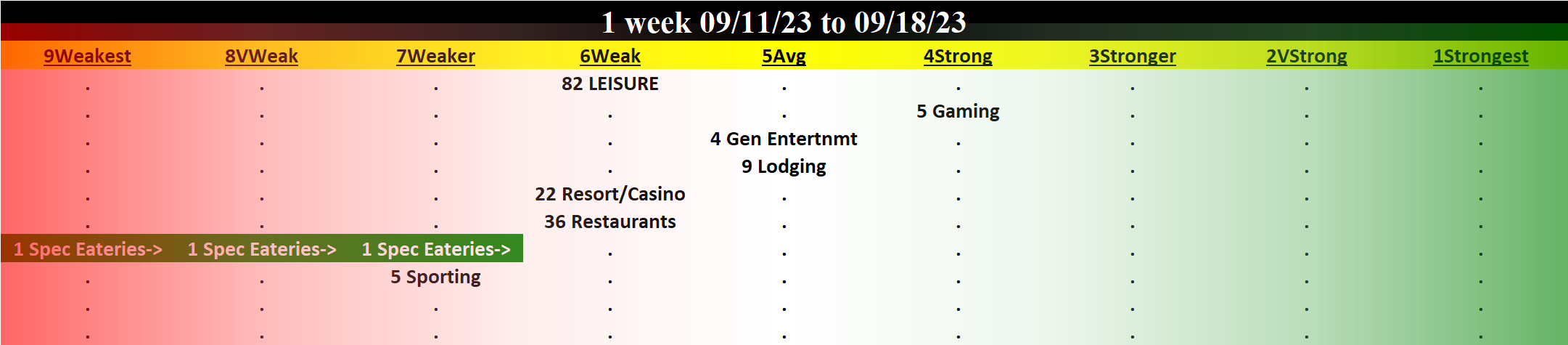

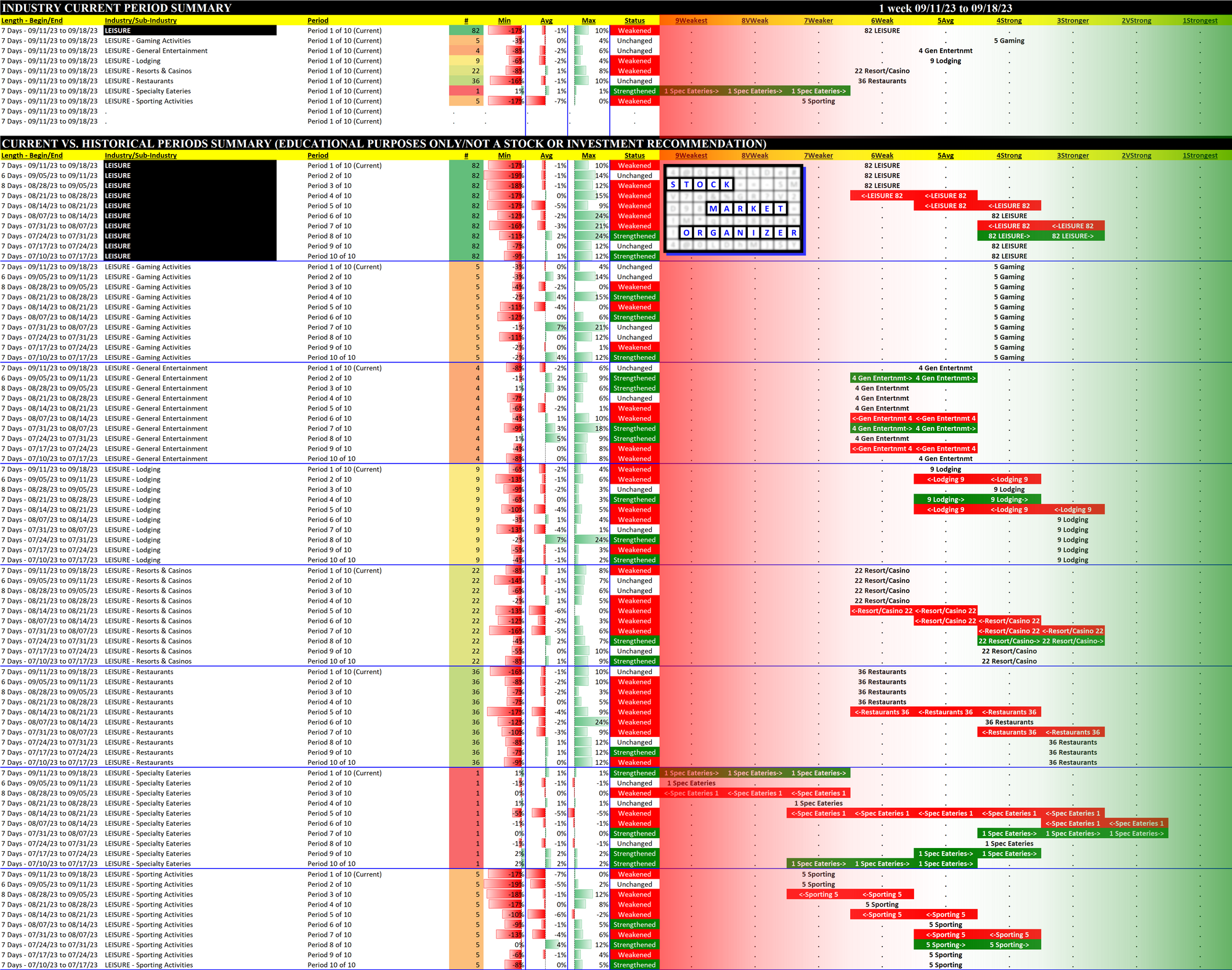

Leisure 2023-09-18: Unchanged at WEAK strength rating (6th strongest of 9 levels), previous move was DOWN

