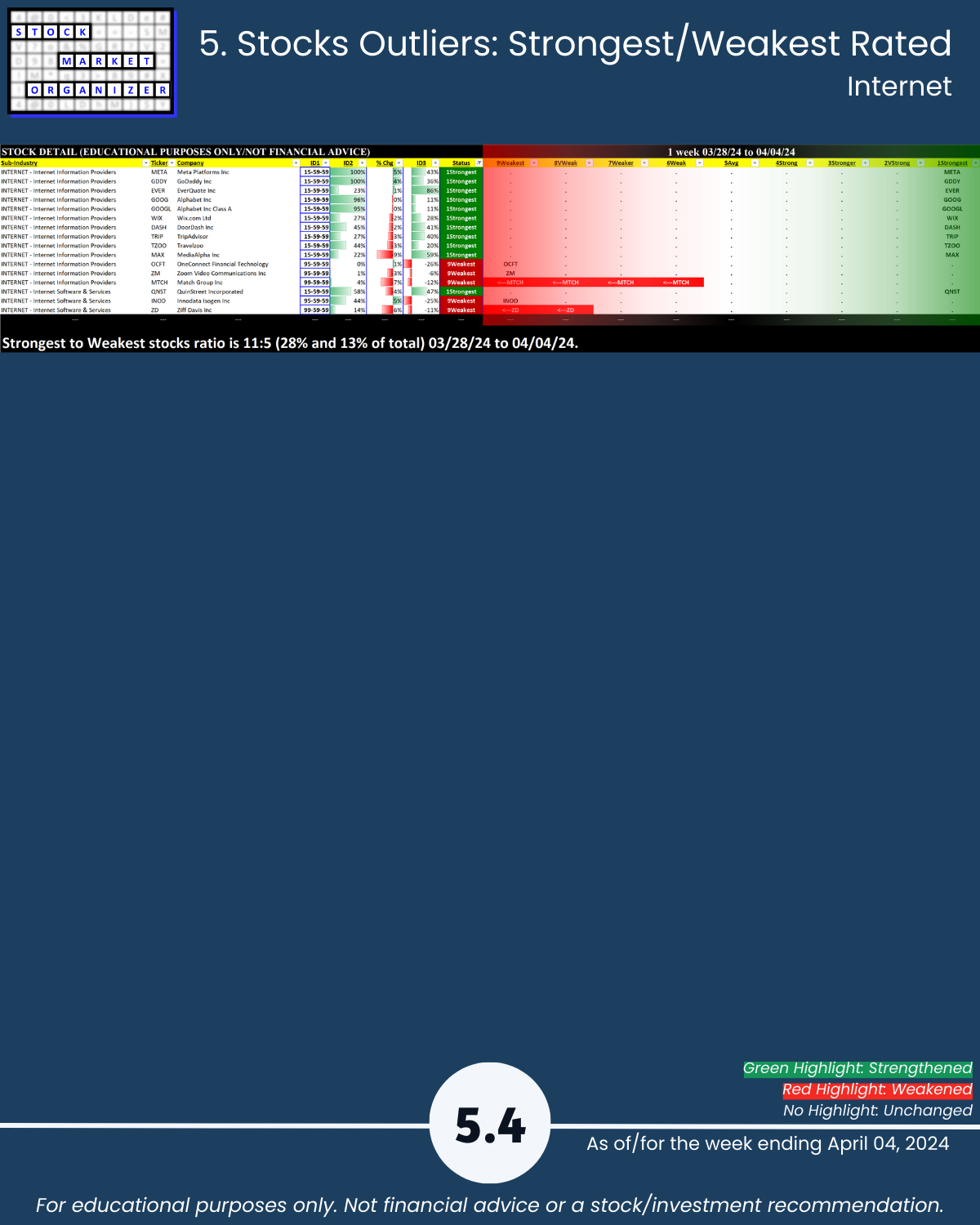

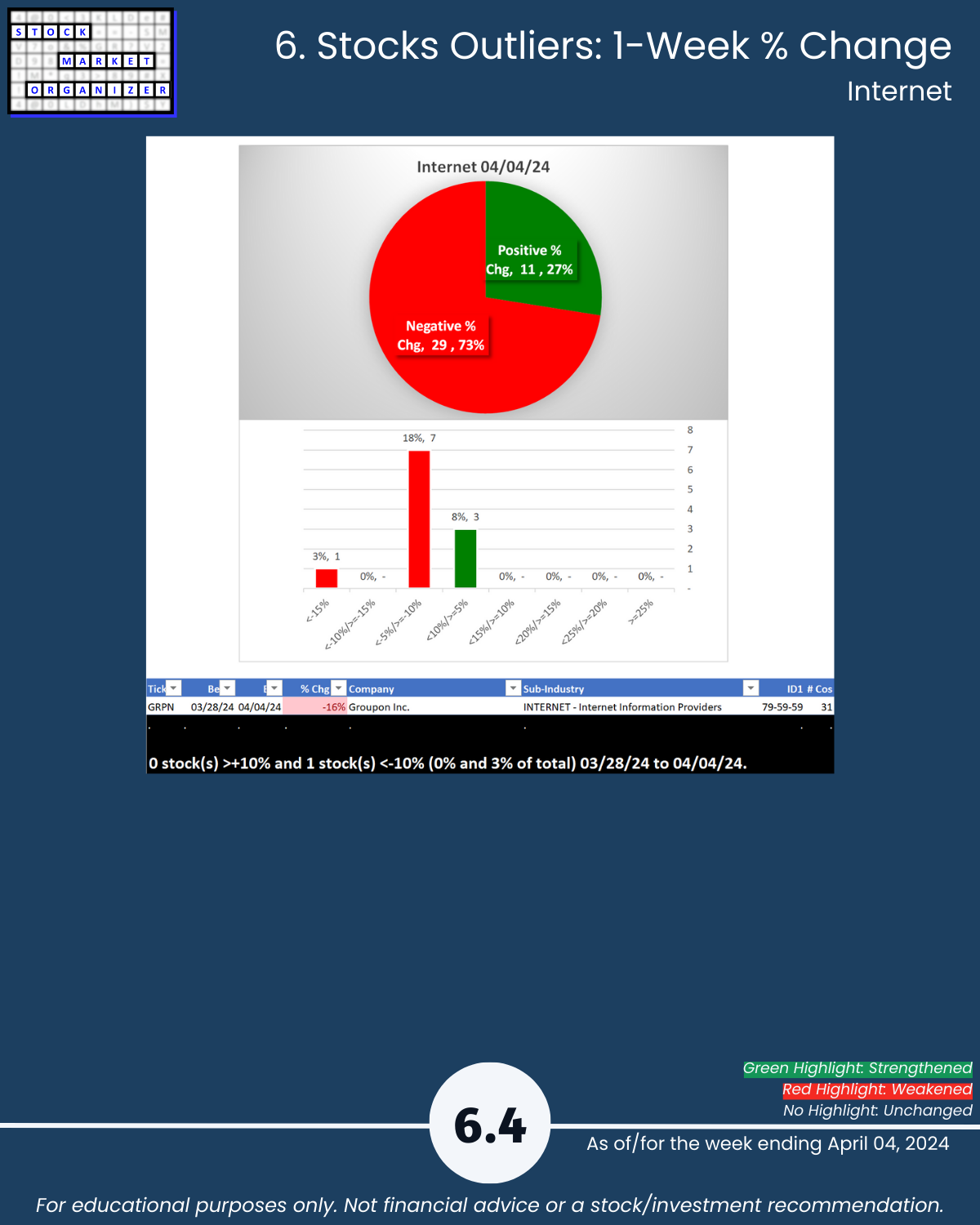

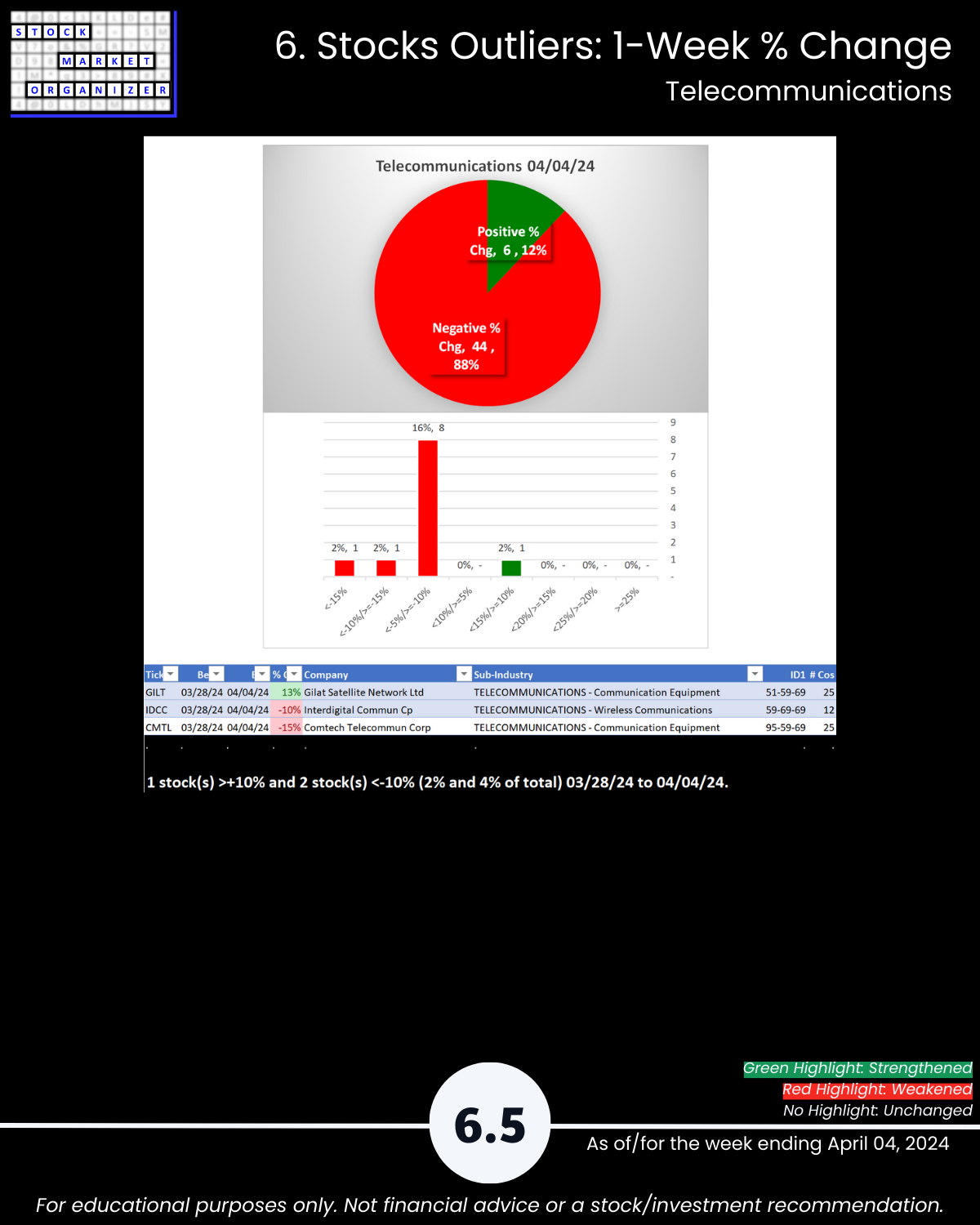

🔹 Industry Strength Level Changes: Software, Electronics, Internet, Telecommunications