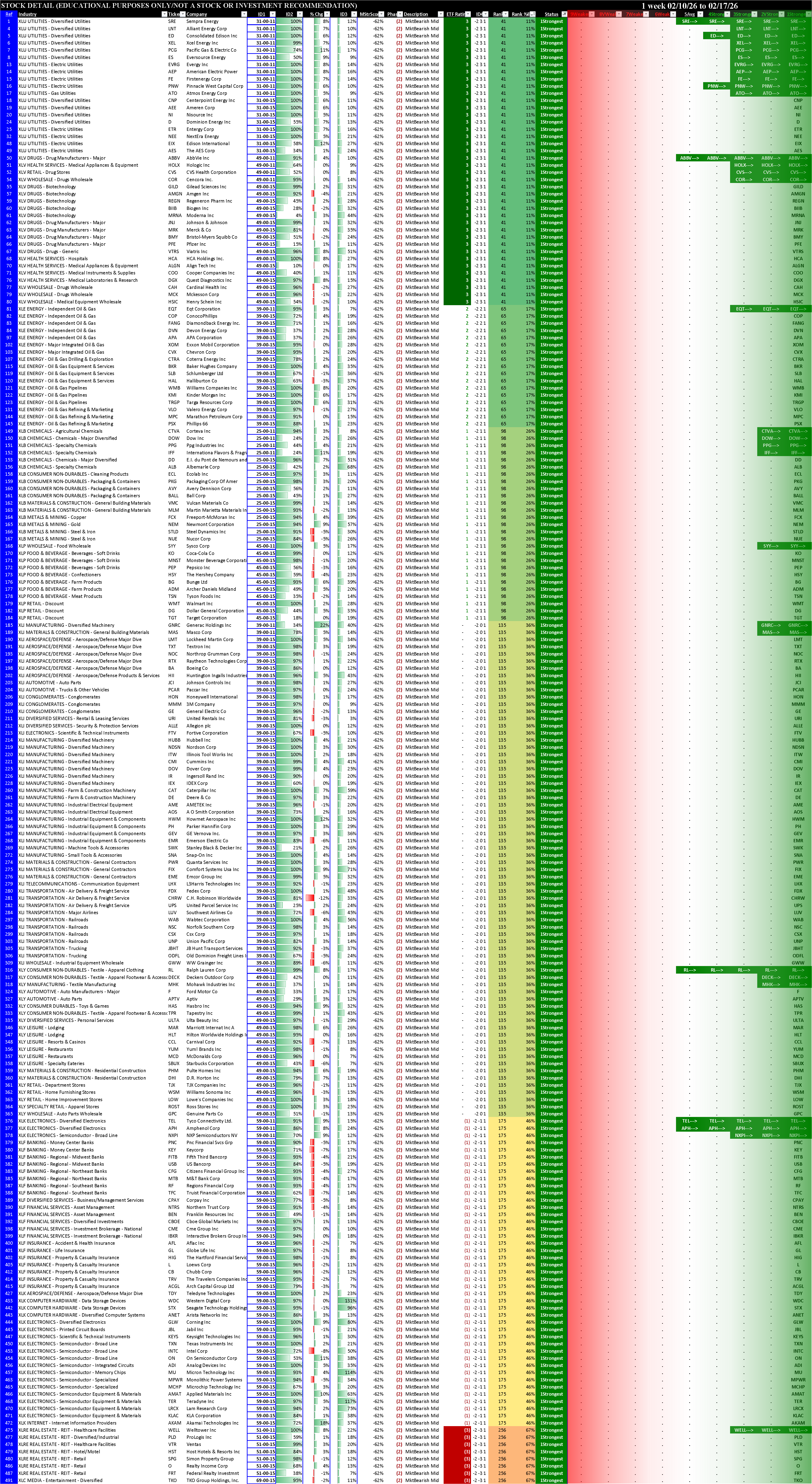

