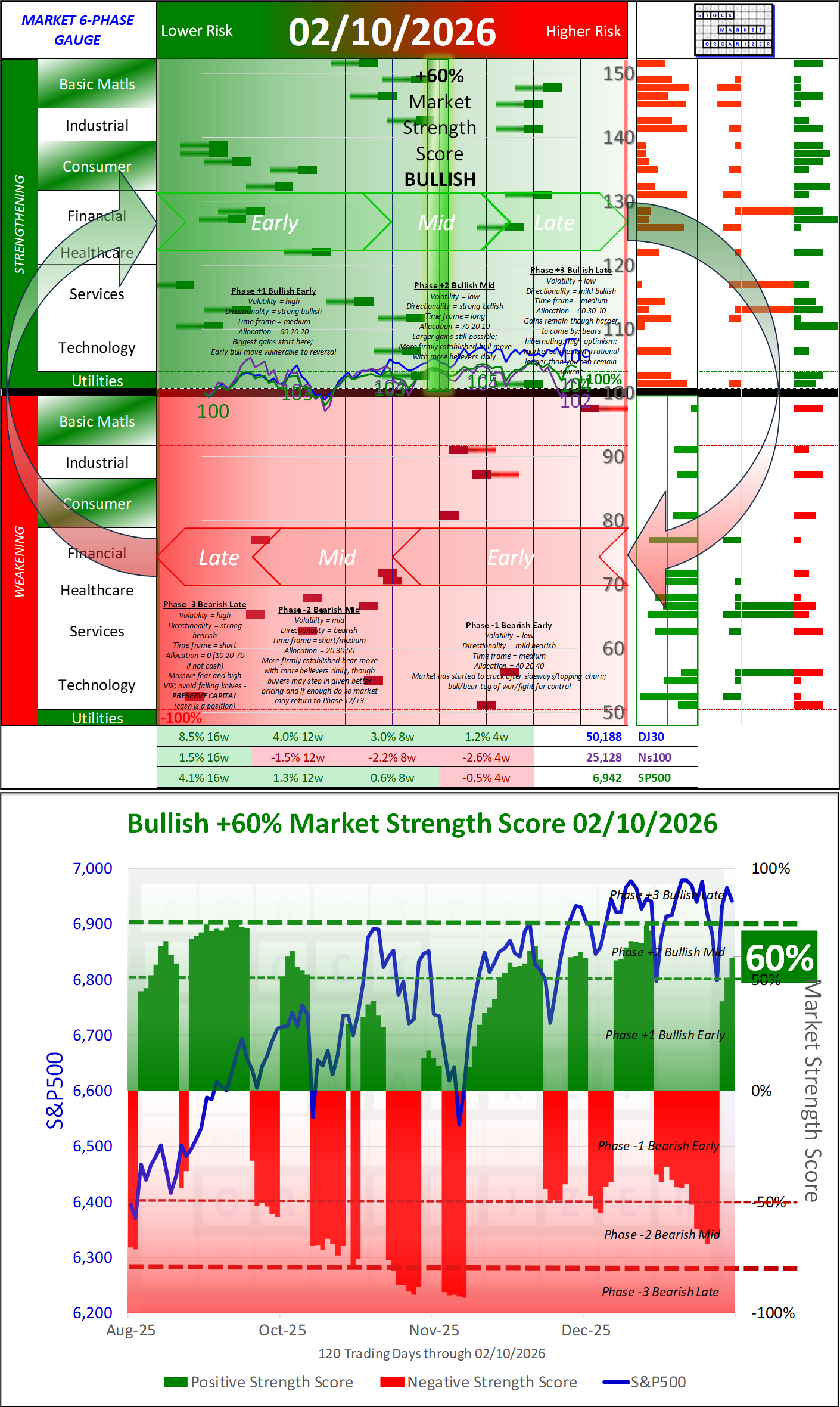

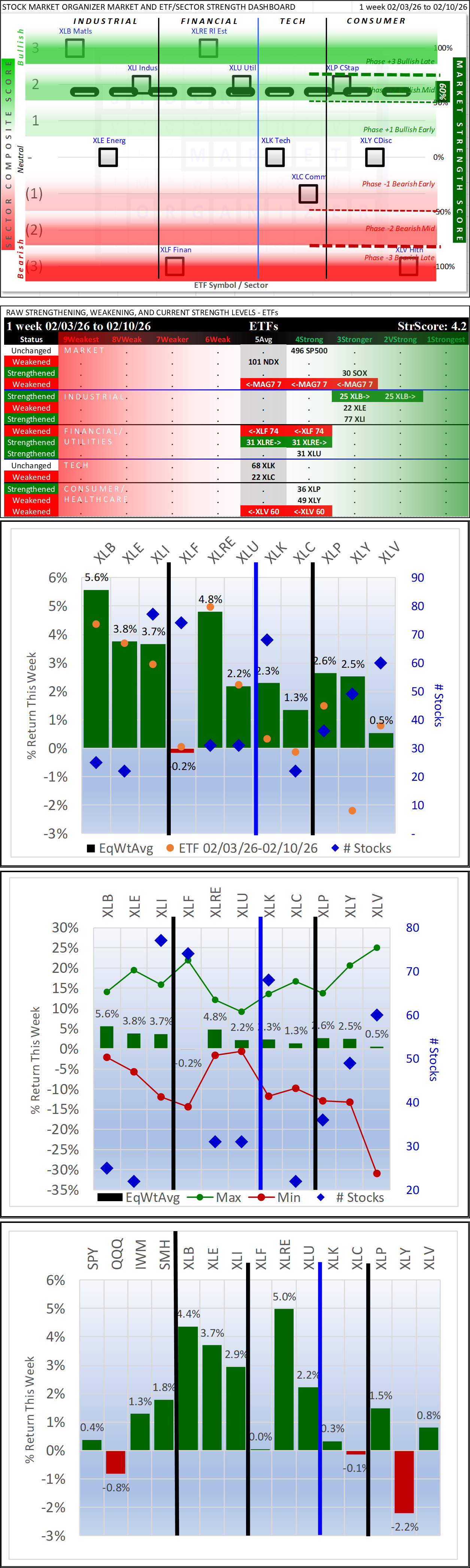

SMO Dashboard Tue 2026-02-10 (Market = Bullish Mid Phase)

TLDR:

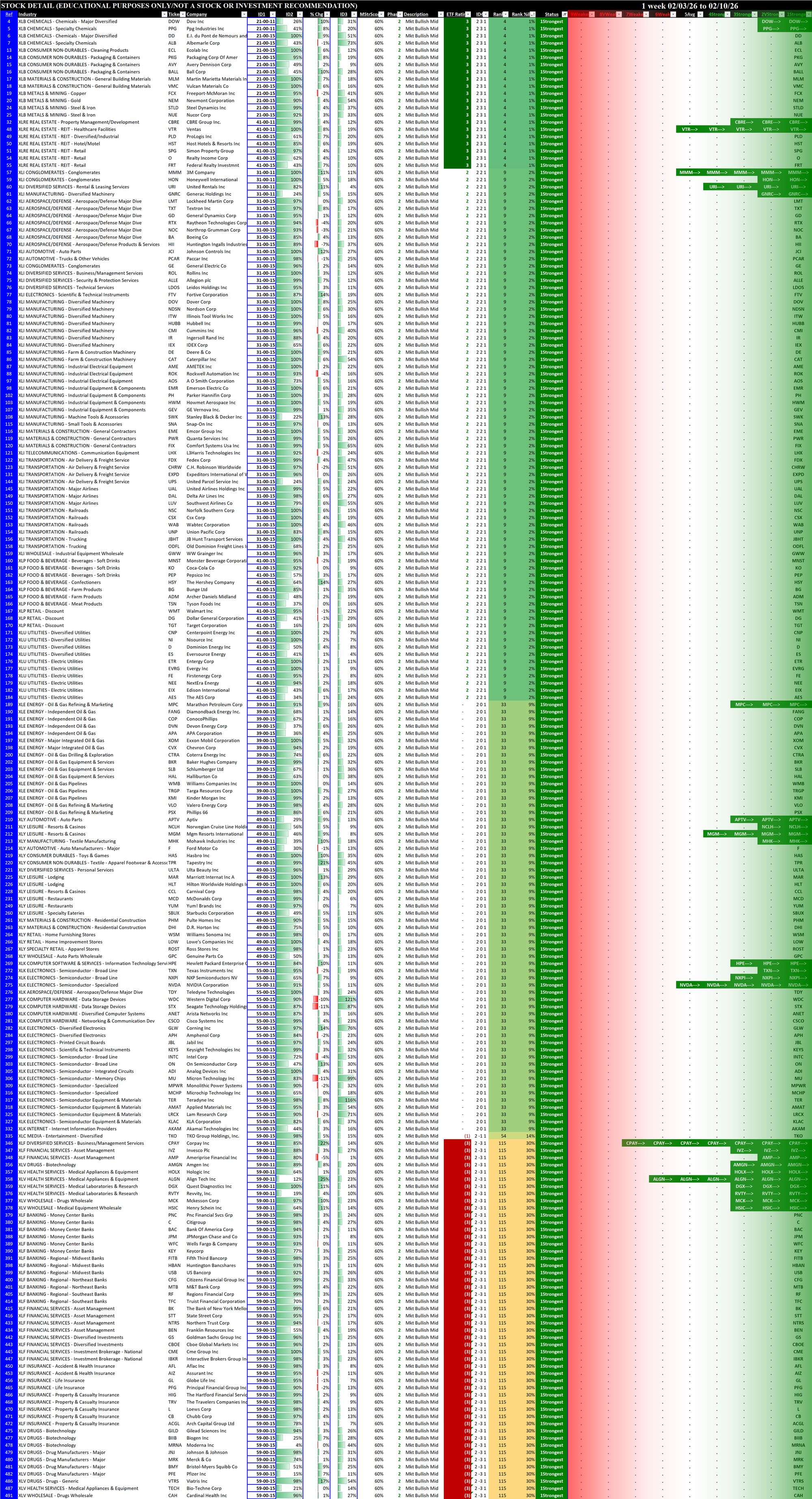

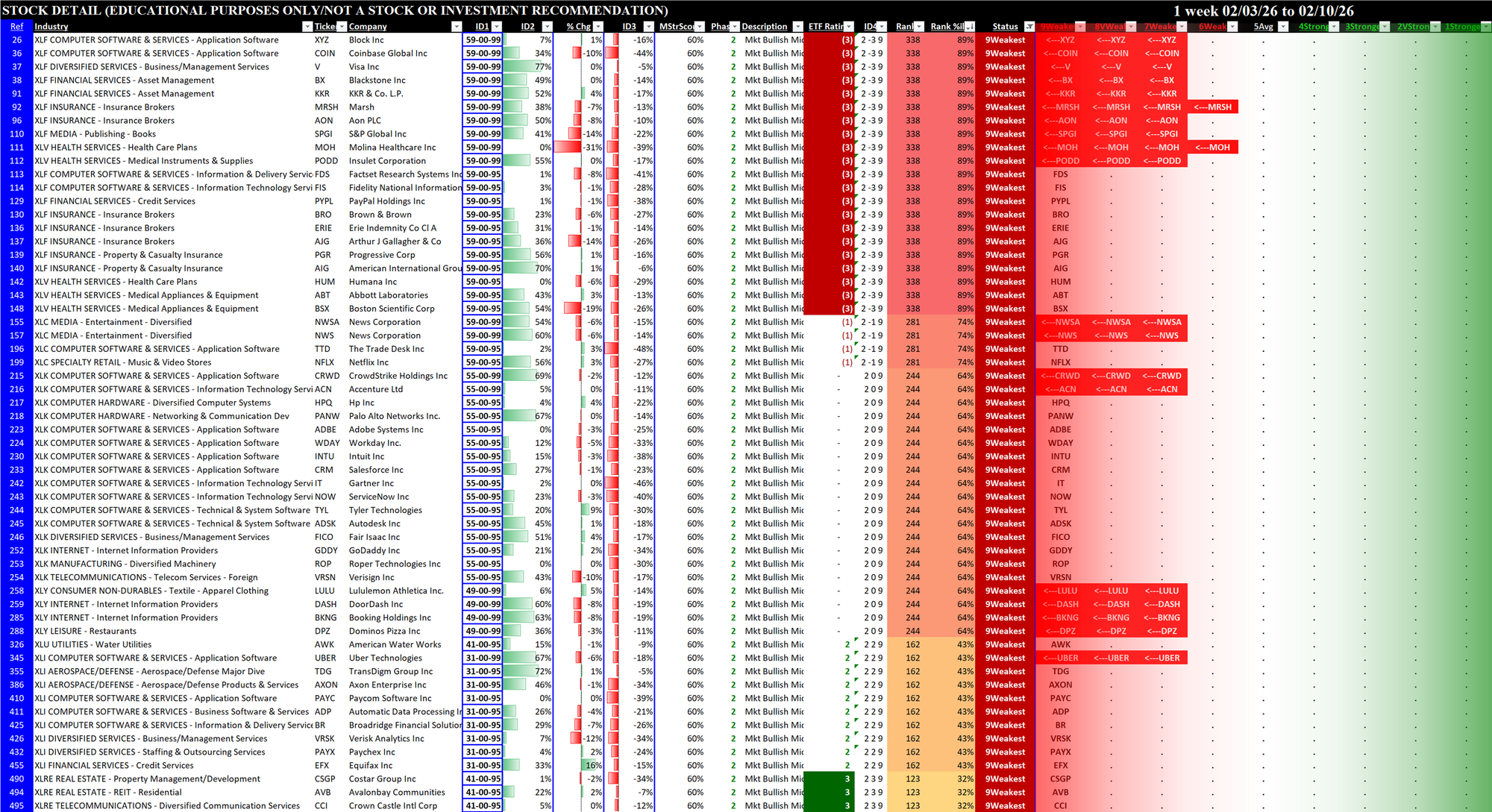

In the quest to stack strength and weakness at the market, sector, industry, sub-industry, and stock levels, below is key current data providing unique insights to target longs and shorts in the current environment.

Consolidation

SP500 is neutral as Mag7 weakened. Tech is mixed with Hardware and Semis doing well and Computer Software and Internet not. Financials are mixed, led by Banks and Real Estate as Financial Services lag. Utilities are strong.

The column labeled "Rating" reflects the strength (based on this system's criteria) of the individual vehicle (index, sector, or industry).

Market Strength Score

Currently +60% which is mid-level Bullish - neither early nor late in this cycle.

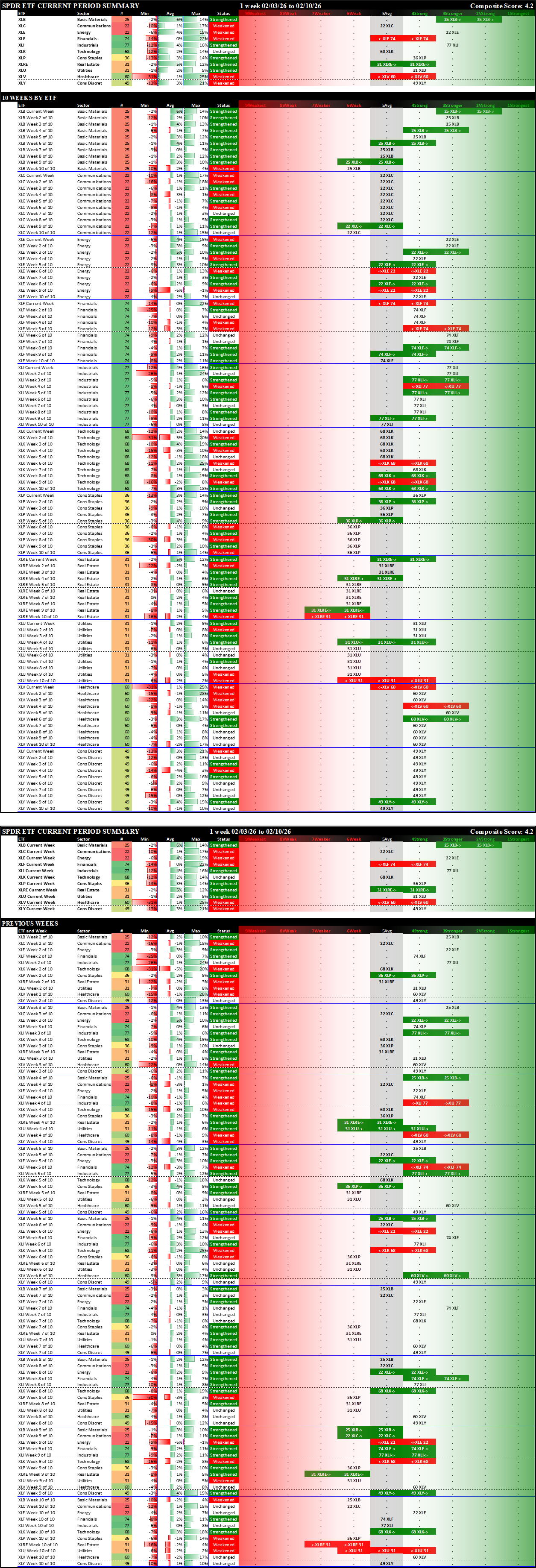

SPDR Sector ETFs Detail

XLB Materials and XLRE Real Estate led this week while XLF Financials and XLV Healthcare lagged.

Context - 10 Week Lookbacks, by ETF and by Week

Sector ETFs Stocks Rated 1Strongest and 9Weakest

Long and short candidates are listed below, ranked based on market, sector, and stock strength characteristics.