WEAKENED

🔹 Industries:

- Strongest Hardware, Software, Electronics, Internet (5Avg)

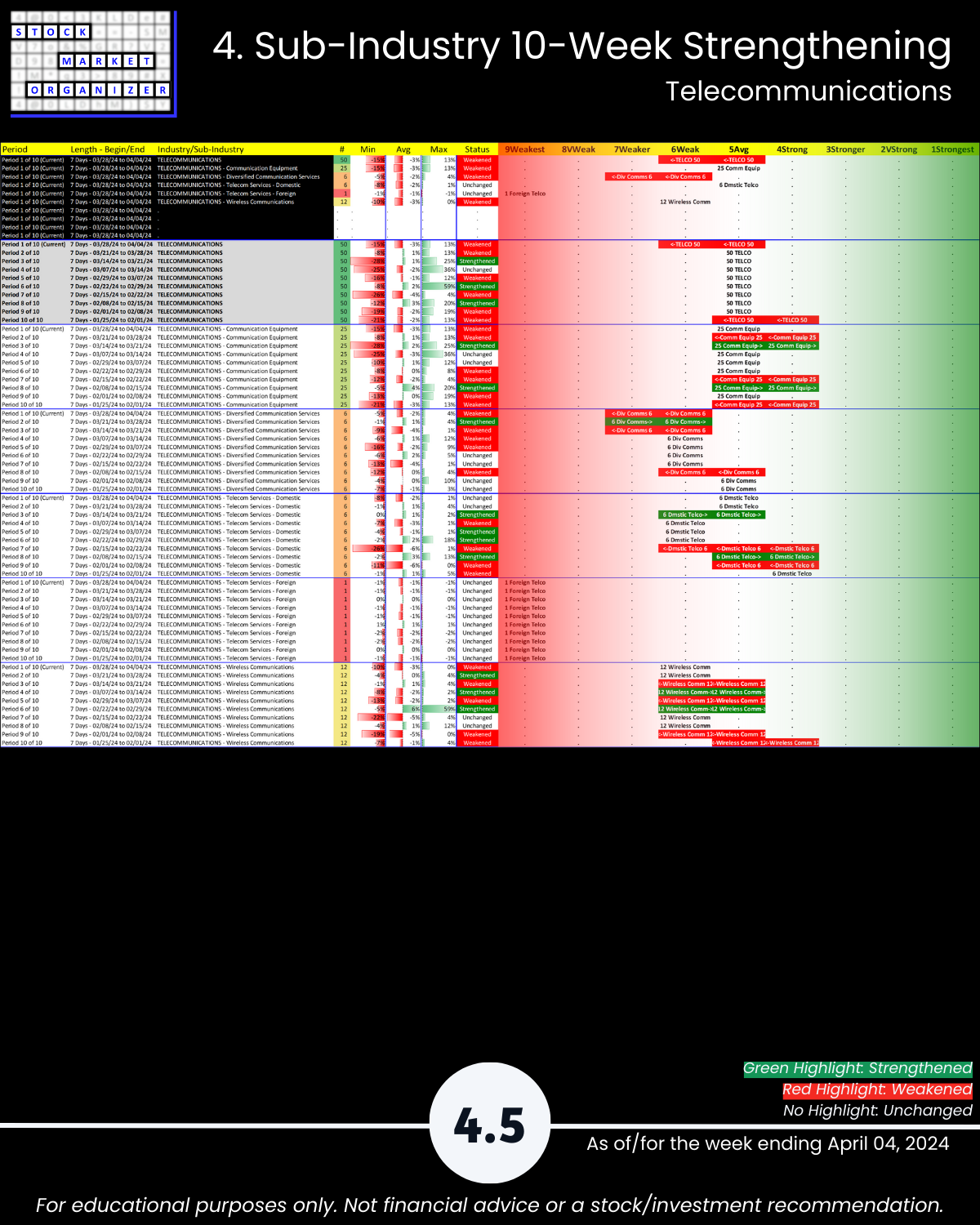

- Weakest Telecommunications (6Weak)

