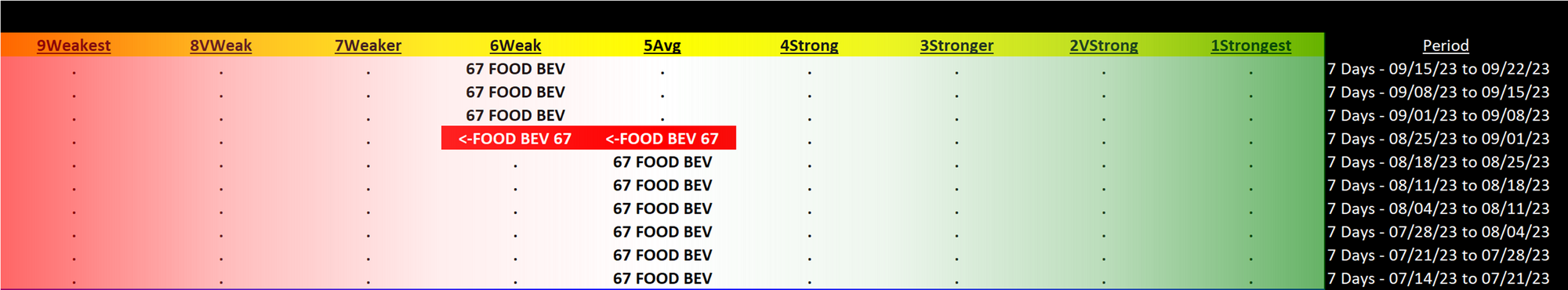

Food & Beverage 2023-09-22: Unchanged at WEAK strength rating (6th strongest of 9 levels), previous move was DOWN

TABLE OF CONTENTS

- INDUSTRY OVERVIEW

1A. Performance

1B. Background - SUB-INDUSTRIES AND STOCKS DETAIL

2A. Sub-Industries Overview

2B. Sub-Industries 10-Week Strengthening Analysis

2C. Stocks 1 Week Strongest and Weakest - STRENGTH BY LOOKBACK PERIOD (with Best/Worst stocks)