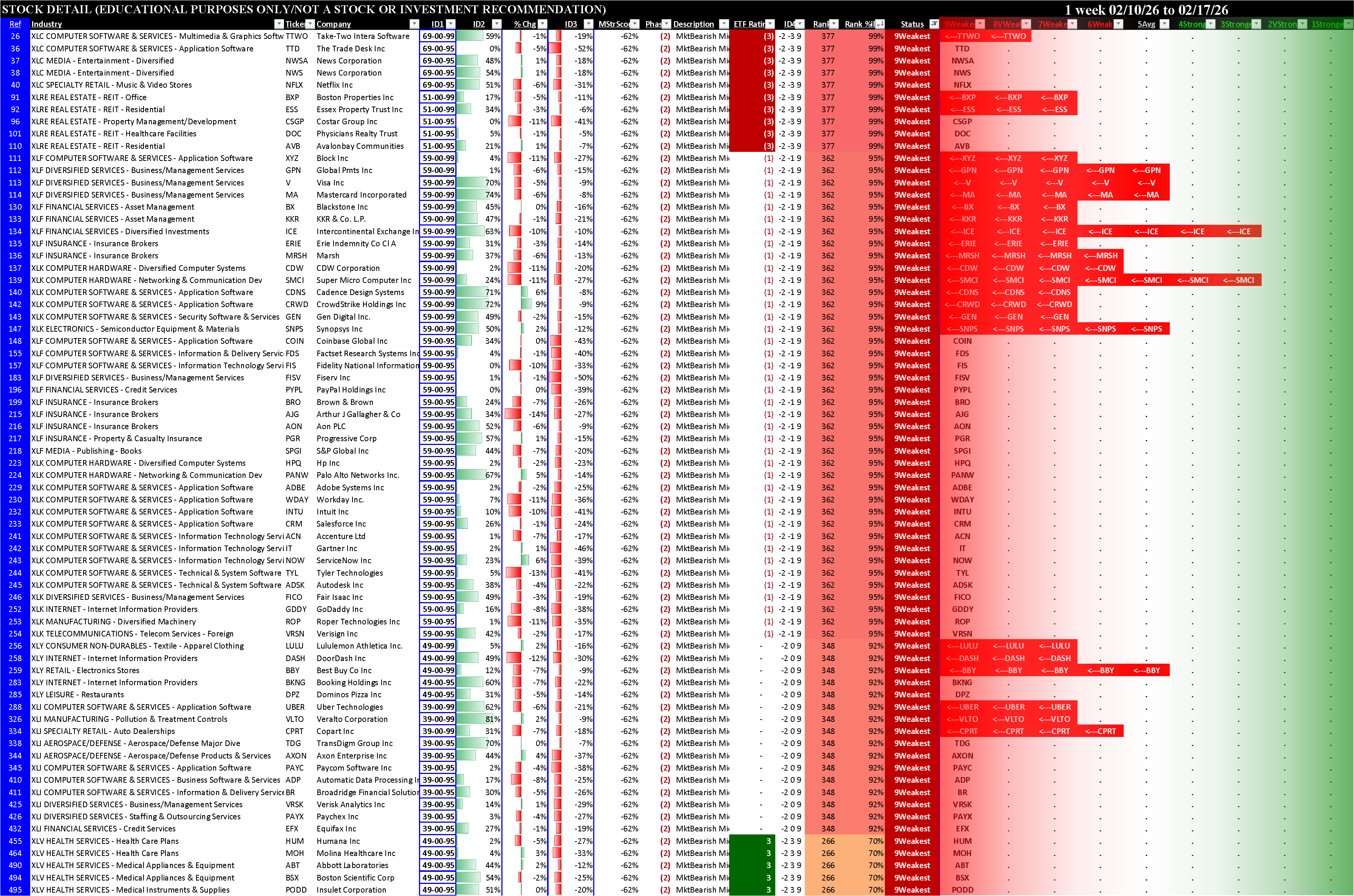

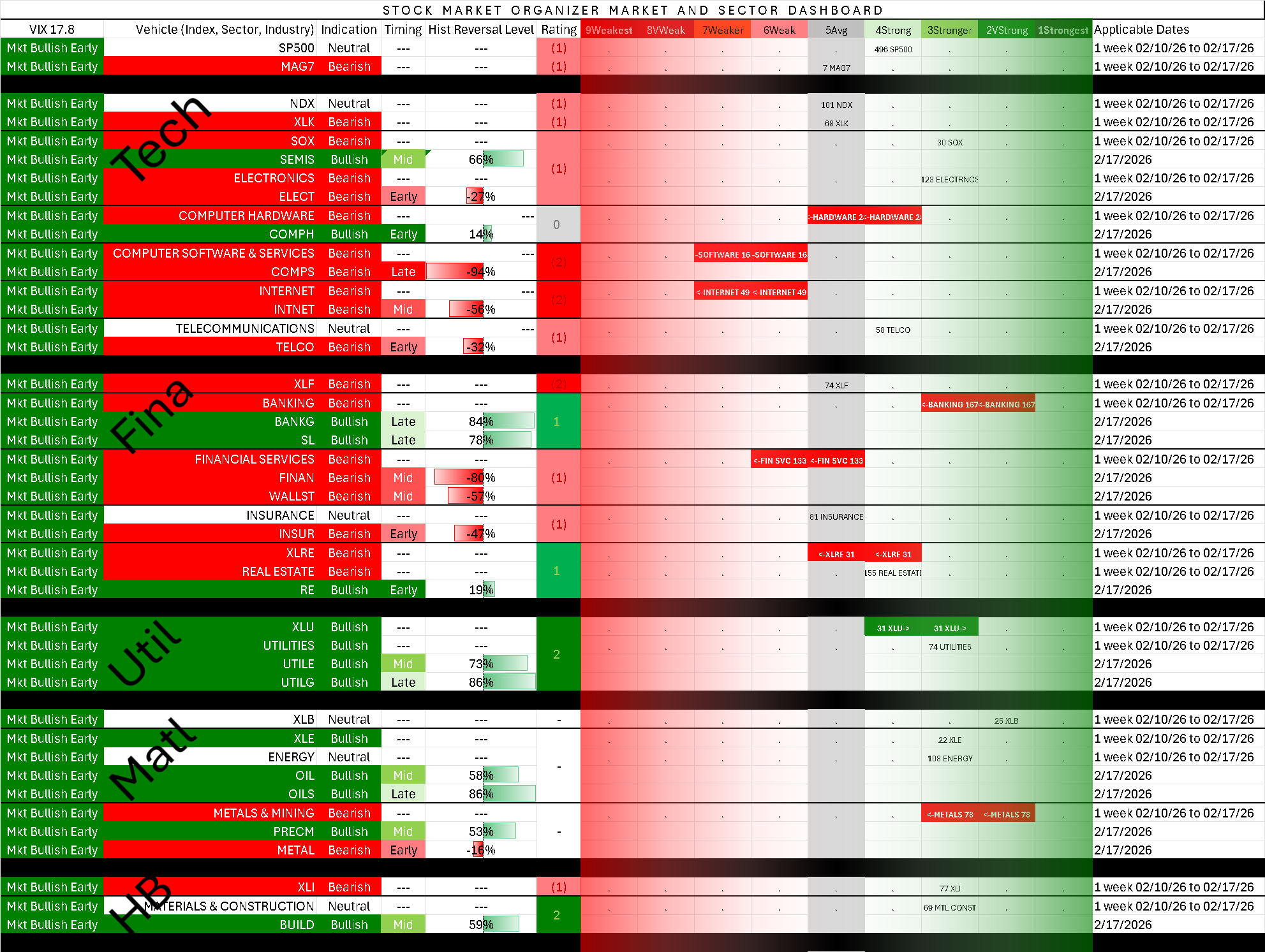