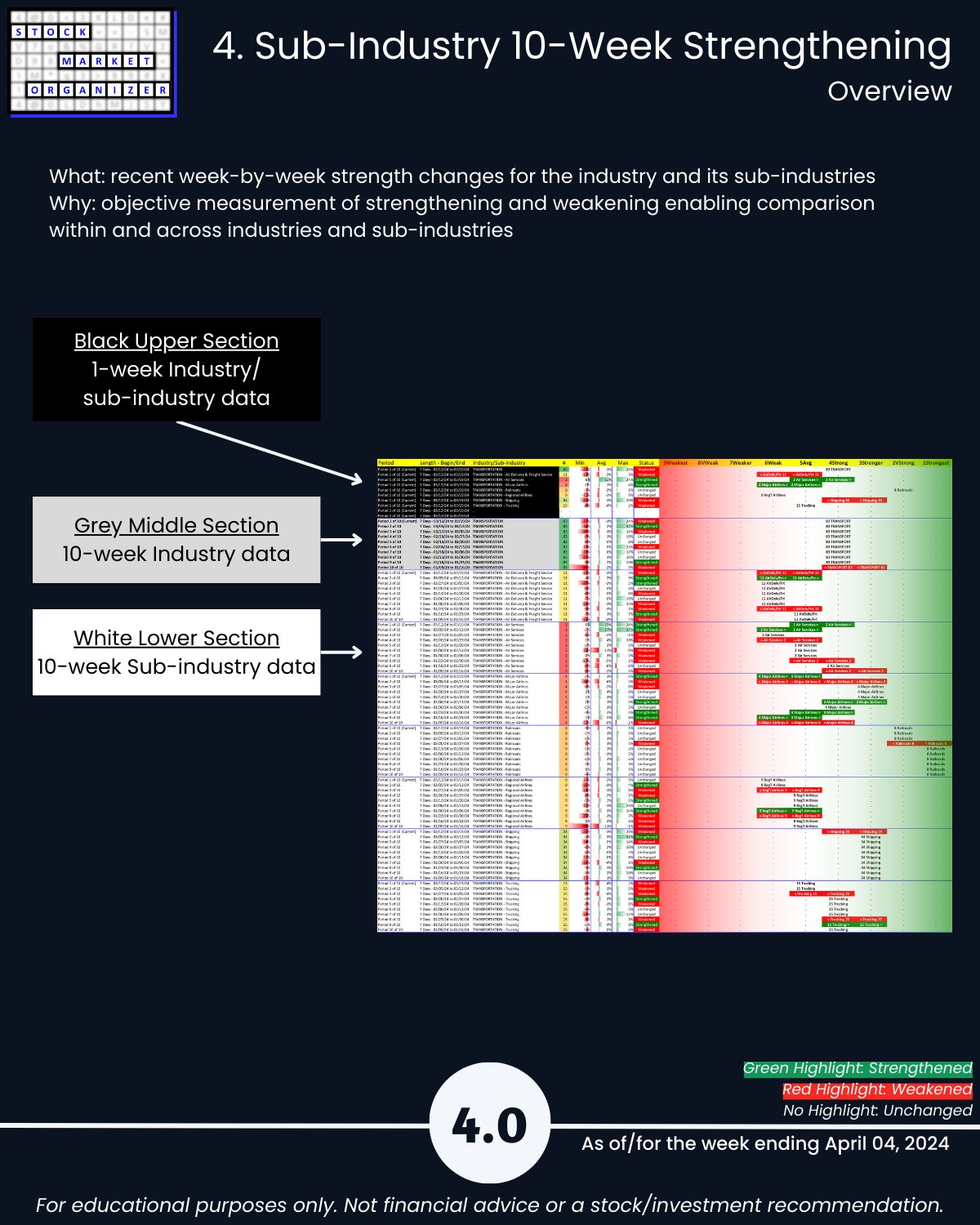

🔹 Sub-industries (30):

- 3% Strengthened, 37% Weakened

- Strongest: Circuit Bds, Security SW/Ser, Storage (3Stronger)

- Weakest: Networking, Hlthcare Info Serv, Div Comms (7Weaker)

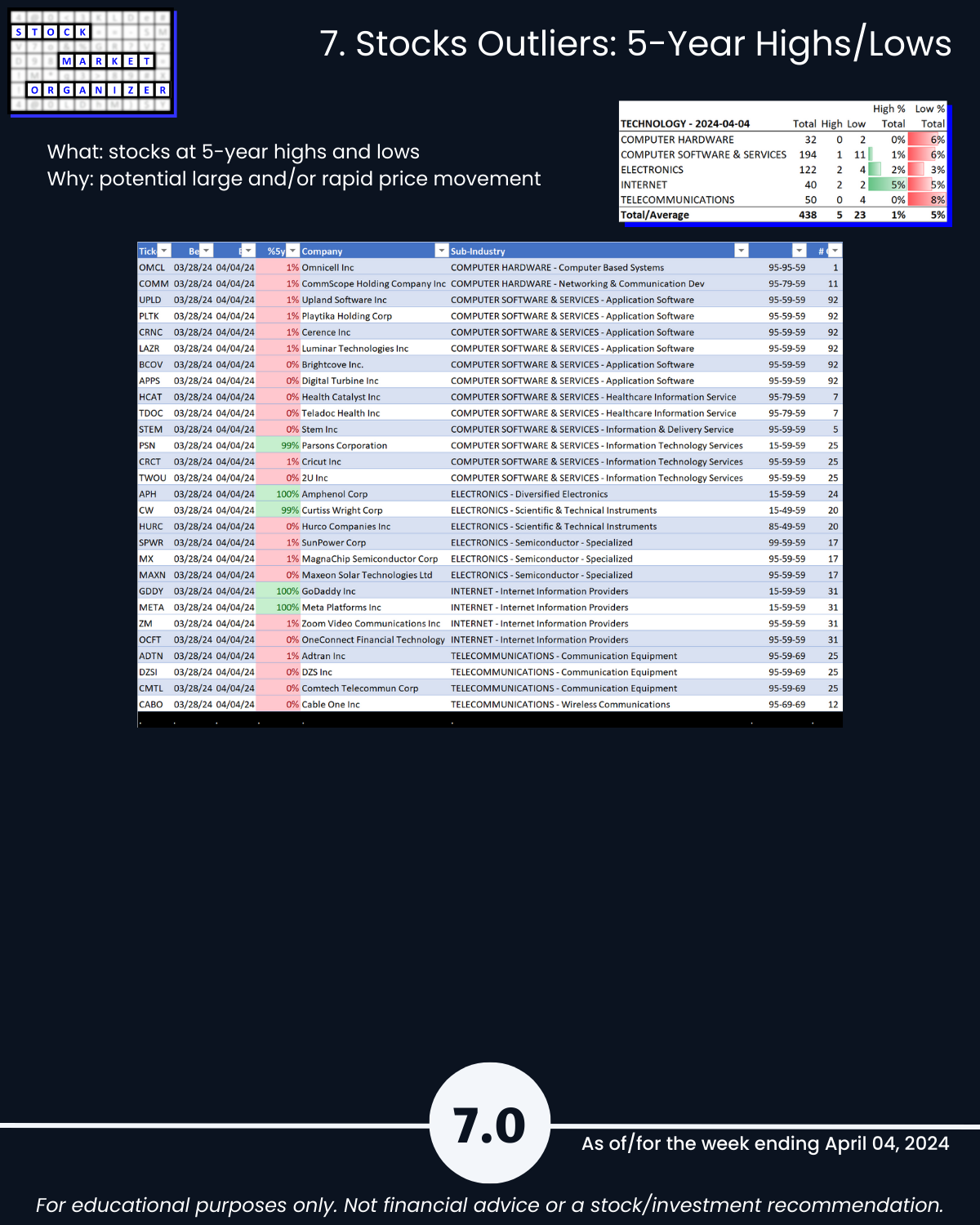

- @ 5 Year+ Highs/Lows: No outliers

🔹 Stocks:

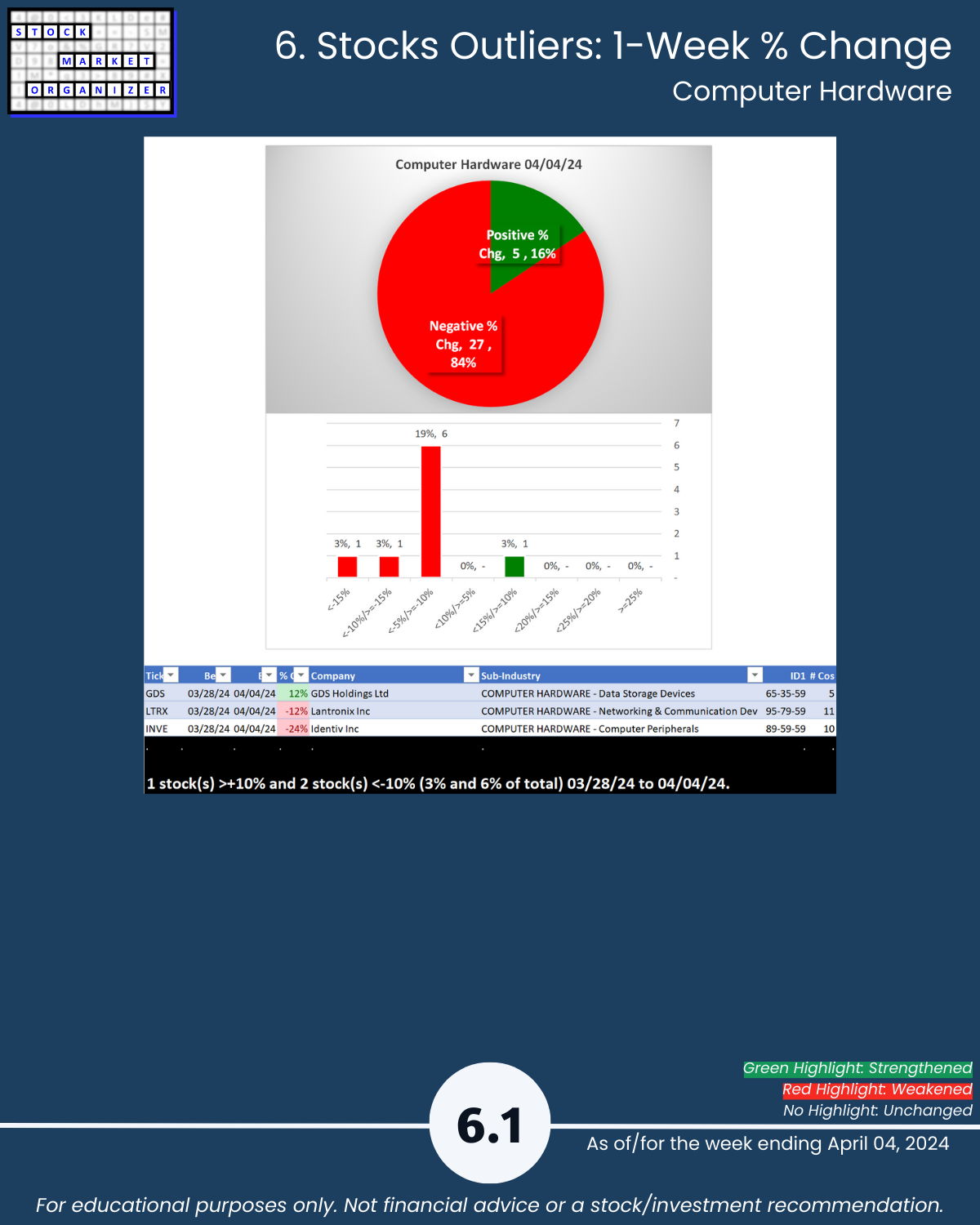

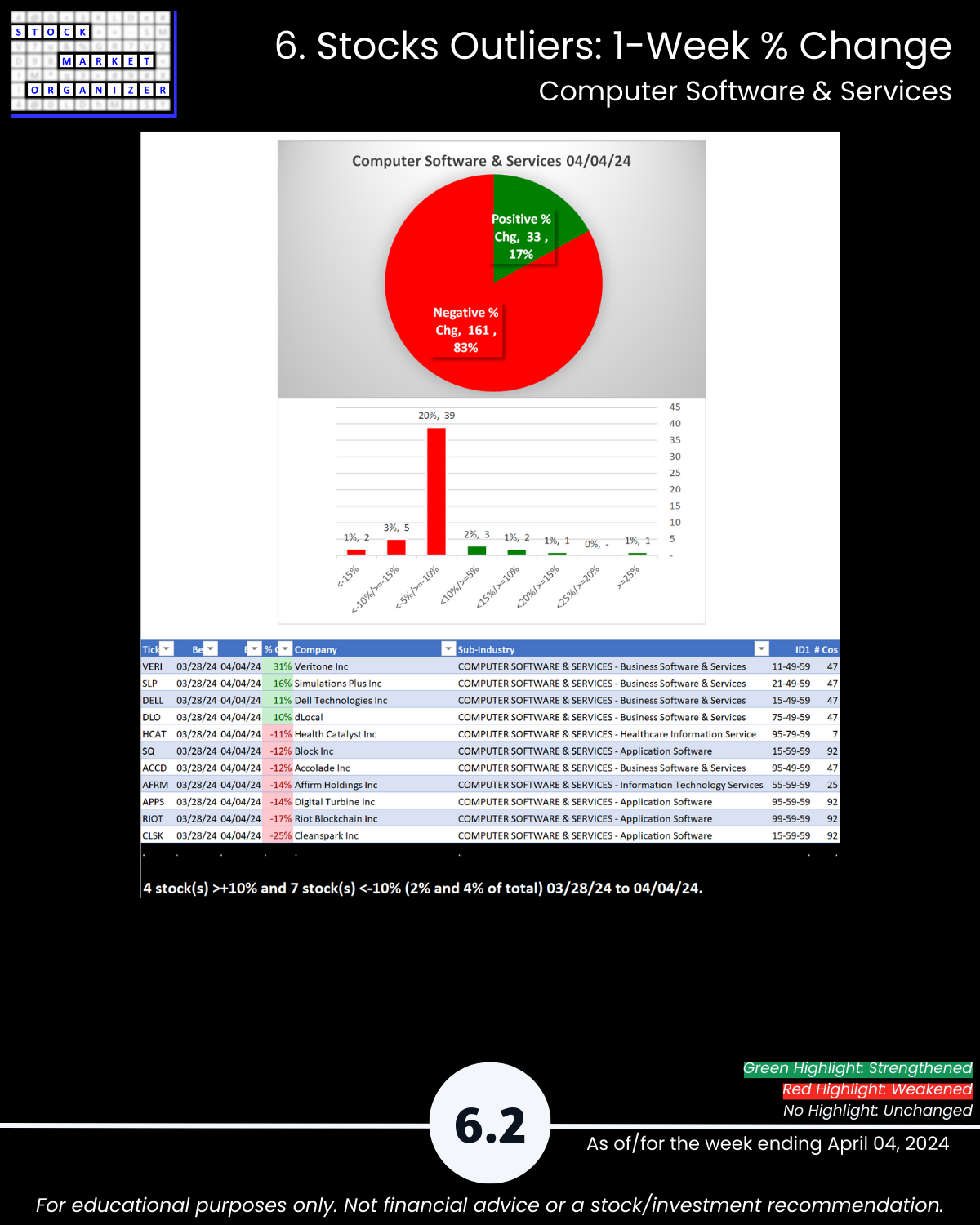

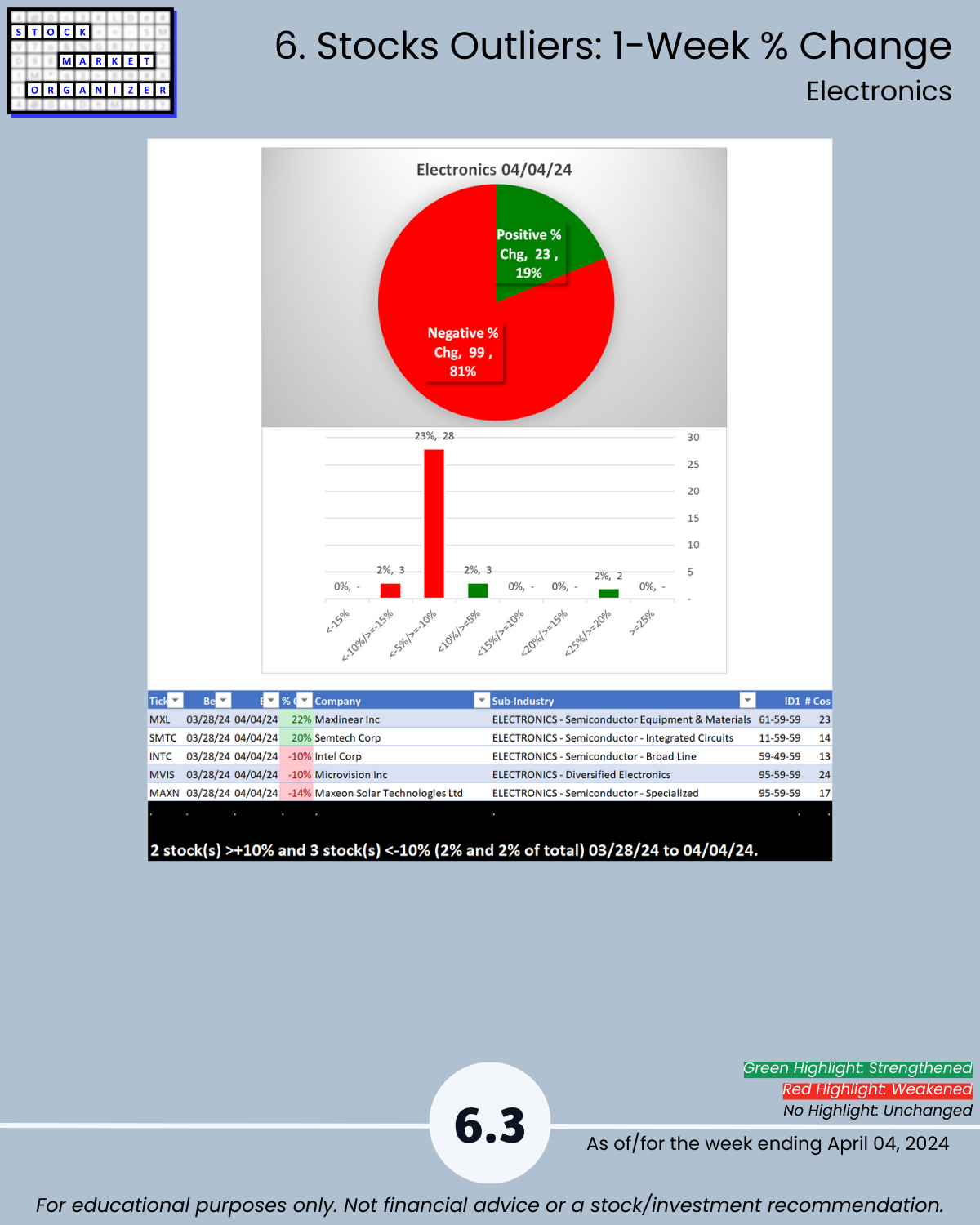

- Positive:Negative: Industry avg 18%/82%; All largely negative ranging from 73% to 88%