SUMMARY

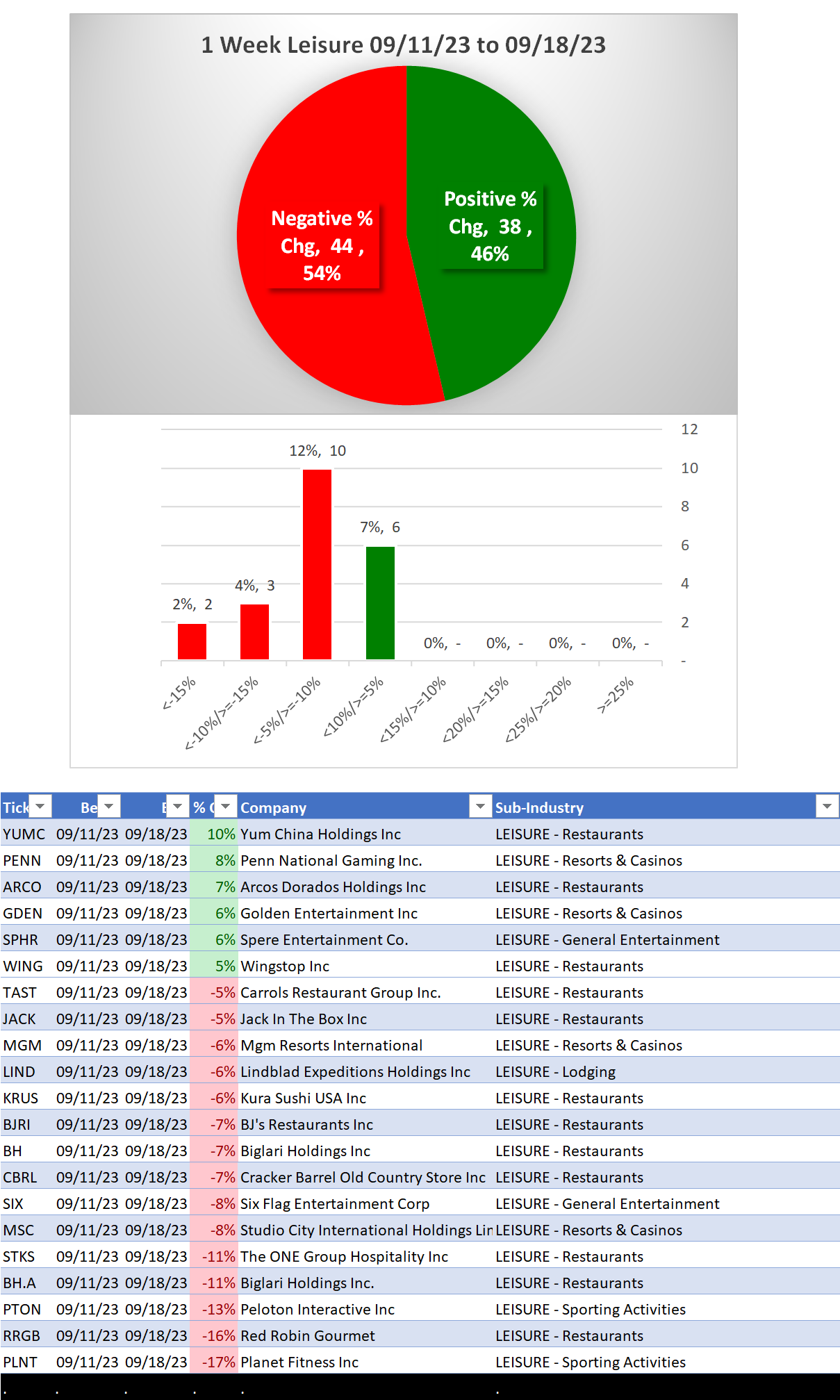

Performance

Bottom Line: weakened 3 levels in 7 weeks

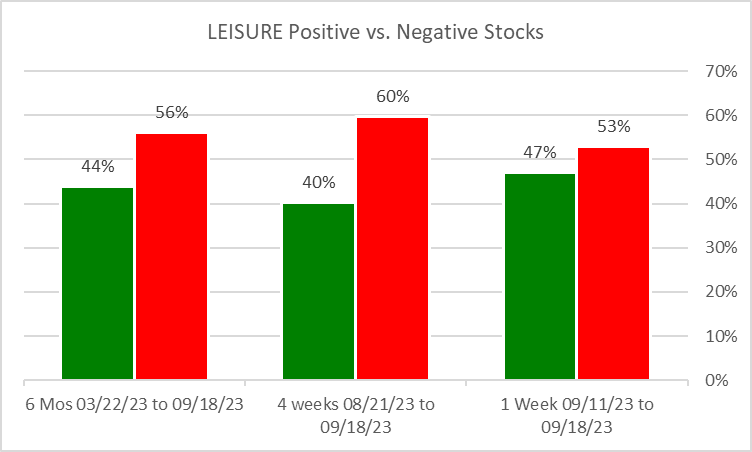

Context: 1 week positive/negative stocks ratio is STRONGER than both 6 Mos and 4 weeks

Other Notes:

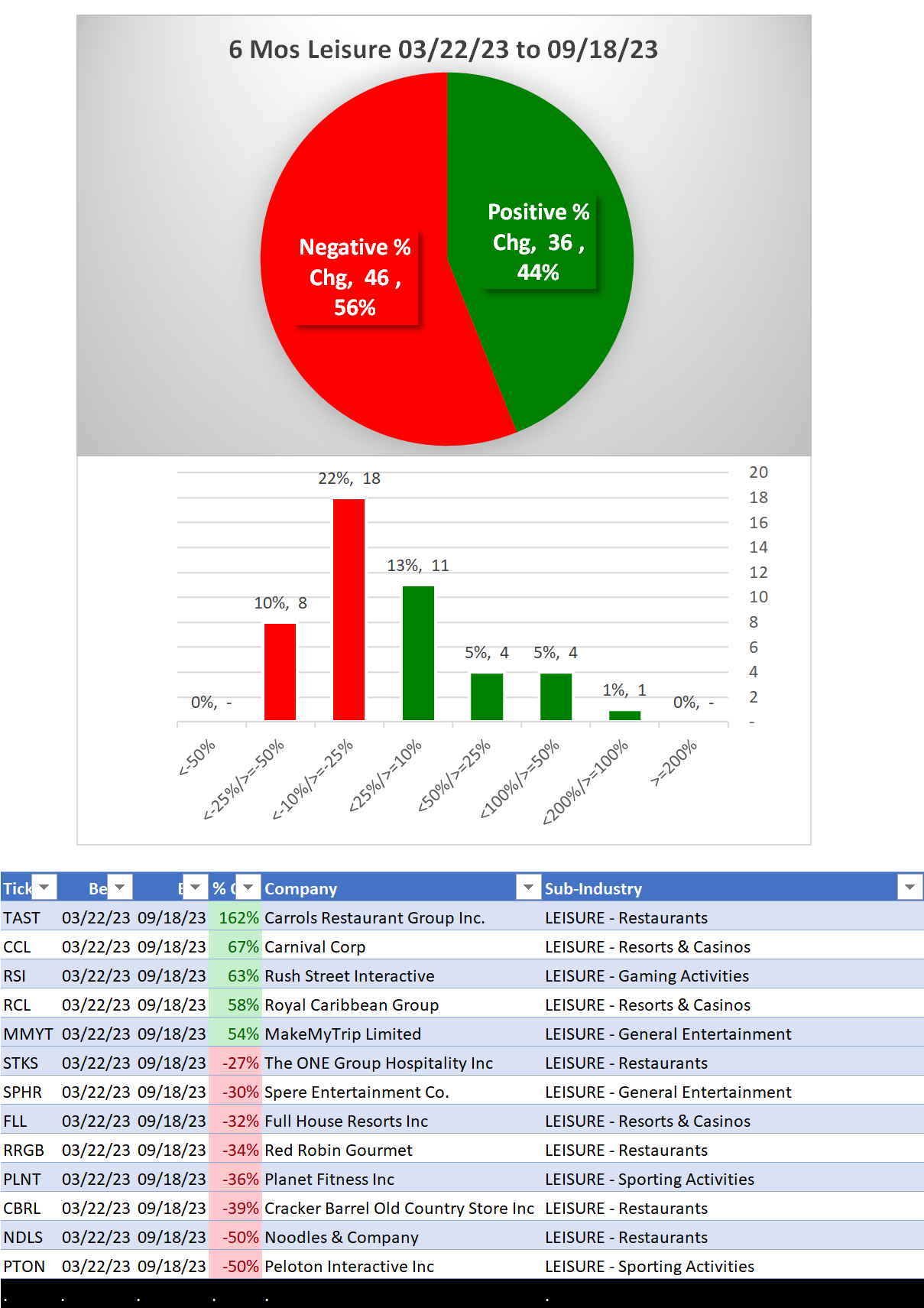

Past 6 months

- TAST +167%

- CCL and RCL cruise lines +67% and +58%

- Restaurants are weak

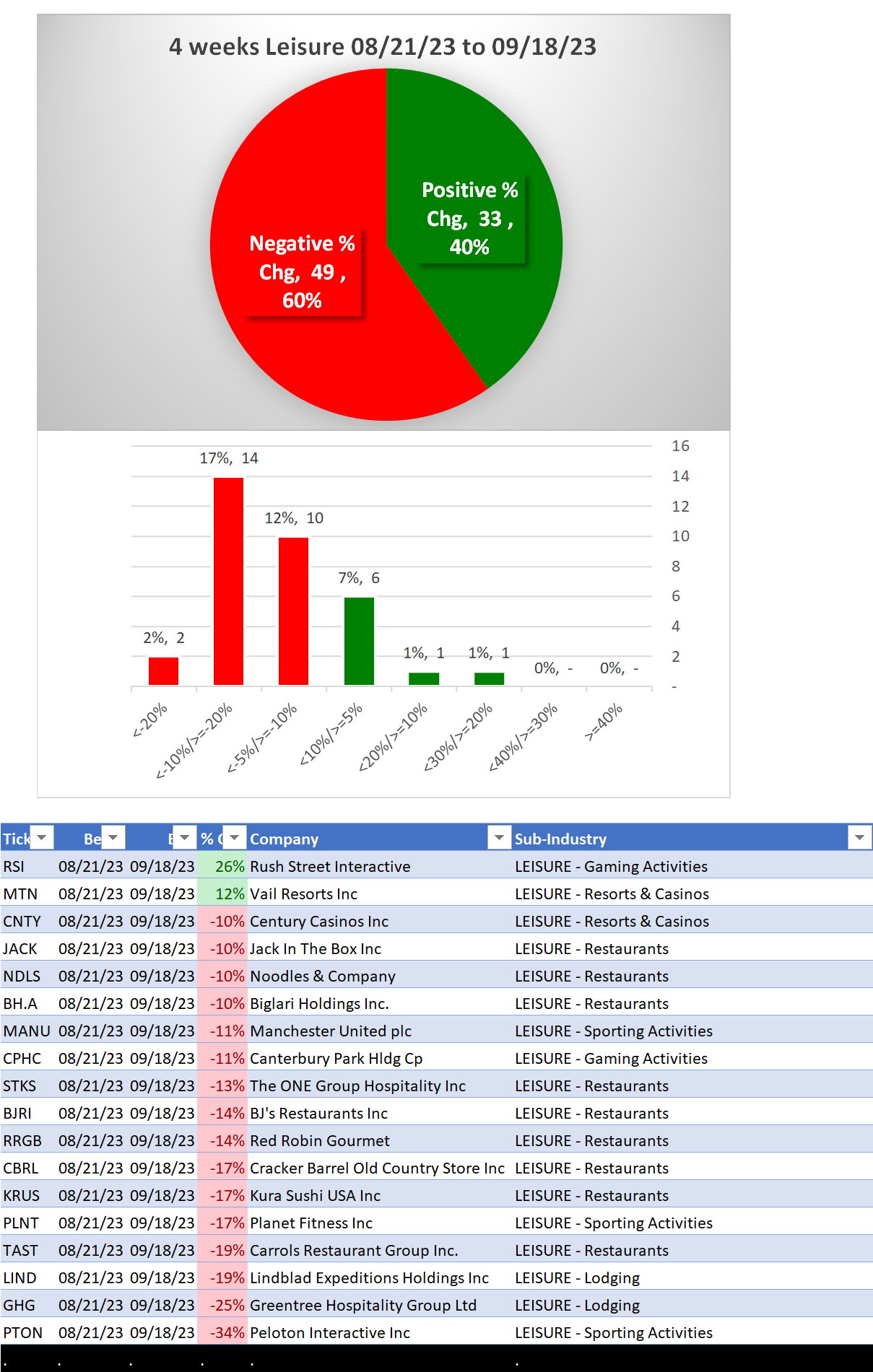

Past 4 weeks

- 9 restaurants down more than -10%

Background

Material of 7 sub-industries (82 stocks total, average 12 stocks/sub-industry):

36 stocks Restaurants

22 stocks Resorts & Casinos

9 stocks Lodging

10 Biggest Market Cap stocks:

MCD, SBUX, MAR, CMG, HLT, LVS, YUM, RCL, YUMC, QSR

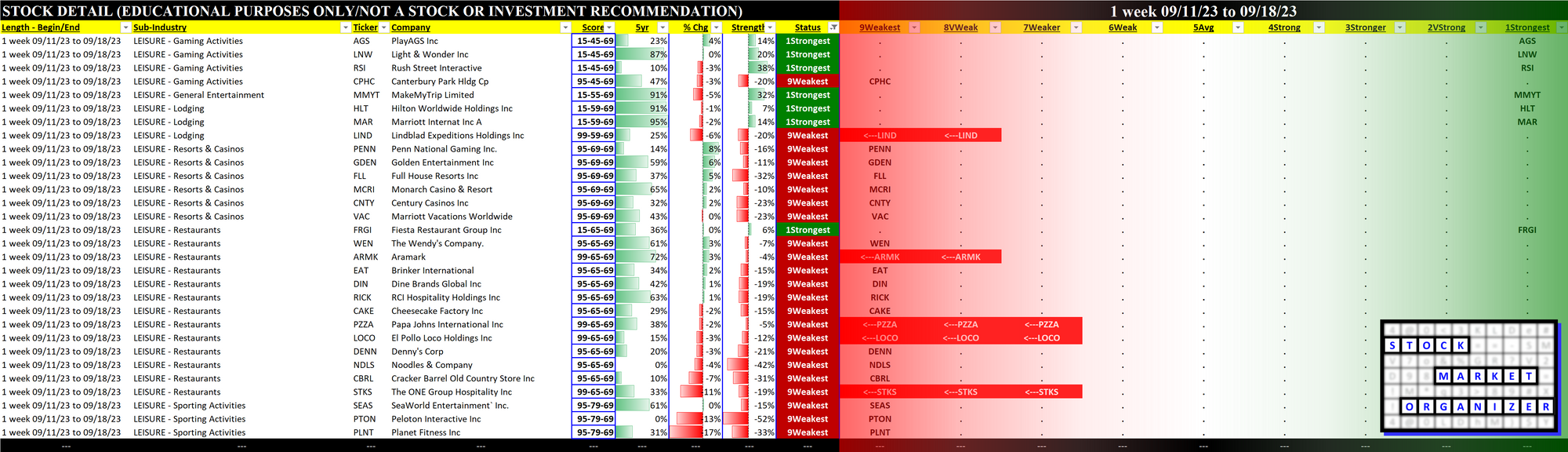

DETAIL: 1 Week Performance Review

Status

Strengthened: 1/7 sub-industries

Weakened: 0/7 sub-industries

Strongest at Strong rating/4th strongest of 9 levels:

5 stocks Gaming Activities

Weakest at Weaker rating/7th strongest of 9 levels:

5 stocks Sporting Activities

1 stock Specialty Eateries

Detail Charts: Sub-Industry and Stock

10-Week Week-by-Week Industry/Sub-industry Strength Comparison

What: recent week-by-week strength changes for the industry and each underlying sub-industry

Why: objective measurement of strengthening and weakening enabling comparison within and across industries and sub-industries

Strongest and Weakest Stocks

What: stocks currently rated Strongest/Weakest (highest/lowest of 9 strength ratings)

Why: most interesting stocks for available capital because

- the Strongest may be meme-stock mania candidates prone to breakouts, and

- the Weakest may be prone to large bottom-fishing/short-covering-driven pops... and may also be primed for bigger and faster falls.

(Not guaranteed and not a recommendation - weak stocks in weakening sub-industries may be better shorts than high-flyers.)

DETAIL: Lookbacks 6 Mos vs. 4 weeks vs. 1 Week

6 Mos Lookback

4 Weeks Lookback

1 Week Lookback