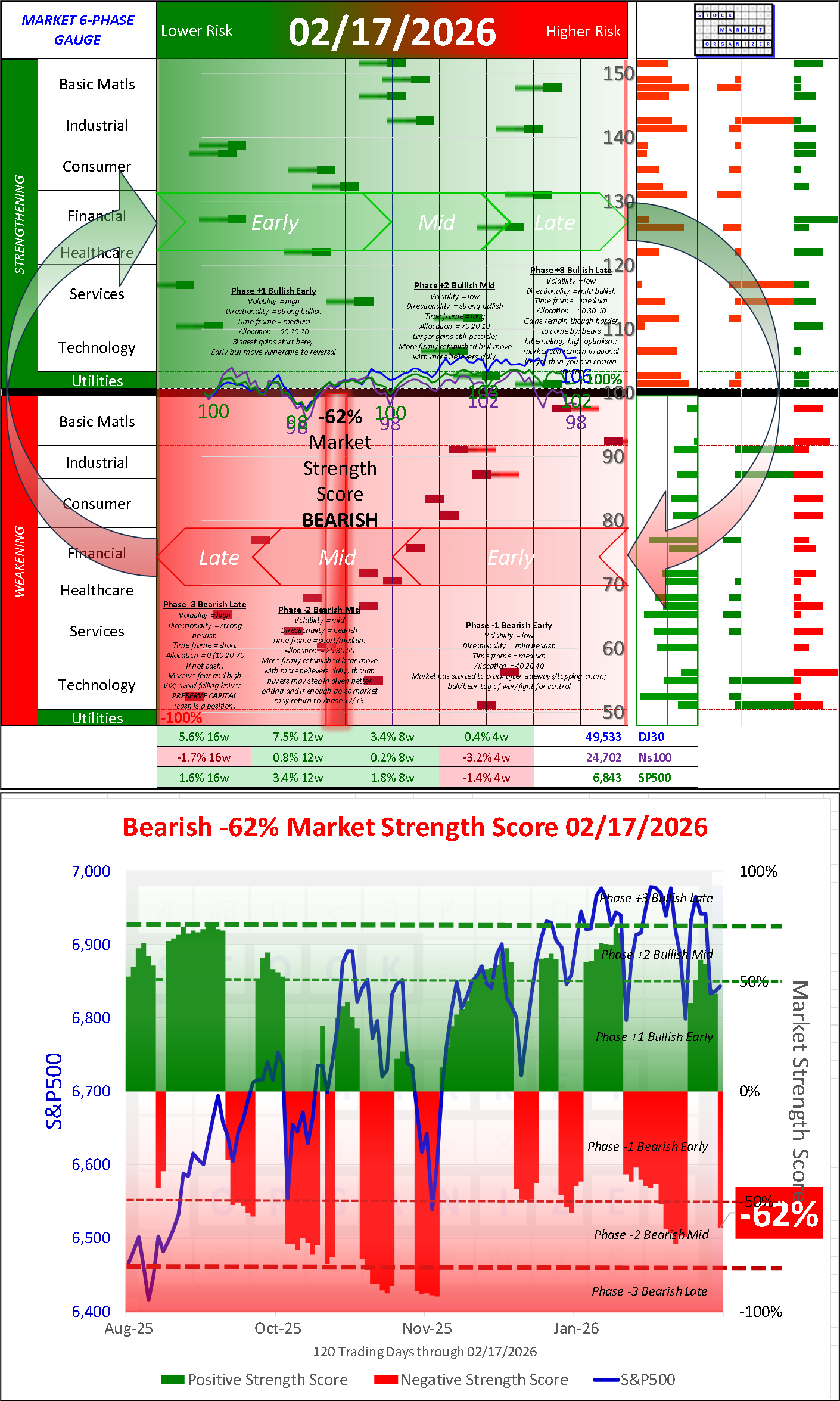

SMO Dashboard Tue 2026-02-17 (Market = Bearish Mid Phase)

TLDR:

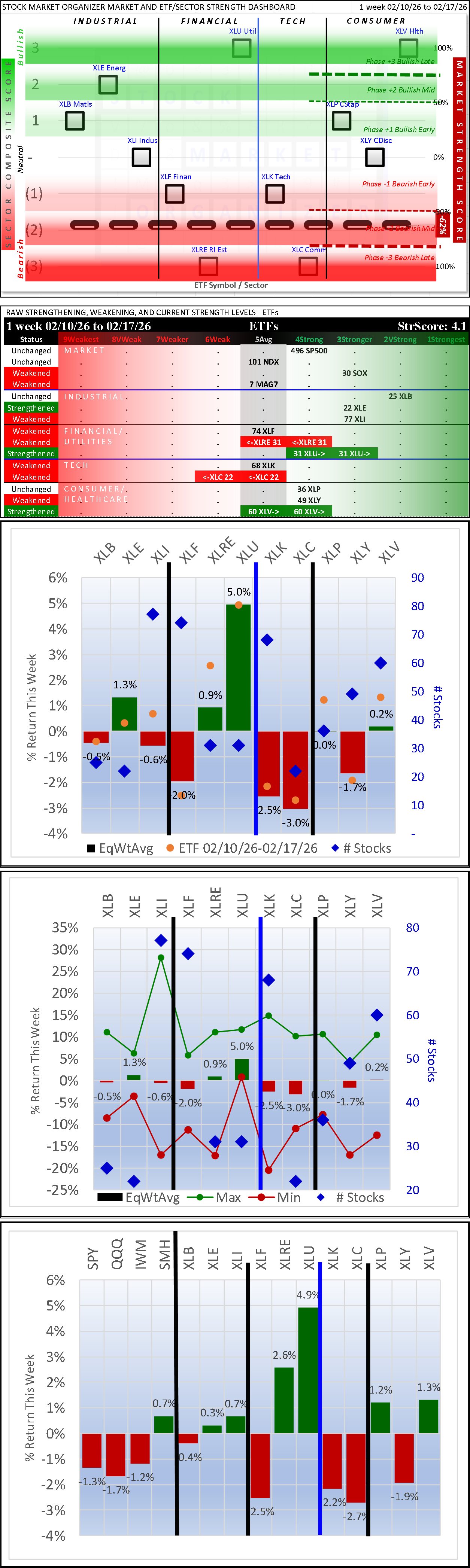

I stack strength and weakness at the market, sector, industry, sub-industry, and stock levels with the aid of the unique current environment analysis shown below.

Commentary

The Market Strength Score turned negative today. Be cautious.

SP500 and NDX were unchanged in strength while both the SOX and Mag7 weakened slightly. Tech is not currently strong. Financials are mixed but on balance weakened. Utilities remain strong, with all XLU stocks positive for the week. Materials are neutral.

The column labeled "Rating" reflects the strength (based on this system's criteria) of the individual vehicle (index, sector, or industry).

Market Strength Score

Changed to negative after today's action, currently -62% which is mid-level Bearish.

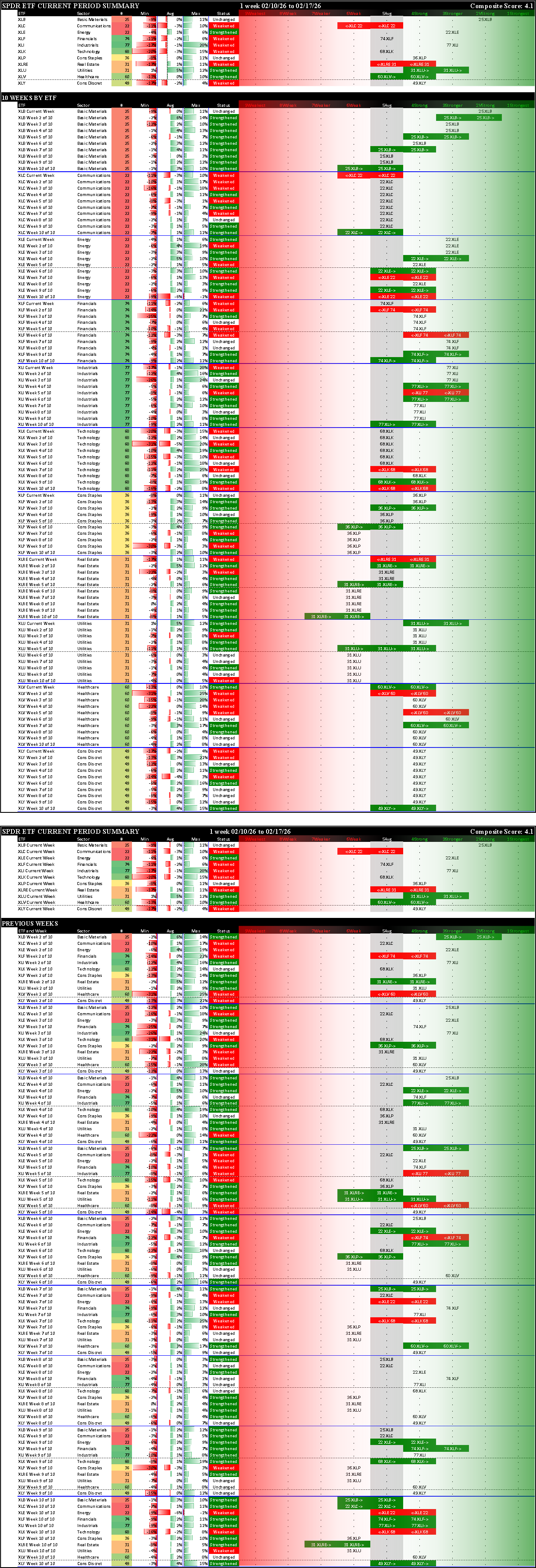

SPDR Sector ETFs Detail

XLU Utilities and XLV Health led this week while XLC Communications and XLRE Real Estate lagged.

Context - 10 Week Lookbacks, by ETF and by Week

Sector ETFs Stocks Rated 1Strongest and 9Weakest

Long and short candidates are listed below, ranked based on market, sector, and stock strength characteristics.