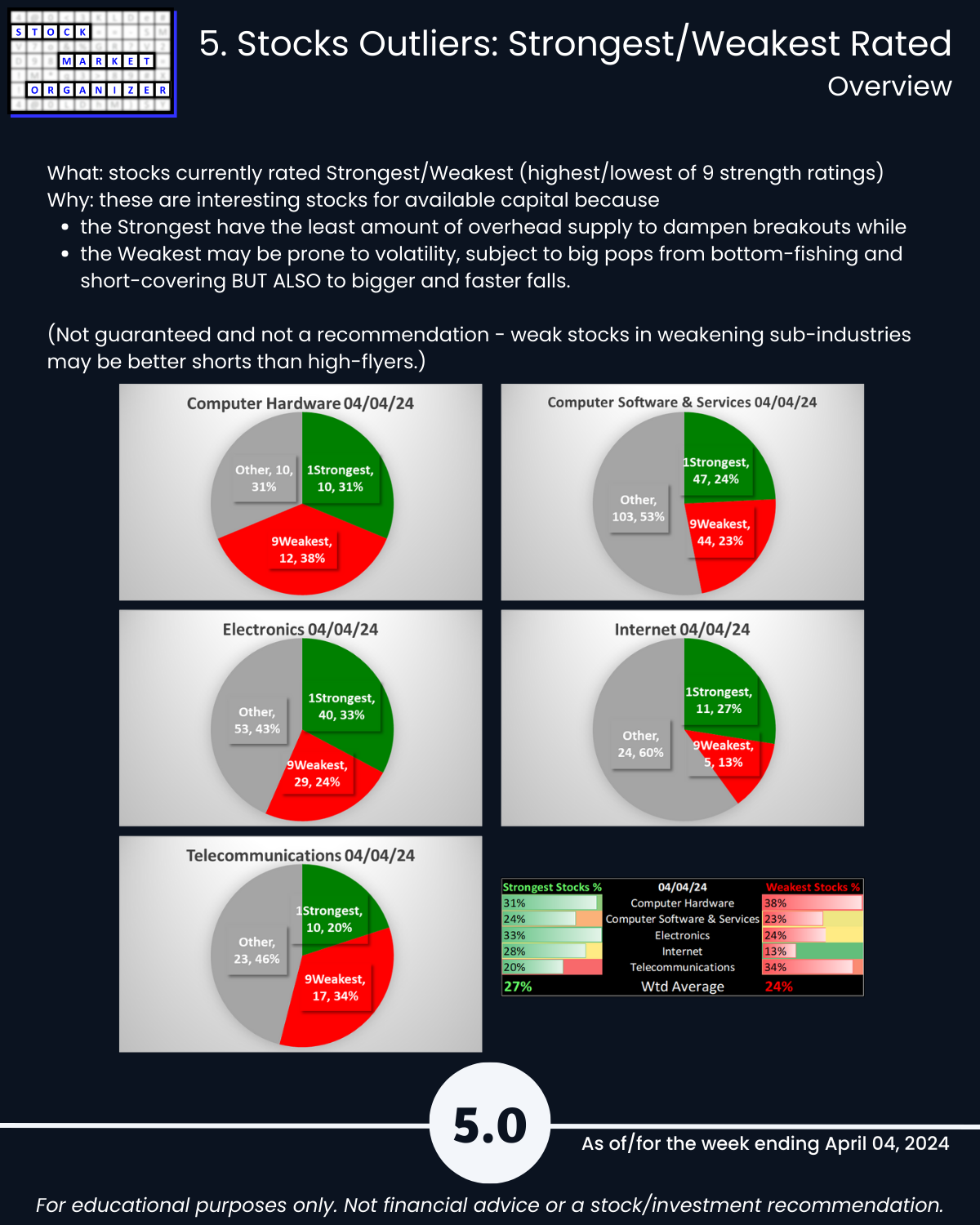

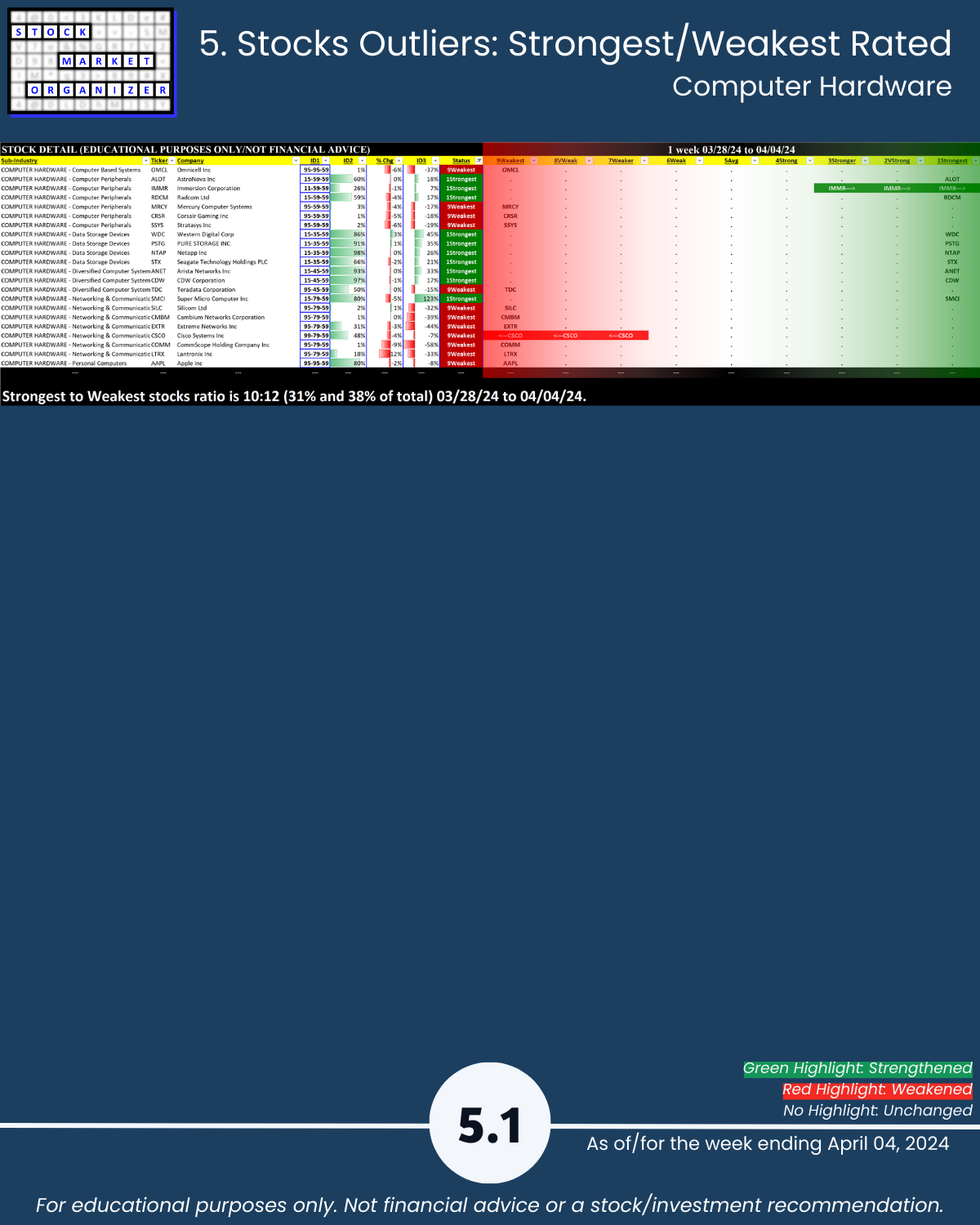

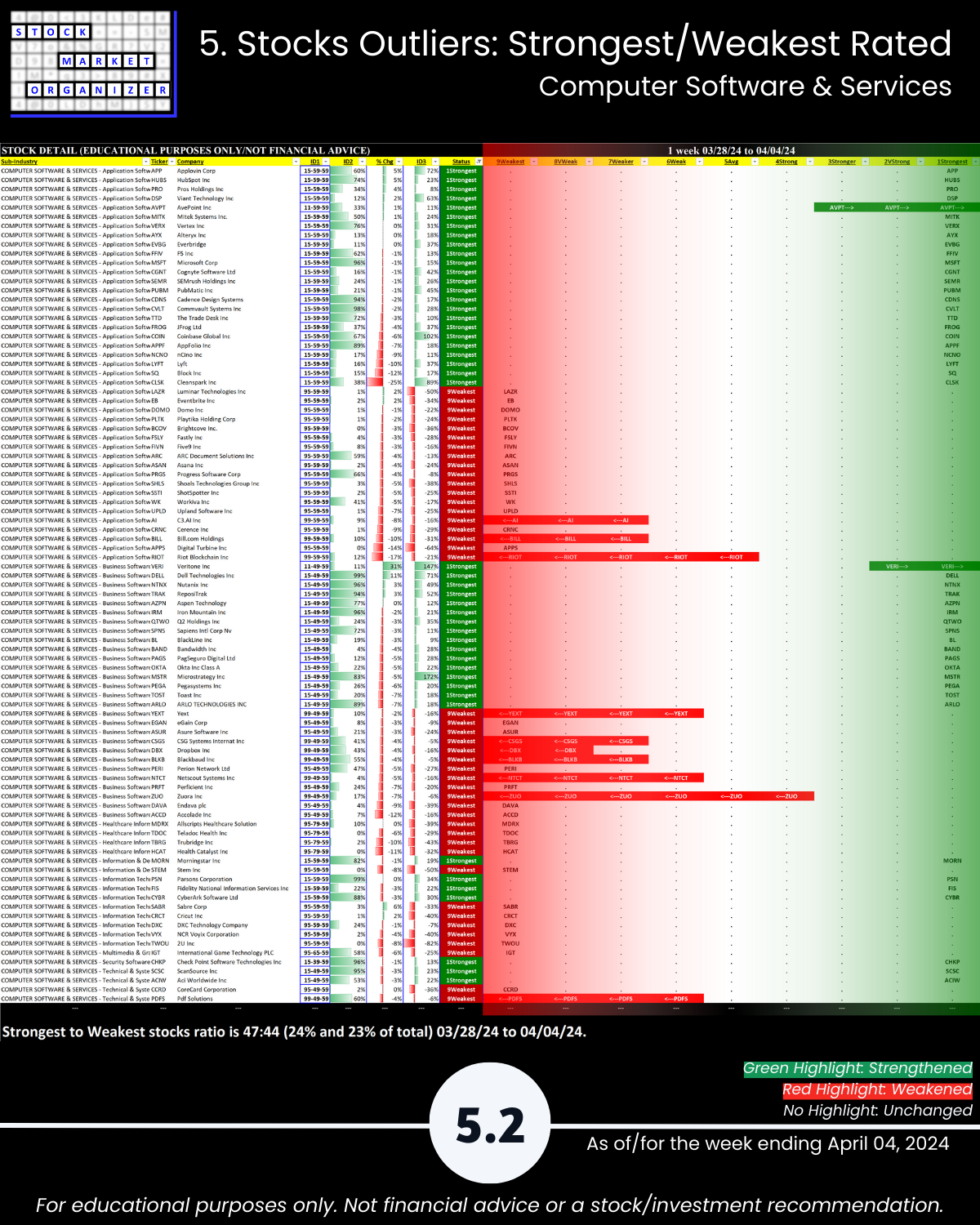

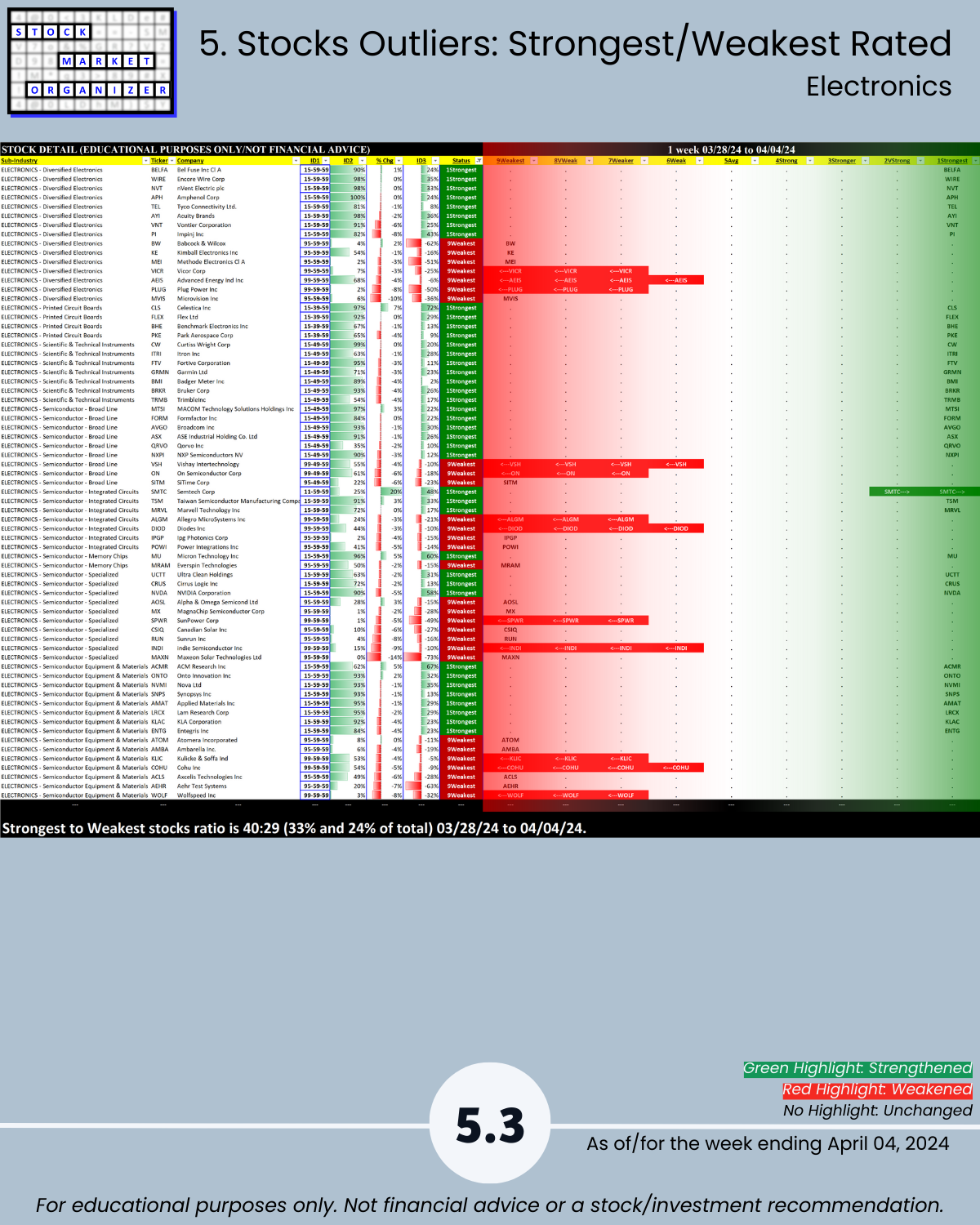

- Strongest:Weakest: Industry avg 27%/24%; Electronics 33%:24%, Internet 28%:13% of total

- Outlier Stocks: INVE -24%, VERI +31%, CLSK -25%, MXL +22%, SMTC +20%

THE “WHY” BEHIND THIS METHOD (SEEKING STRENGTH MARKETWIDE)

The stronger your stocks the greener your P&L.

