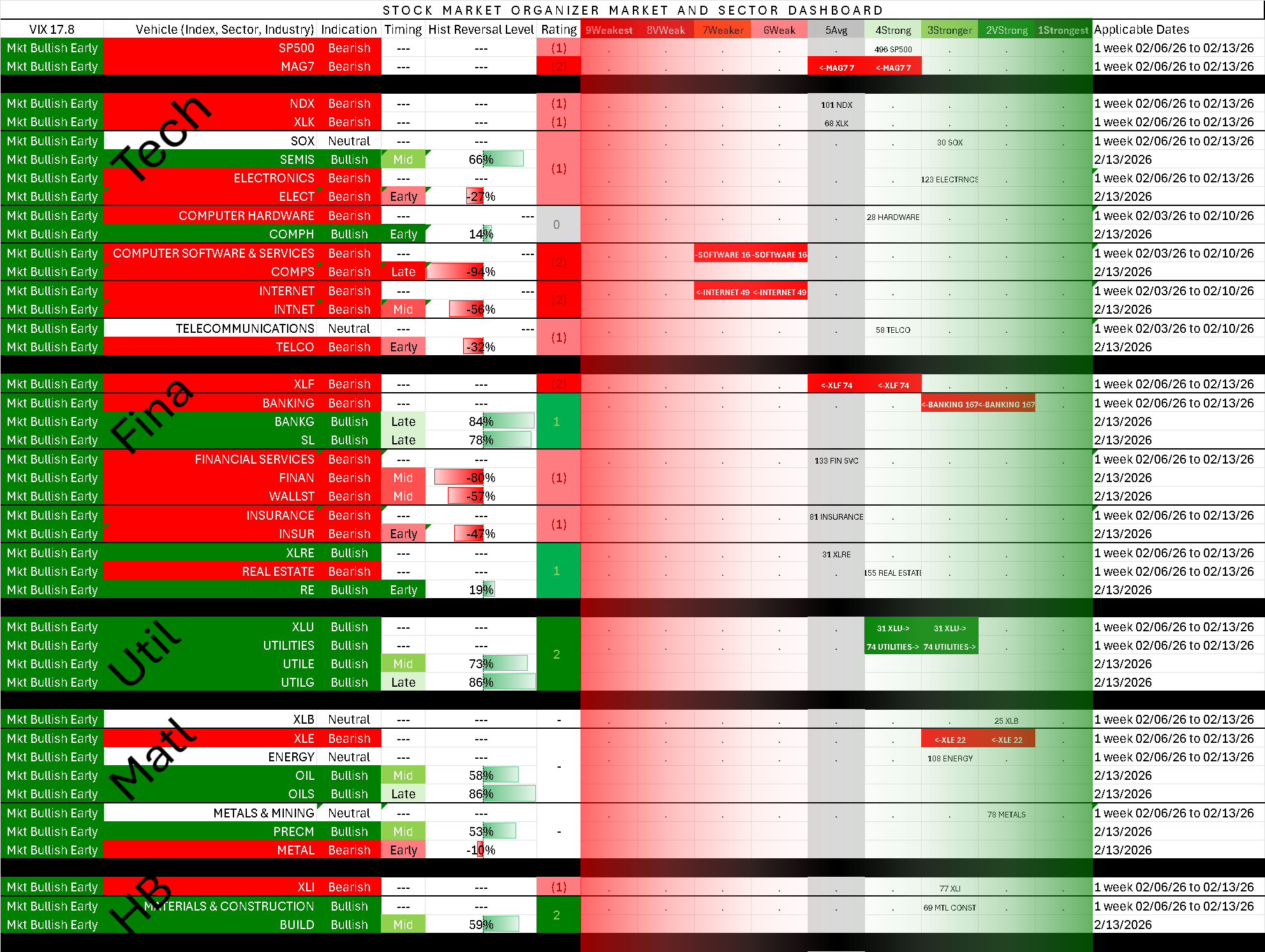

SMO Dashboard Fri 2026-02-13 (Market = Bullish Early Phase)

TLDR:

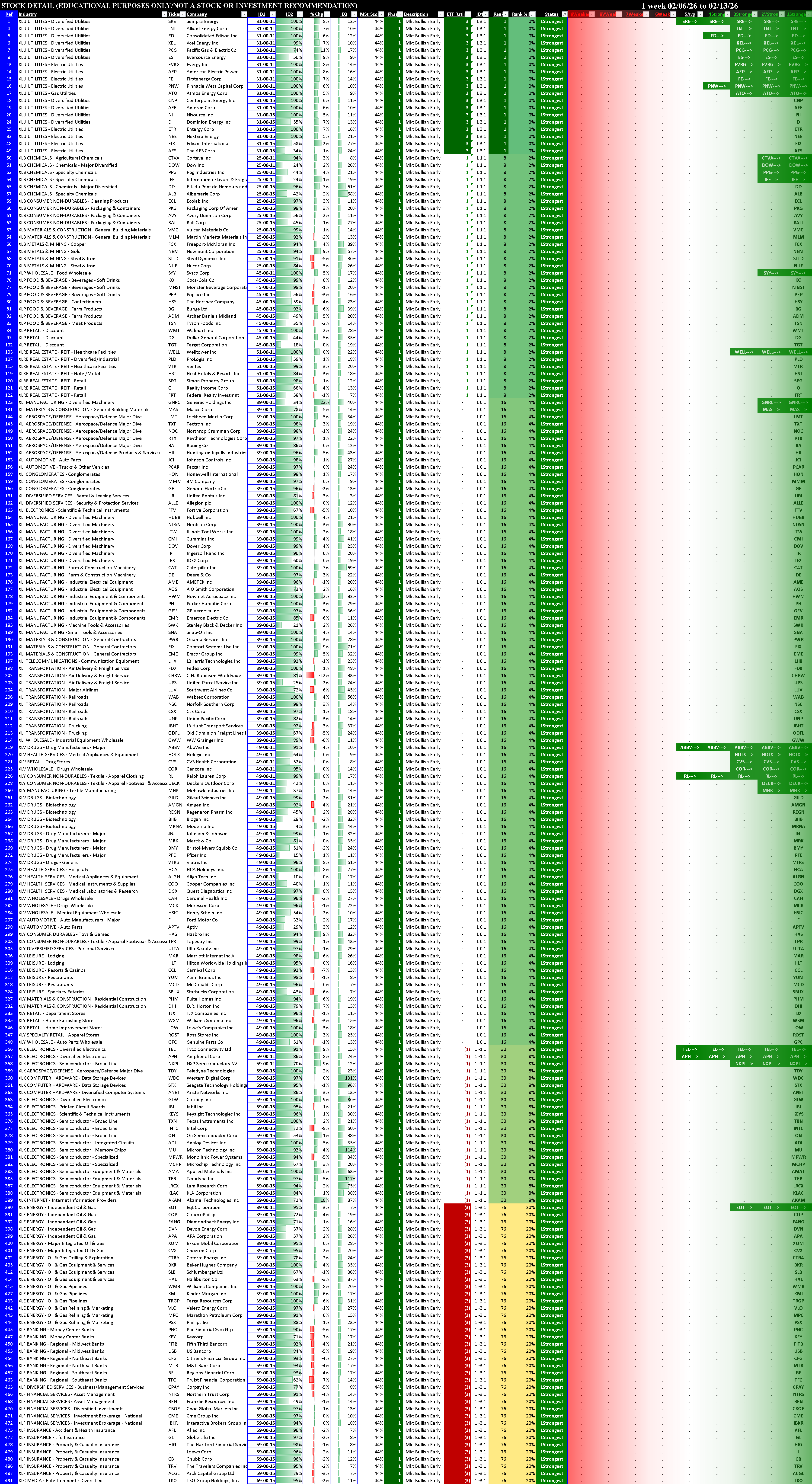

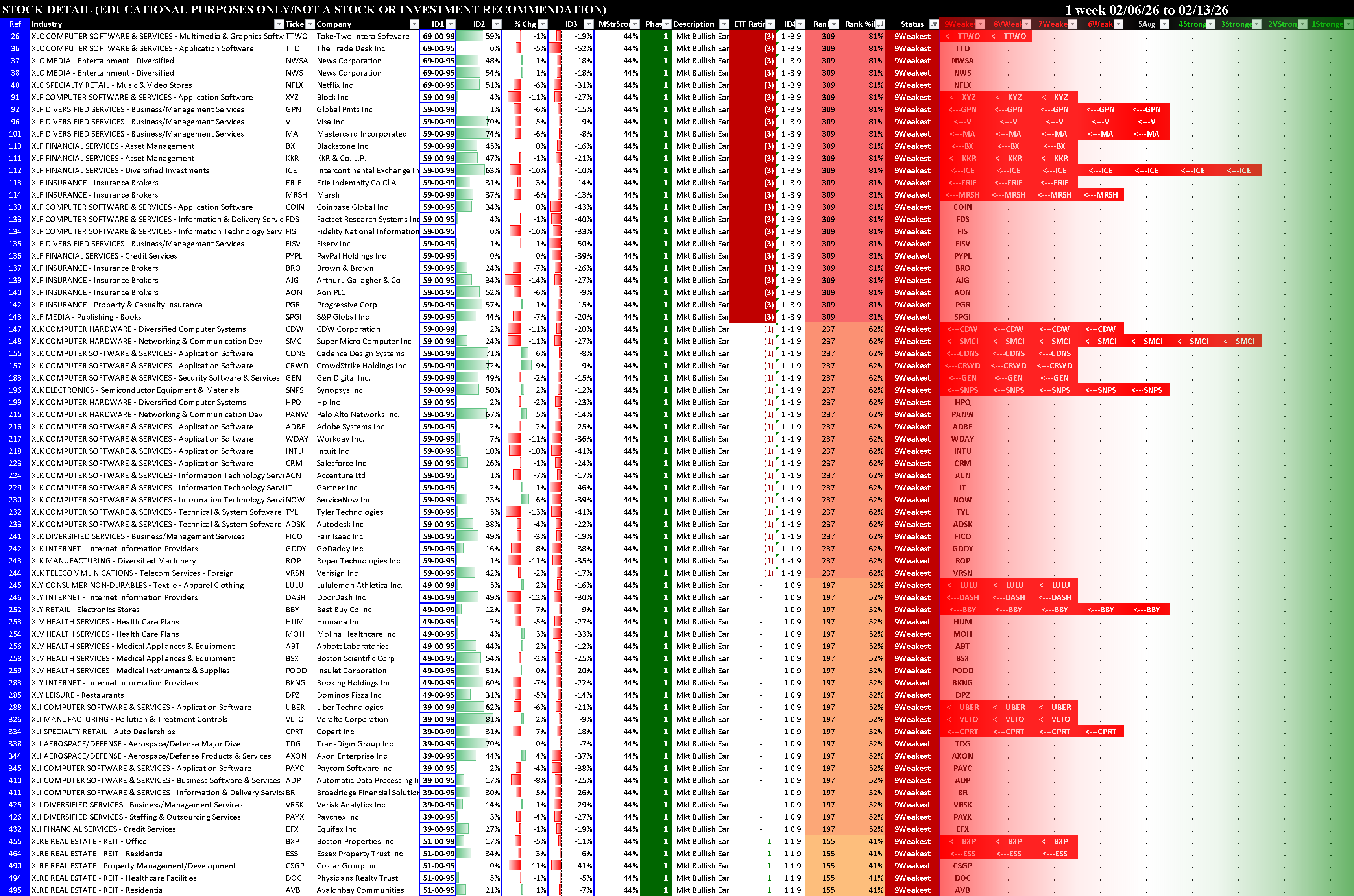

In the quest to stack strength and weakness at the market, sector, industry, sub-industry, and stock levels, below is key current data providing unique insights to target longs and shorts in the current environment.

Commentary

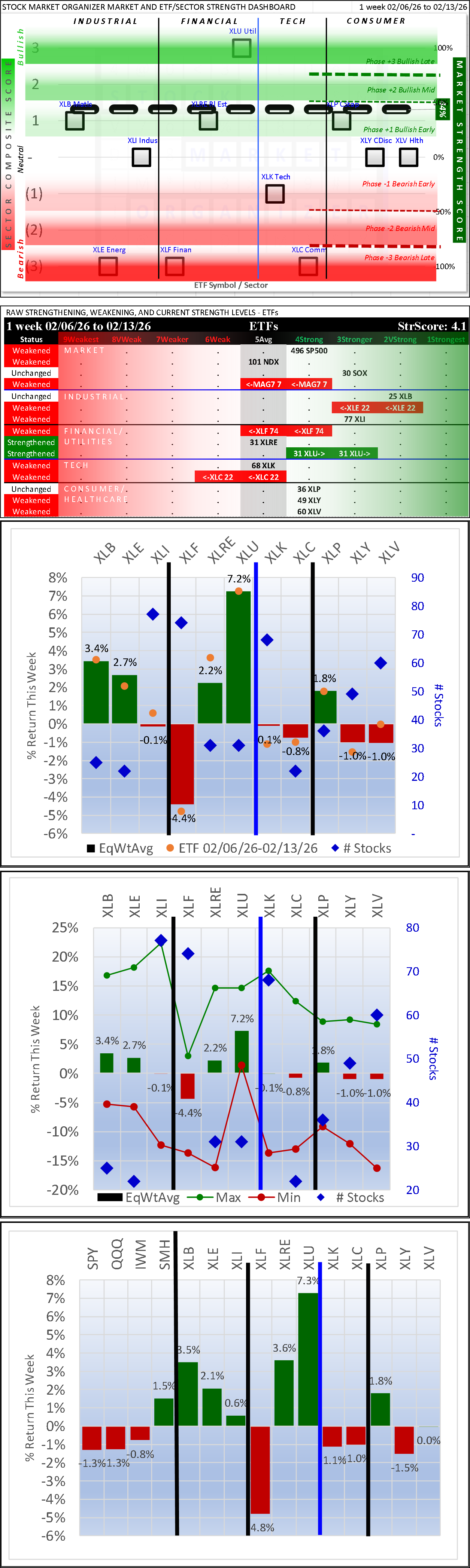

SP500, NDX, and SOX weakened, less so than did the Mag7. Tech as a group weakened. Financials are mixed but on balance weakened. Utilities remain strong, with all XLU stocks positive for the week. Materials are neutral.

Though the index levels were not dramatically changed, there was much volatility under the market surface, as flagged by concerned market commentators.

The column labeled "Rating" reflects the strength (based on this system's criteria) of the individual vehicle (index, sector, or industry).

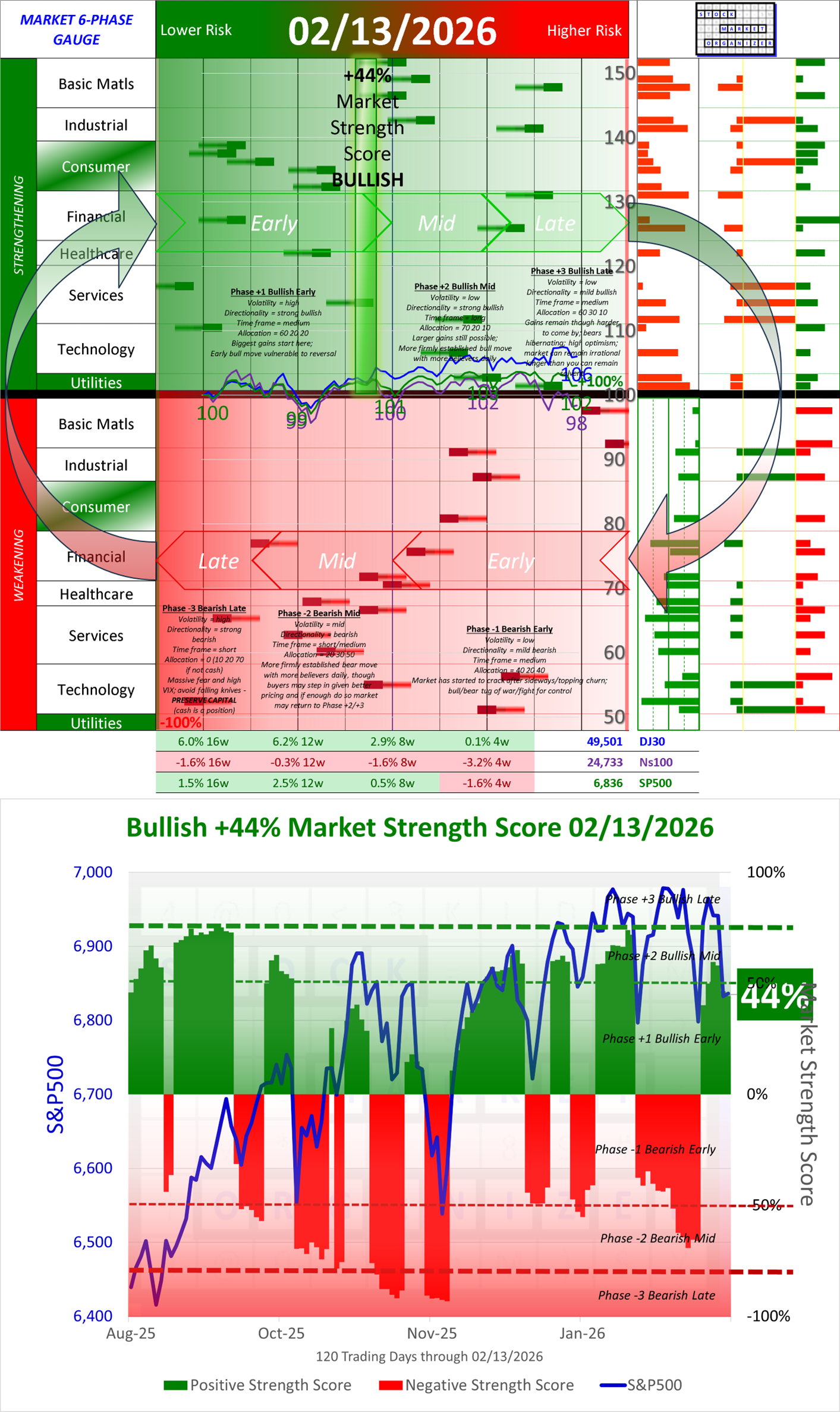

Market Strength Score

Currently +44% which is early-level Bullish. The decline from Tuesday's +60% reading gives the market more breathing room, at the same time this decline puts the market on the verge of a potential reversal to a negative strength score. There is no change in this system's actions until that change actually happens.

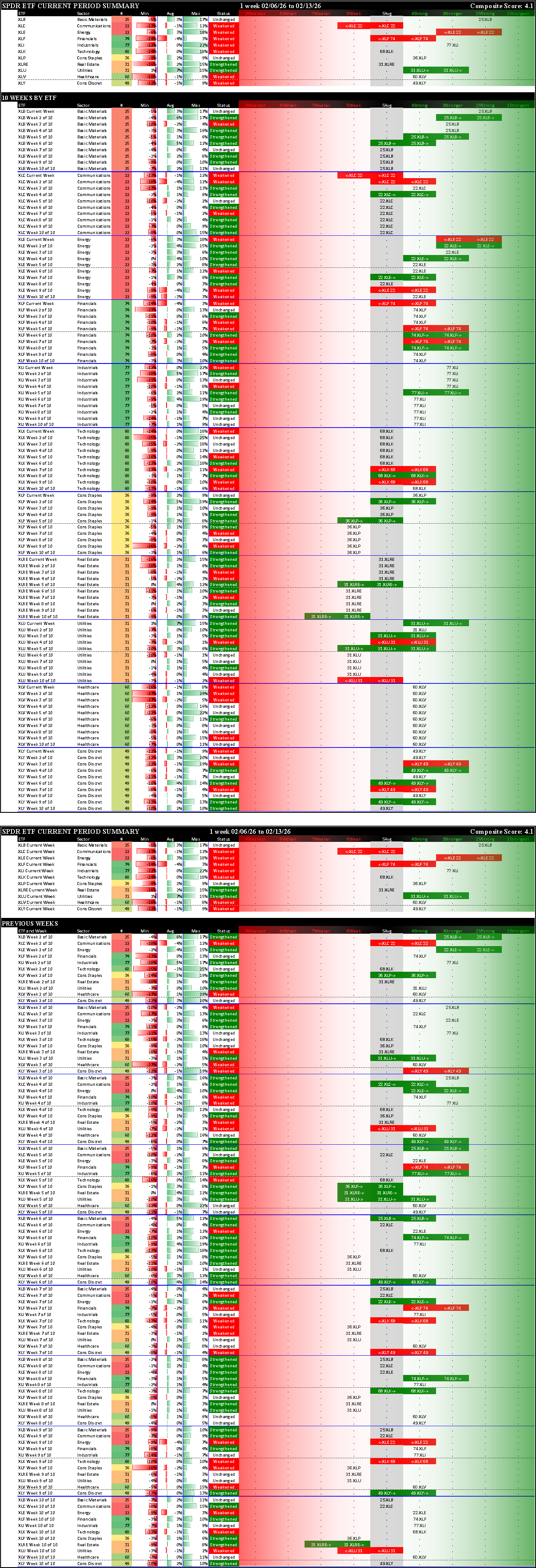

SPDR Sector ETFs Detail

XLU Utilities led this week while XLE Energy, XLF Financials, and XLC Communications lagged.

Context - 10 Week Lookbacks, by ETF and by Week

Sector ETFs Stocks Rated 1Strongest and 9Weakest

Long and short candidates are listed below, ranked based on market, sector, and stock strength characteristics.