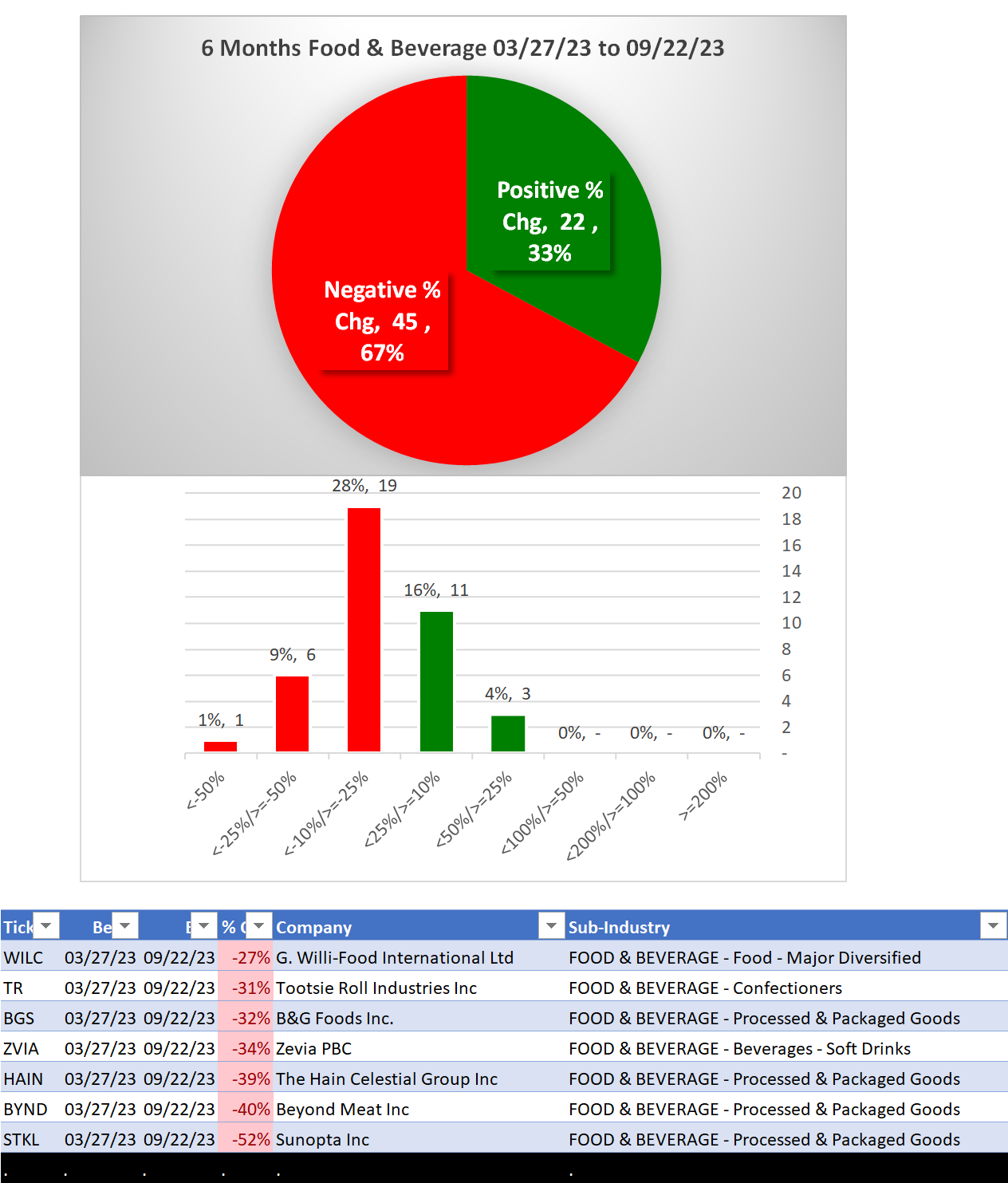

3A. Lookback 6 Months

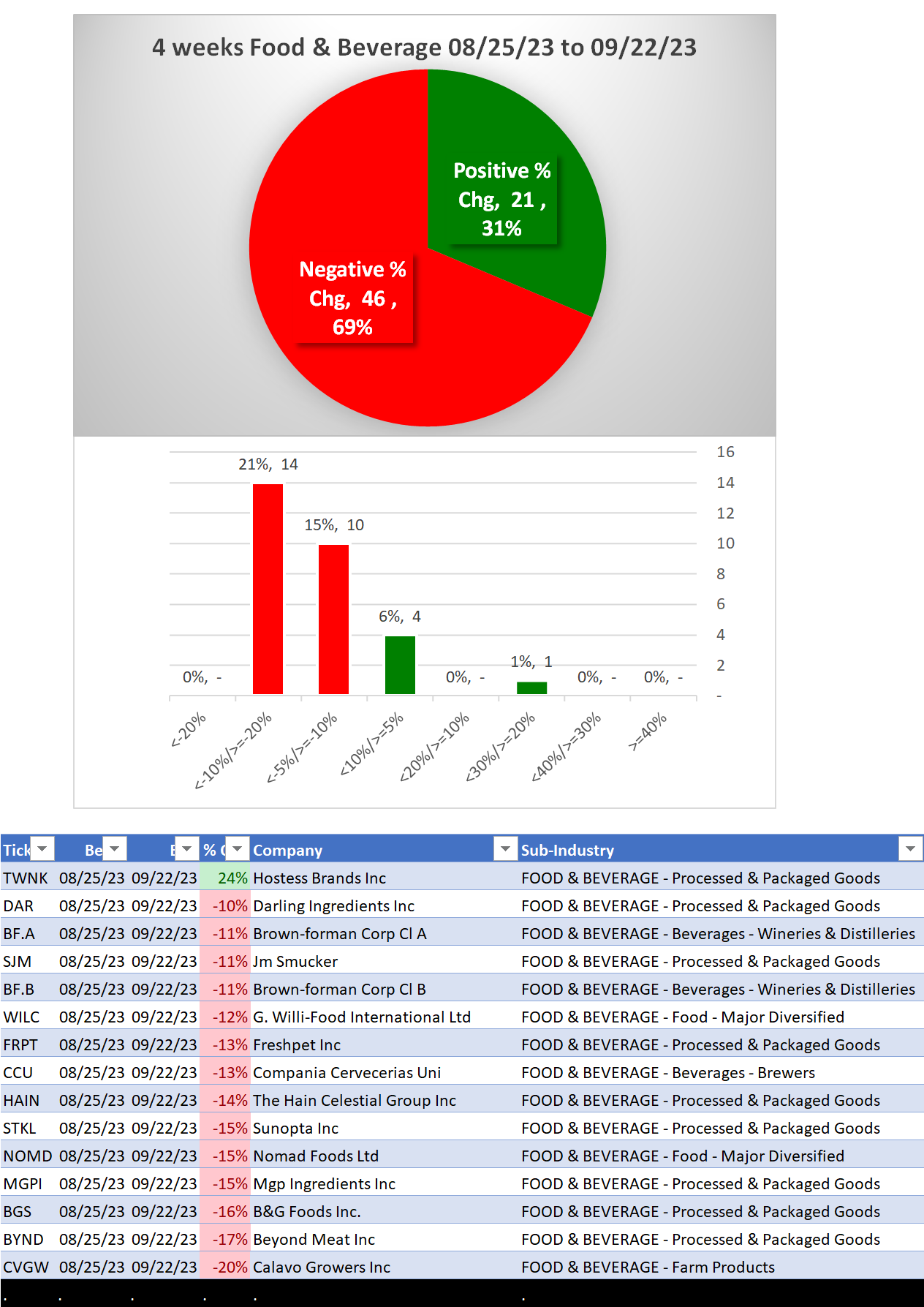

3B. Lookback 4 weeks

3C. Lookback 1 Week

1. INDUSTRY OVERVIEW

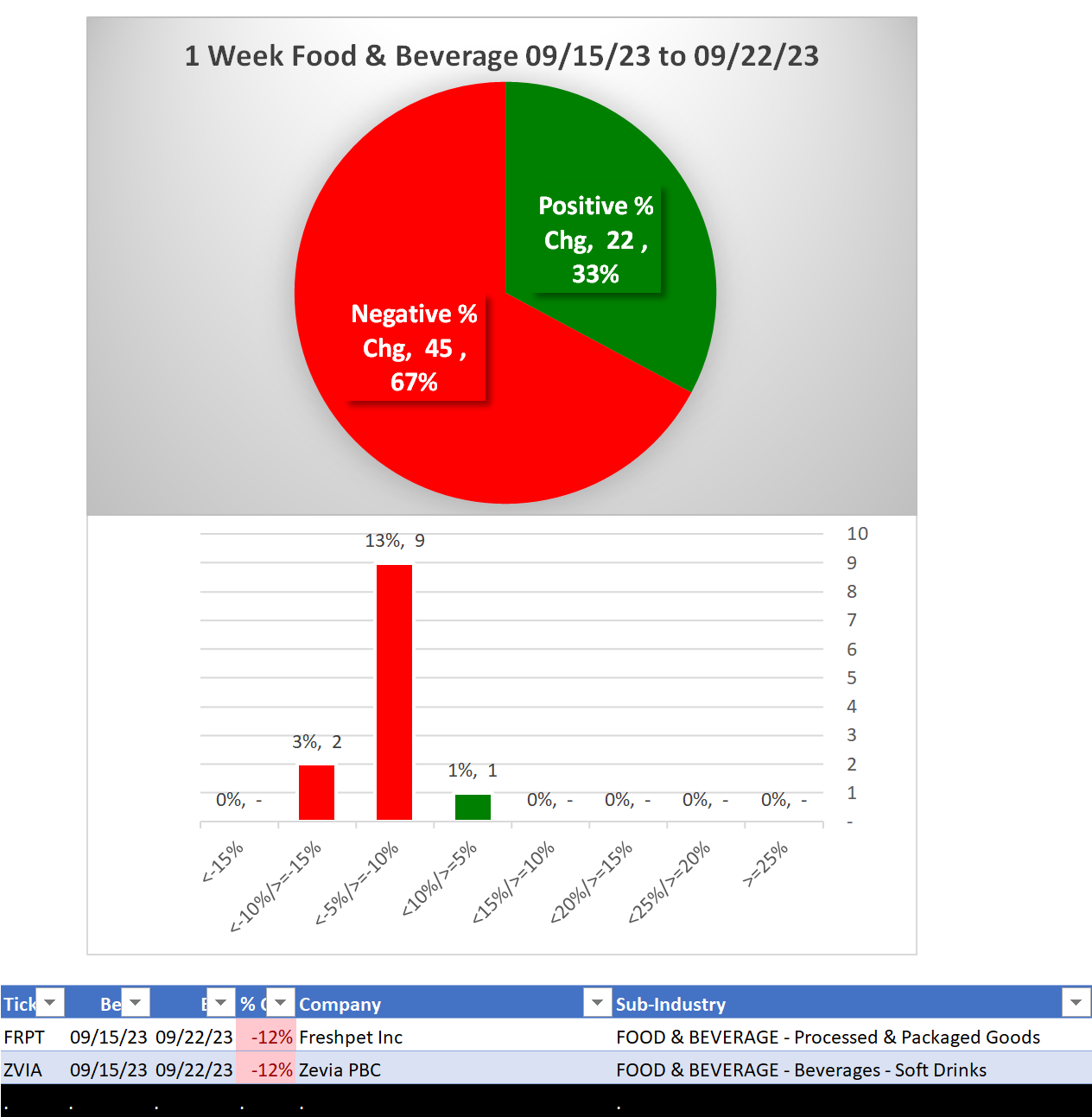

1A. Performance

Past 10 Weeks Strengthening/Weakening week-by-week, per the following chart:

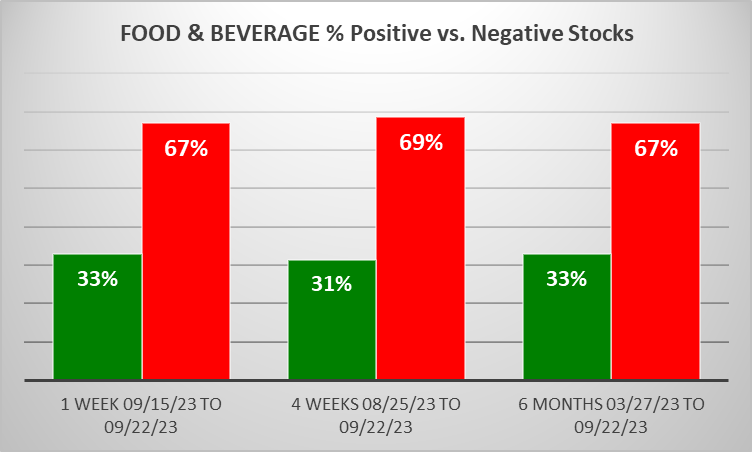

STRENGTHENING 1 Week vs. Mid- and Longer-Term // 1 week positive/negative stocks ratio is HIGHER than both 4 weeks and 6 Months, per the following chart:

1B. Background

Largest of 8 sub-industries (67 stocks, average 8):

- Processed & Packaged Goods (23 stocks)

- Beverages - Soft Drinks (9 stocks)

- Farm Products (9 stocks)

- Food - Major Diversified (9 stocks)

Top 10 by Market Capitalization:

KO/Coca-Cola Co, PEP/Pepsico Inc, FMX/Fomento Economico Mexicano Sab, BUD/Anheuser-Busch InBev, MDLZ/Mondelez International Inc, ABEV/Ambev S.A., MNST/Monster Beverage Corporation, STZ/Constellation Brands Inc, KDP/Keurig Dr Pepper Inc, ADM/Archer Daniels Midland

2. SUB-INDUSTRIES AND STOCKS DETAIL

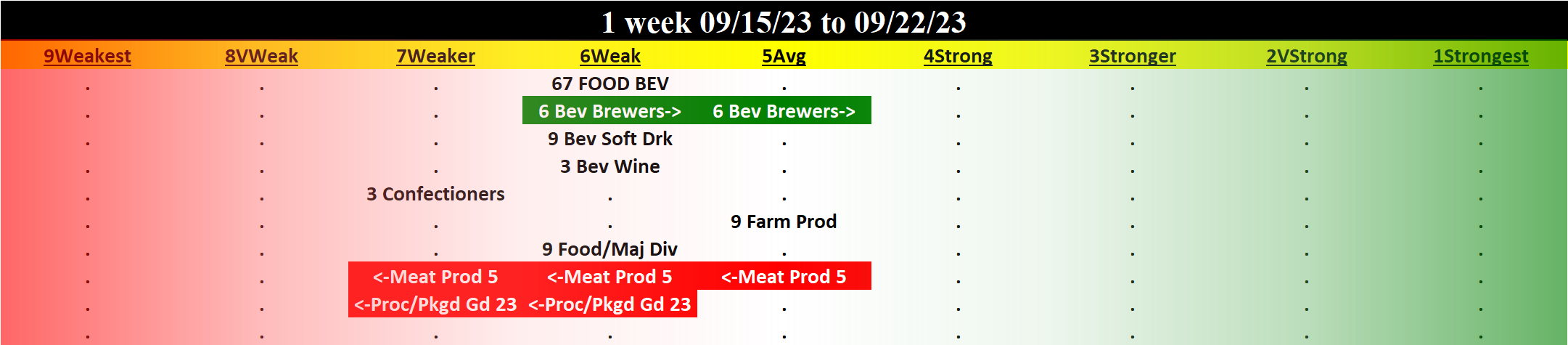

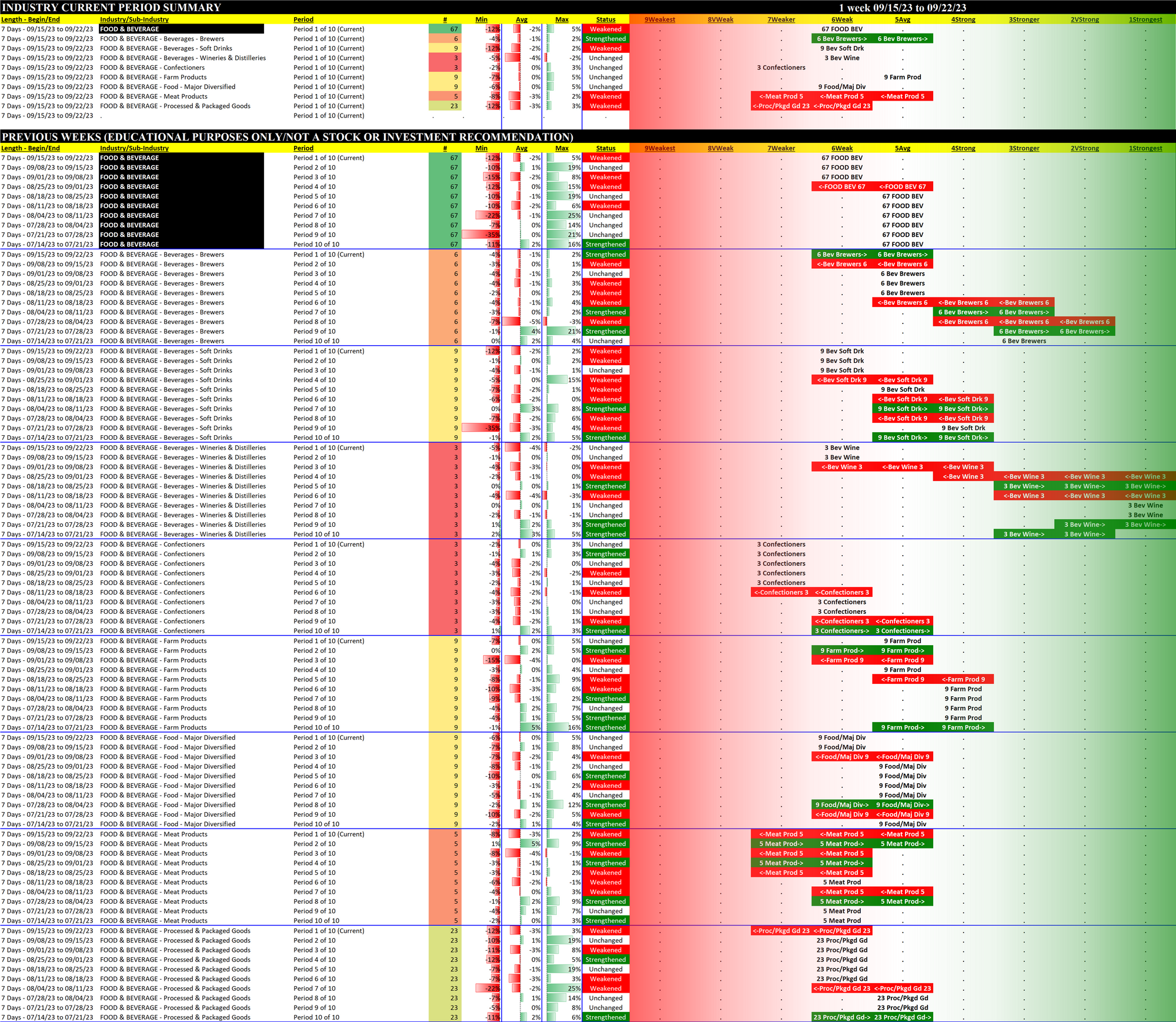

2A. Sub-Industries Overview

Strengthened: 1/8 sub-industries

Weakened: 2/8 sub-industries

STRONGEST at Average rating/5th strongest of 9 levels:

- Beverages - Brewers (6 stocks)

- Farm Products (9 stocks)

WEAKEST at Weaker rating/7th strongest of 9 levels:

- Confectioners (3 stocks)

- Meat Products (5 stocks)

- Processed & Packaged Goods (23 stocks)

2B. Sub-Industries 10-Week Strengthening Analysis

What: recent week-by-week strength changes for the industry and each underlying sub-industry

Why: objective measurement of strengthening and weakening enabling comparison within and across industries and sub-industries

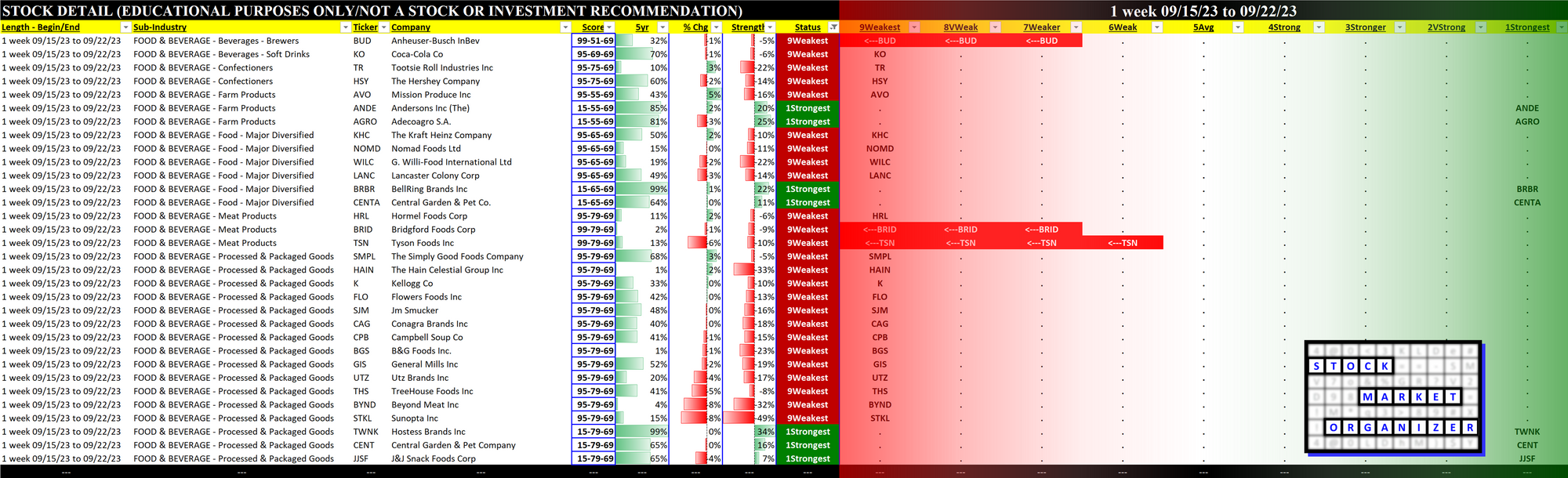

2C. Stocks 1 Week Strongest and Weakest

What: stocks currently rated Strongest/Weakest (highest/lowest of 9 strength ratings)

Why: most interesting stocks for available capital because

- the Strongest have the least amount of overhead supply to dampen breakouts while

- the Weakest may be prone to volatility, subject to big pops from bottom-fishing and short-covering BUT ALSO to bigger and faster falls.

(Not guaranteed and not a recommendation - weak stocks in weakening sub-industries may be better shorts than high-flyers.)

3. STRENGTH BY LOOKBACK PERIOD (with Best/Worst stocks)

3A. Lookback 6 Months

3B. Lookback 4 weeks

3C. Lookback 1 Week