The journey to 100%+ returns begins with 10% returns.

The journey to multi-month rallies begins with one up week.

You won’t find what you aren’t looking for.

Look at any number of triple-digit gainers over the past year or less - obviously NVDA, certainly CVNA, SKYW, POWL, ANF, SMCI.

Each started with 10% gains.

Maybe 10% gainers keep going, and maybe they don’t.

But if you aren’t looking for them, and what might keep them rising (strengthening sub-industry, industry, and market), then you won’t find them.

The market does not have to be so complicated.

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

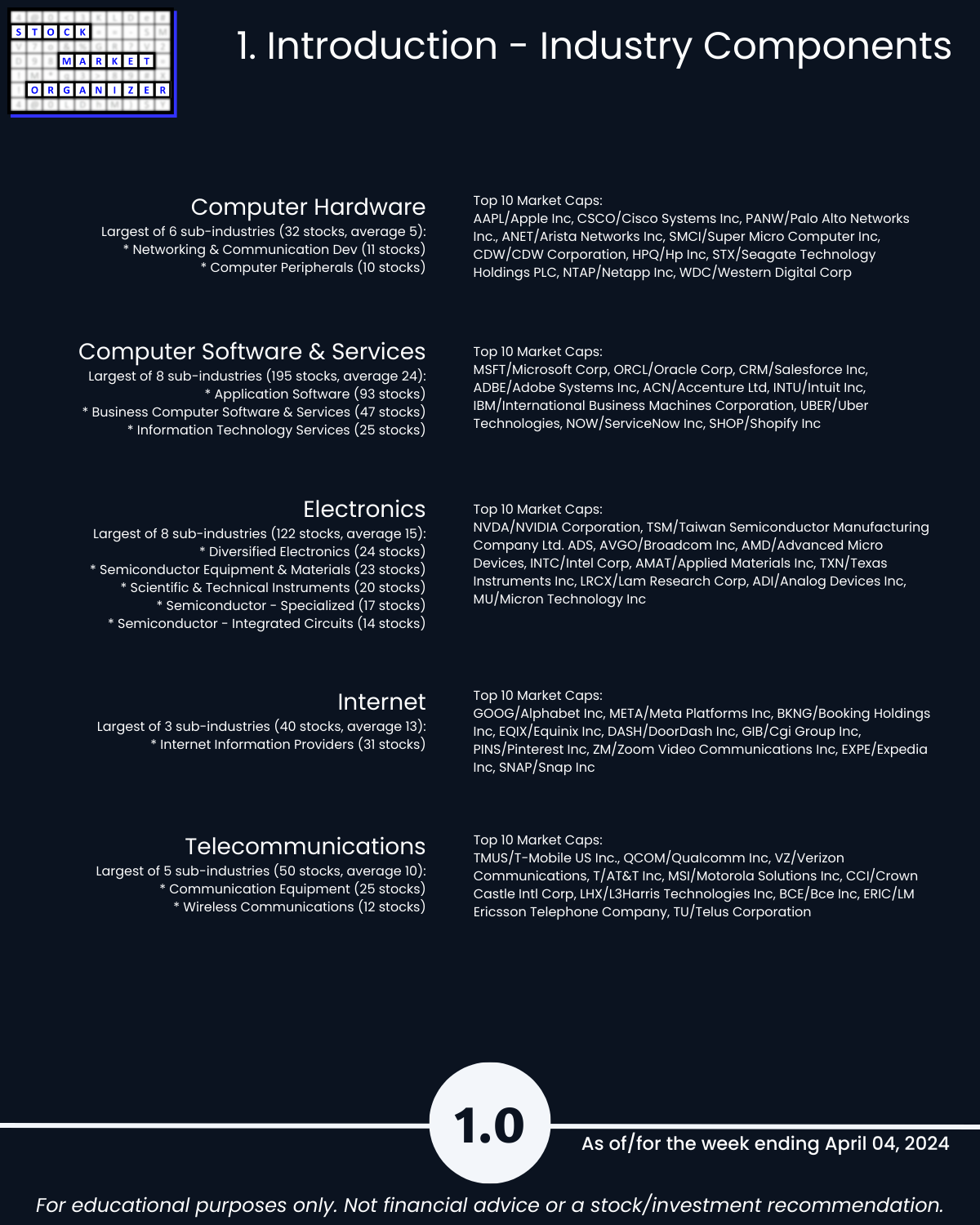

1. Introduction

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

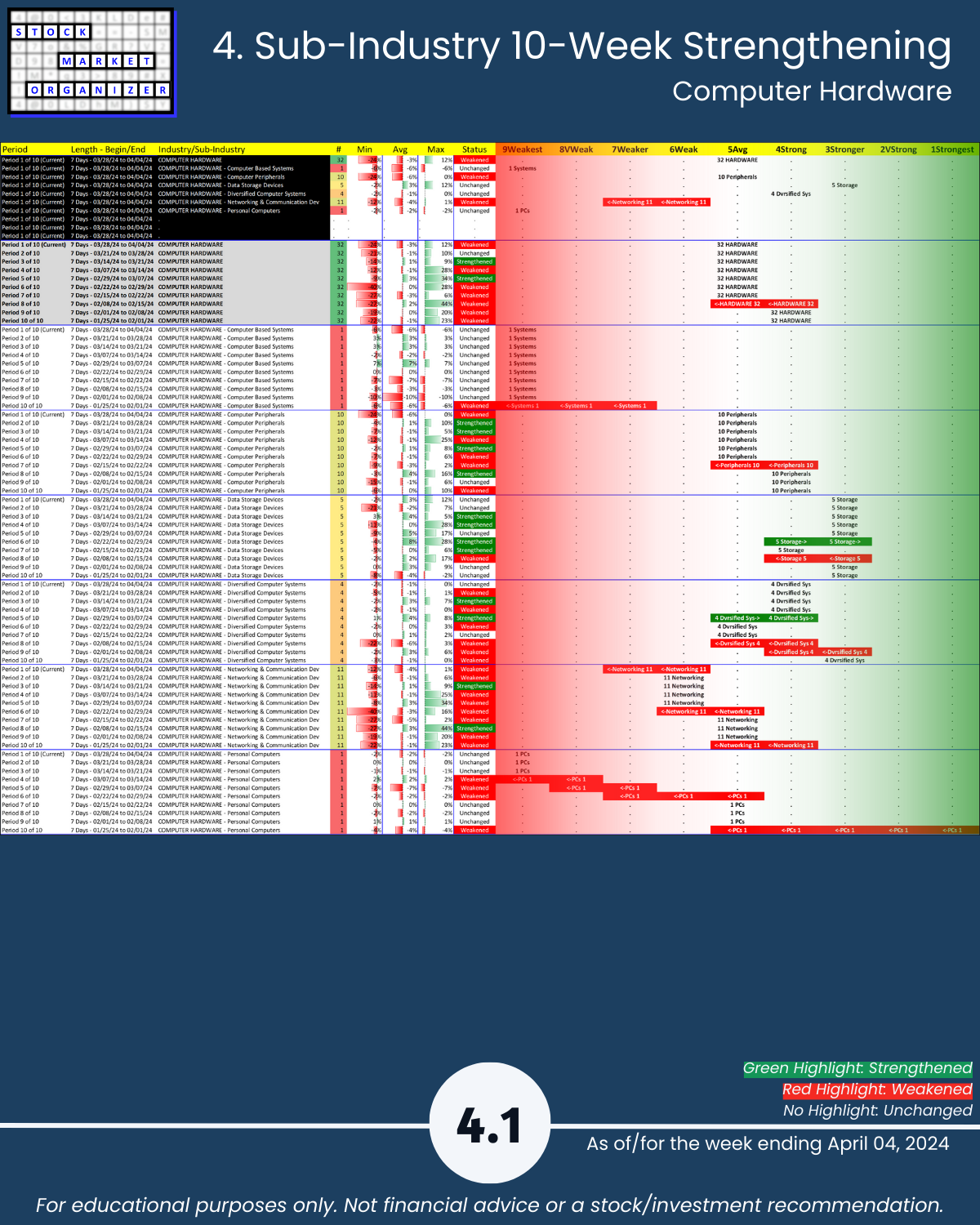

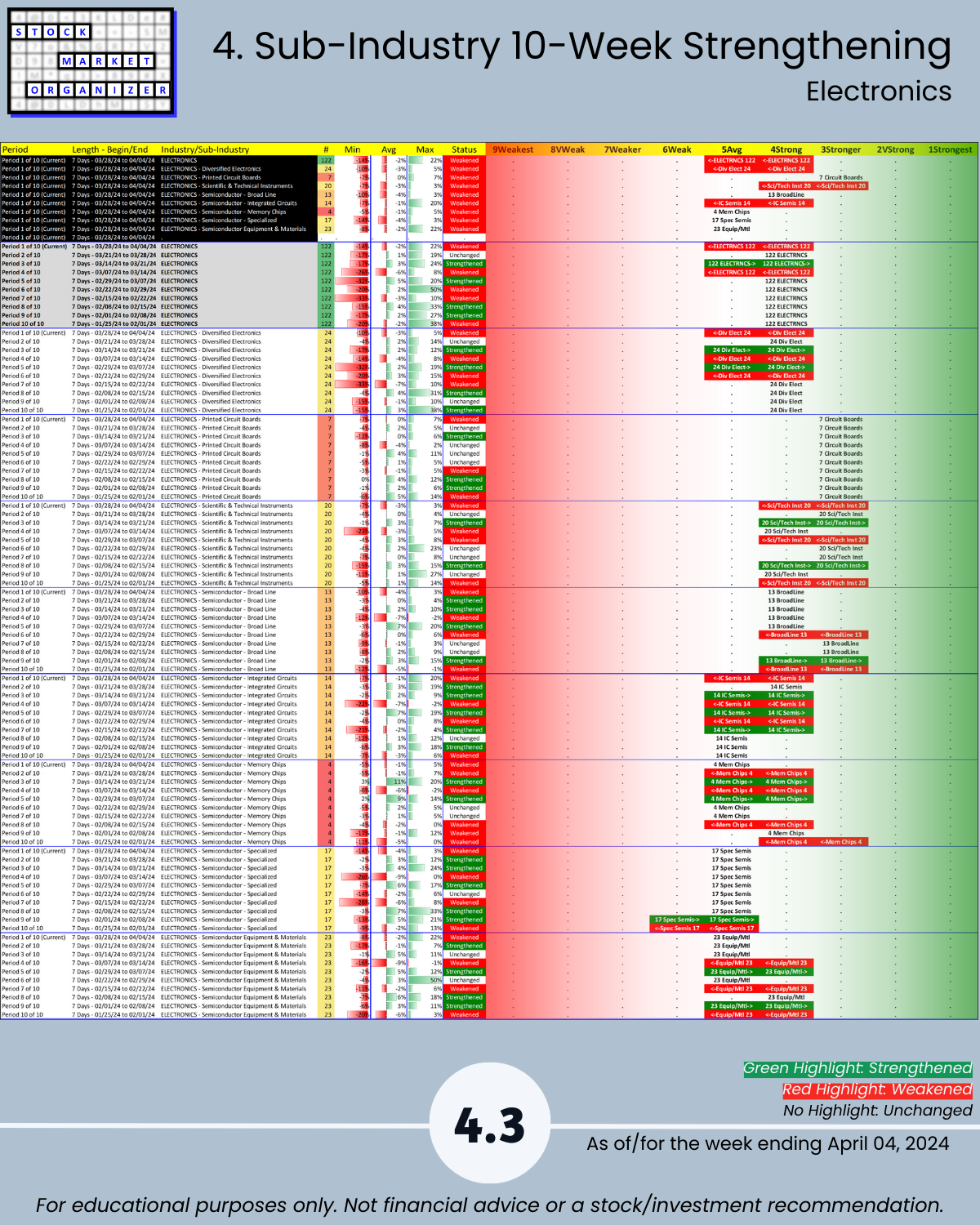

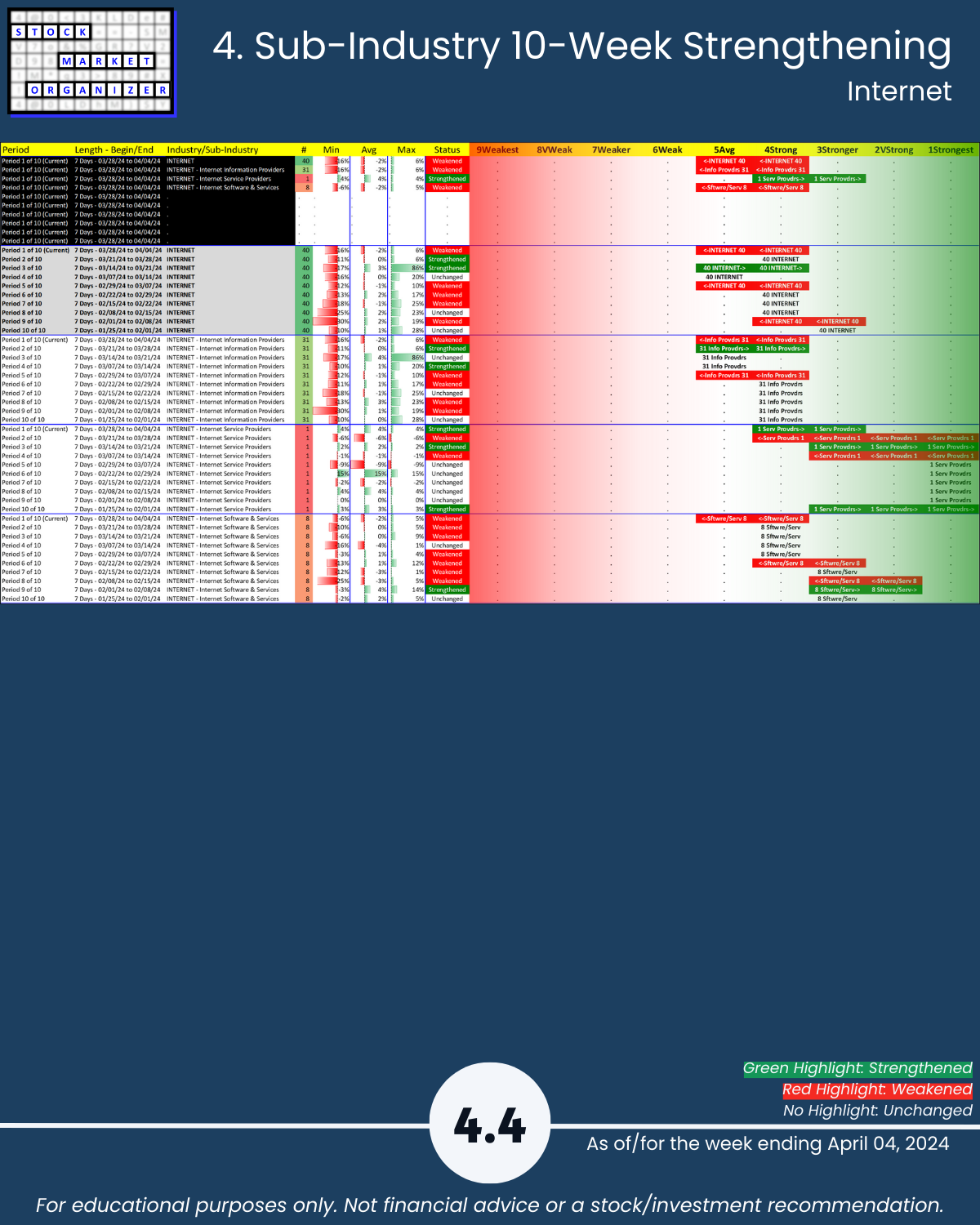

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows